RH (NYSE:RH) Reports Sales Below Analyst Estimates In Q3 Earnings, Stock Drops

Luxury furniture retailer RH (NYSE:RH) missed analysts' expectations in Q3 FY2023, with revenue down 13.6% year on year to $751.2 million. The company's full-year revenue guidance of $3.07 billion at the midpoint came in slightly below analysts' estimates. It made a non-GAAP loss of $0.42 per share, down from its profit of $5.67 per share in the same quarter last year.

Is now the time to buy RH? Find out by accessing our full research report, it's free.

RH (RH) Q3 FY2023 Highlights:

Revenue: $751.2 million vs analyst estimates of $757.9 million (0.9% miss)

EPS (non-GAAP): -$0.42 vs analyst estimates of $1.09 (-$1.51 miss)

The company reconfirmed its revenue guidance for the full year of $3.07 billion at the midpoint

Free Cash Flow of $17.57 million, down 81.8% from the same quarter last year

Gross Margin (GAAP): 45.3%, down from 48.4% in the same quarter last year

Formerly known as Restoration Hardware, RH (NYSE:RH) is a specialty retailer that exclusively sells its own brand of of high-end furniture and home decor.

Home Furniture Retailer

Furniture retailers understand that ‘home is where the heart is’ but that no home is complete without that comfy sofa to kick back on or a dreamy bed to rest in. These stores focus on providing not only what is practically needed in a house but also aesthetics, style, and charm in the form of tables, lamps, and mirrors. Decades ago, it was thought that furniture would resist e-commerce because of the logistical challenges of shipping large furniture, but now you can buy a mattress online and get it in a box a few days later; so just like other retailers, furniture stores need to adapt to new realities and consumer behaviors.

Sales Growth

RH is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it's growing off a smaller base than its larger counterparts.

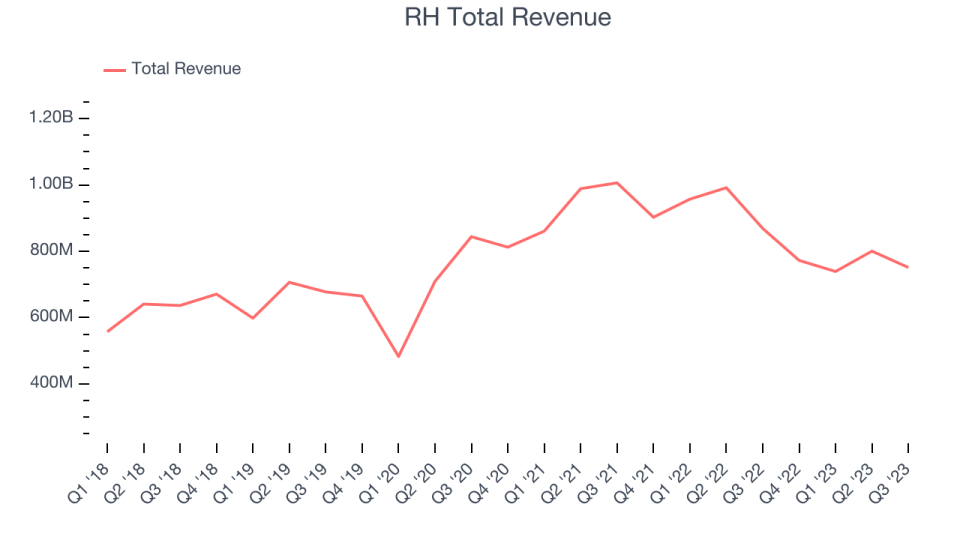

As you can see below, the company's annualized revenue growth rate of 3.7% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was mediocre as its store footprint remained relatively unchanged.

This quarter, RH reported a rather uninspiring 13.6% year-on-year revenue decline, missing Wall Street's expectations. Looking ahead, analysts expect sales to grow 7.4% over the next 12 months.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Key Takeaways from RH's Q3 Results

Sporting a market capitalization of $5.15 billion, RH is among smaller companies, but its more than $382.7 million in cash on hand and positive free cash flow over the last 12 months puts it in an attractive position to invest in growth.

We struggled to find many strong positives in these results. Its revenue, adjusted operating margin, and EPS missed analysts' expectations, with management citing higher than anticipated expenses from international openings, the pending acquisition of the New York Guesthouse property (expected to close in Q4 for approximately $58 million), and its unsuccessful efforts to buy the One Ocean Drive Miami Beach property. Furthermore, the company faced macroeconomic headwinds as mortgage rates peaked above 8% in early October-as a furniture and interior design/architecture-focused company, RH is highly leveraged to housing trends. Overall, the results could have been better. The company is down 6.6% on the results and currently trades at $262.76 per share.

RH may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.