Reynolds Consumer Products Inc (REYN) Reports Strong 2023 Financial Results and Positive ...

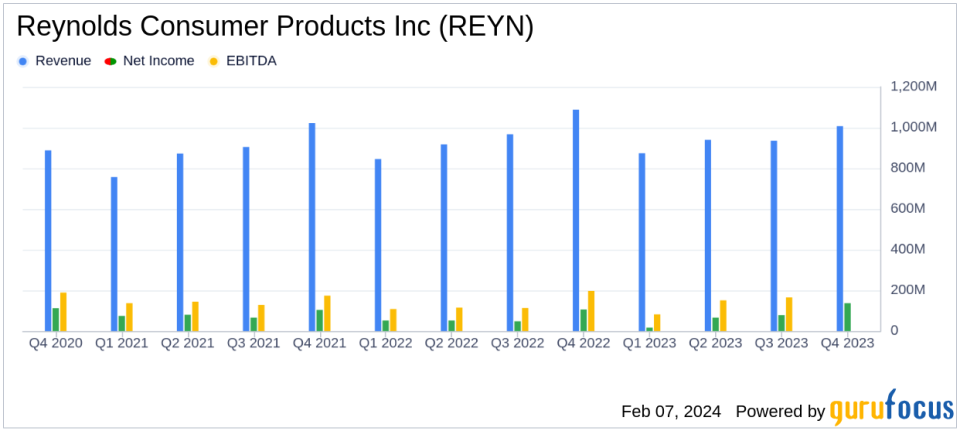

Net Income: Increased to $298 million in 2023, up from $258 million in 2022.

Adjusted EBITDA: Rose to $636 million in 2023, a significant improvement from $546 million in 2022.

Operating Cash Flow: Reached a record $644 million, compared to $219 million in the previous year.

Net Debt Leverage: Improved to 2.7x, down from 3.8x at the end of 2022.

Earnings Per Share (EPS): Increased to $1.42 in 2023, up from $1.23 in 2022.

2024 Outlook: Guides double-digit net income growth with net debt reduction to $1.5 to $1.6 billion by year-end.

On February 7, 2024, Reynolds Consumer Products Inc (NASDAQ:REYN) released its 8-K filing, detailing a robust financial performance for the fourth quarter and full fiscal year of 2023. The company, a leading provider of household products, operates through segments such as Reynolds Cooking & Baking, Hefty Waste and Storage, Hefty Tableware, and Presto Products, offering a range of products from aluminum foil to disposable tableware.

2023 Performance Highlights

Despite a challenging economic environment, REYN managed to increase its market share, with retail volume decreasing only 2% compared to the industry's average decline of 4%. The company's net income and Adjusted EBITDA both saw a 16% increase over the previous year. This growth was attributed to the successful execution of the Reynolds Cooking & Baking recovery plan, portfolio optimization, and lower operational costs, which were partially offset by higher SG&A expenses, including increased advertising investments.

Free cash flow for the year stood at an impressive $540 million, a $449 million increase from the previous year. The company's net debt to trailing twelve months Adjusted EBITDA ratio improved significantly, indicating a strong financial position and enhanced ability to manage debt obligations.

Financial Achievements and Industry Significance

REYN's financial achievements are particularly noteworthy in the Packaging & Containers industry, where operational efficiency and market share are critical for success. The company's record operating cash flow and reduced net debt leverage demonstrate its ability to generate cash and manage debt effectively, which is crucial for sustaining growth and weathering economic fluctuations.

Key Financial Metrics

Reynolds Consumer Products Inc reported net revenues of $3,756 million for the fiscal year 2023, a slight decrease from $3,817 million in 2022. The dip in net revenues was primarily due to a decrease in non-retail net revenues, which fell from $268 million in 2022 to $197 million in 2023. However, retail net revenues remained stable at $3,559 million, compared to $3,549 million in the previous year.

The balance sheet reflects a healthy liquidity position with cash and cash equivalents of $115 million at the end of 2023, up from $38 million at the end of 2022. The company's debt was reduced to $1,832 million, resulting in a net debt of $1,717 million, a notable improvement from the previous year's $2,091 million debt and $1,753 million net debt.

Outlook and Dividend Announcement

Looking ahead to 2024, REYN expects to continue its positive trajectory with projected net revenues between $3,530 to $3,640 million and net income ranging from $331 to $347 million. Adjusted EBITDA is forecasted to be between $660 to $680 million, with earnings per share anticipated to be $1.57 to $1.65. The company also plans to reduce its net debt to $1.5 to $1.6 billion by the end of 2024.

Additionally, the Board of Directors has approved a quarterly dividend of $0.23 per common share, reinforcing the company's commitment to shareholder returns.

Management's Perspective

"Reynolds Consumer Products is performing very well in a challenging economic environment and I am extremely proud of all that our team accomplished in 2023," said Lance Mitchell, President and Chief Executive Officer. "We increased market share in our largest categories, restored operational stability in the Reynolds Cooking & Baking business, outperformed our earnings expectations and drove record cash flows, resulting in leverage of less than three times Adjusted EBITDA at year end. Our integrated brand and store brand model remains a competitive advantage and we will build upon these accomplishments to drive further earnings growth and financial flexibility in 2024."

Reynolds Consumer Products Inc's strong performance in 2023, coupled with a positive outlook for 2024, positions the company as a resilient player in the industry, capable of delivering value to investors even in uncertain times. For more detailed information, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Reynolds Consumer Products Inc for further details.

This article first appeared on GuruFocus.