REX American Resources Corp (REX) Reports Robust Fiscal Year Earnings, Surpassing Analyst ...

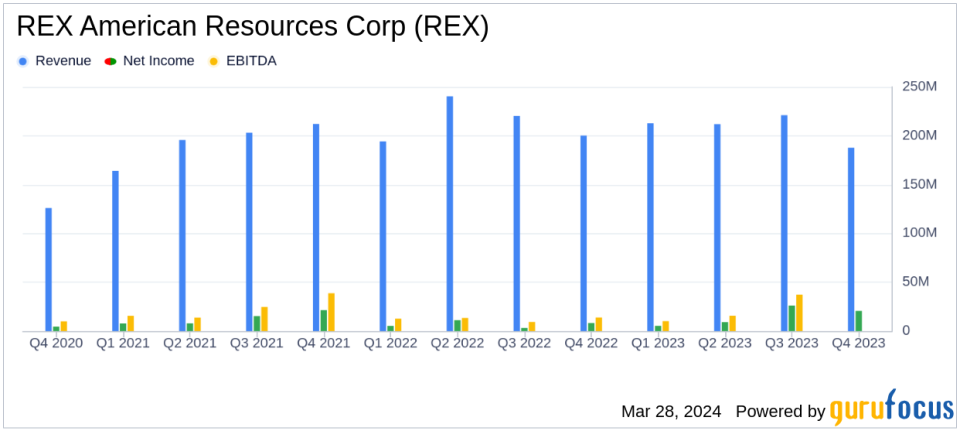

Full Fiscal Year 2023 Revenue: $833.4 million, a slight decline from $855.0 million in the previous year.

Full Fiscal Year 2023 Net Income: $60.9 million, significantly up from $27.7 million in the prior year, showcasing a strong increase in profitability.

Q4 2023 Revenue: $187.6 million, down from $200.2 million in Q4 2022, yet the company achieved a substantial gross profit increase.

Q4 2023 Net Income: $20.6 million, more than doubling from $8.2 million in Q4 2022, with earnings per share of $1.16, beating the estimated $0.446.

Balance Sheet Strength: Ended the year with $378.7 million in cash and short-term investments, and no bank debt, indicating strong financial health.

REX American Resources Corp (NYSE:REX) released its 8-K filing on March 28, 2024, revealing its full fiscal year and fourth-quarter earnings for 2023. The company, a prominent player in the ethanol production industry, operates through its Ethanol and By-Products segments, producing key commodities such as dried distillers grains, modified distillers grains, and non-food grade corn oil.

Despite a slight decrease in annual revenue from $855.0 million in the previous year to $833.4 million in 2023, REX achieved a remarkable increase in net income attributable to shareholders, which rose to $60.9 million from $27.7 million in 2022. This significant improvement in profitability is attributed to decreased corn and natural gas prices and increased production levels. The diluted net income per share for the full fiscal year was $3.47, marking the second-highest in the company's history and surpassing analyst estimates.

For the fourth quarter of 2023, REX reported net sales and revenue of $187.6 million, down from $200.2 million in the same quarter of the previous year. Despite the lower revenue, the company's gross profit for the quarter soared to $30.4 million from $13.3 million in Q4 2022, leading to a net income of $20.6 million, more than double the $8.2 million reported in the same period last year. The earnings per share for the quarter stood at $1.16, significantly exceeding the estimated $0.446.

REX's financial achievements are particularly noteworthy in the context of the Chemicals industry, where efficient operations and cost management are critical for maintaining profitability. The company's ability to optimize production costs and navigate the volatile pricing landscape for ethanol and co-products has proven to be a key factor in its financial success.

The balance sheet reflects the company's strong financial position, with a substantial amount of cash and short-term investments totaling $378.7 million, and the absence of bank debt. This robust liquidity and financial flexibility position REX well for future investments and growth opportunities, such as the One Earth Energy carbon capture and sequestration project, which is expected to be completed in the second quarter of 2024.

Achieving the second highest net income per share in the Companys history in 2023 is an incredible outcome, and one which we are very proud of," said Mr. Zafar Rizvi, REX Chief Executive Officer. "We plan to continue this focus on profitable, sustainable operations through all market conditions, and as we grow our operations into additional areas, like carbon capture and sequestration."

REX's commitment to sustainable operations is further illustrated by its ongoing carbon capture project, which is expected to enhance the company's long-term profitability. Additionally, the company's strategic focus on efficient operations and profitability has allowed it to navigate market fluctuations successfully.

In summary, REX American Resources Corp's fiscal year 2023 results demonstrate a strong financial performance, with significant growth in net income and earnings per share. The company's strategic initiatives and robust balance sheet provide a solid foundation for future growth and profitability, making it a potentially attractive option for value investors.

Explore the complete 8-K earnings release (here) from REX American Resources Corp for further details.

This article first appeared on GuruFocus.