RGC Resources Inc (RGCO) Reports Increased Earnings in First Quarter

Net Income: Increased to $5,019,992 or $0.50 per share from $3,256,405 or $0.33 per share in the previous year.

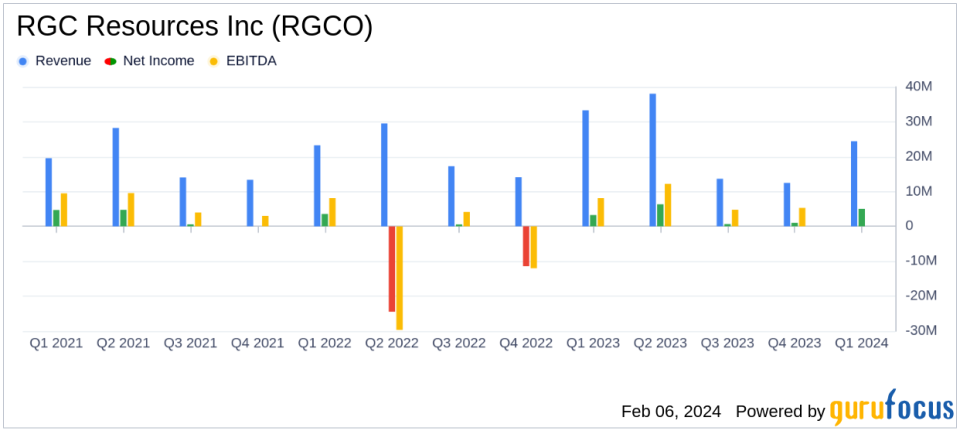

Operating Revenues: Decreased to $24,419,352 from $33,282,335 year-over-year.

Operating Income: Rose to $6,652,037 from $5,544,485 in the same quarter last year.

Equity in Earnings of Unconsolidated Affiliate: Grew significantly to $1,467,835 from just $1,232.

Interest Expense: Increased to $1,636,273 from $1,369,164 year-over-year.

Dividends: Cash dividends per common share increased slightly to $0.2000 from $0.1975.

RGC Resources Inc (NASDAQ:RGCO) released its 8-K filing on February 5, 2024, announcing a significant increase in consolidated earnings for the first quarter ended December 31, 2023. The company, which operates in the regulated utilities industry, reported a net income of $5,019,992, or $0.50 per share, compared to the previous year's $3,256,405, or $0.33 per share. This improvement was primarily attributed to nearly $1.5 million in earnings from the company's investment in the Mountain Valley Pipeline, LLC (MVP), as well as improved utility margins.

Performance Highlights and Challenges

RGC Resources Inc's performance this quarter reflects the company's strategic investments and operational focus. The CEO, Paul Nester, acknowledged the positive impact of higher utility margins and the progress of the MVP construction. However, he also noted the inflationary pressures that are expected to temper performance in the upcoming quarters. The company is taking proactive measures by filing for rate relief with the State Corporation Commission to manage increasing costs.

Despite a decrease in operating revenues from $33,282,335 to $24,419,352, the company managed to increase its operating income from $5,544,485 to $6,652,037. This indicates a more efficient operation and a stronger control over expenses. The equity in earnings from the MVP investment also contributed significantly to the bottom line, showcasing the strategic value of the company's investment activities.

Financial Achievements and Industry Significance

The financial achievements of RGC Resources Inc are particularly important in the context of the regulated utilities industry. The industry is known for its stable but modest growth, and any significant increase in earnings or margins is noteworthy. The company's ability to deliver an improved performance, despite the challenges of inflation and regulatory pressures, speaks to its operational resilience and strategic planning.

The slight increase in cash dividends per common share to $0.2000 from $0.1975 also reflects the company's commitment to shareholder returns, which is a critical aspect for investors in the utilities sector, where dividend yield is a key consideration.

Financial Metrics and Importance

Key financial metrics from the income statement, such as the rise in net income and operating income, are vital indicators of the company's profitability and operational efficiency. The balance sheet shows a solid position with total assets increasing to $314,703,235 from $307,952,162. The company's long-term debt decreased from $113,288,995 to $102,461,196, improving its debt profile and potentially reducing future interest expenses.

Utility margins, a non-GAAP measure, are particularly important for RGC Resources Inc as they reflect the profitability of the core utility operations before the cost of gas. This metric helps investors understand the underlying performance of the utility segment, which is the primary revenue generator for the company.

Conclusion and Analysis

RGC Resources Inc's first-quarter performance demonstrates a company that is navigating the complexities of the regulated utilities market with strategic investments and a focus on operational efficiency. The increased earnings from the MVP investment and improved utility margins are key drivers of this quarter's success. However, the company is also aware of the challenges ahead, particularly in managing inflationary costs and regulatory pressures.

For value investors and potential GuruFocus.com members, RGC Resources Inc's latest earnings report provides a glimpse into a company that is delivering growth in a traditionally stable industry, while also maintaining a commitment to shareholder returns. The company's strategic positioning and financial health suggest it is well-equipped to handle the challenges and opportunities that lie ahead.

Explore the complete 8-K earnings release (here) from RGC Resources Inc for further details.

This article first appeared on GuruFocus.