ReWalk Robotics (NASDAQ:RWLK investor five-year losses grow to 82% as the stock sheds US$10m this past week

Over the last month the ReWalk Robotics Ltd. (NASDAQ:RWLK) has been much stronger than before, rebounding by 54%. But that doesn't change the fact that the returns over the last half decade have been stomach churning. In fact, the share price has tumbled down a mountain to land 82% lower after that period. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The million dollar question is whether the company can justify a long term recovery. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

If the past week is anything to go by, investor sentiment for ReWalk Robotics isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for ReWalk Robotics

ReWalk Robotics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over five years, ReWalk Robotics grew its revenue at 2.3% per year. That's far from impressive given all the money it is losing. Nonetheless, it's fair to say the rapidly declining share price (down 13%, compound, over five years) suggests the market is very disappointed with this level of growth. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. A company like this generally needs to produce profits before it can find favour with new investors.

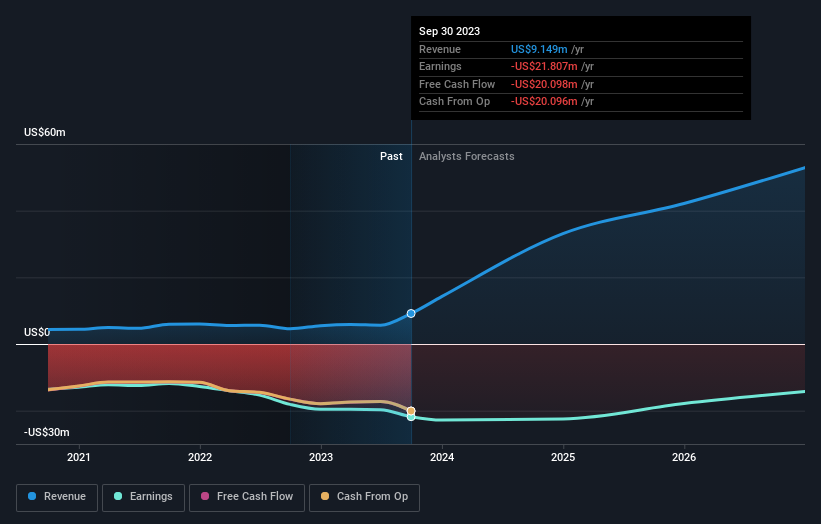

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on ReWalk Robotics' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that ReWalk Robotics shareholders have received a total shareholder return of 25% over the last year. There's no doubt those recent returns are much better than the TSR loss of 13% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand ReWalk Robotics better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for ReWalk Robotics you should know about.

Of course ReWalk Robotics may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.