Ribbon Communications Inc. (RBBN) Reports Notable Earnings Growth for 2023

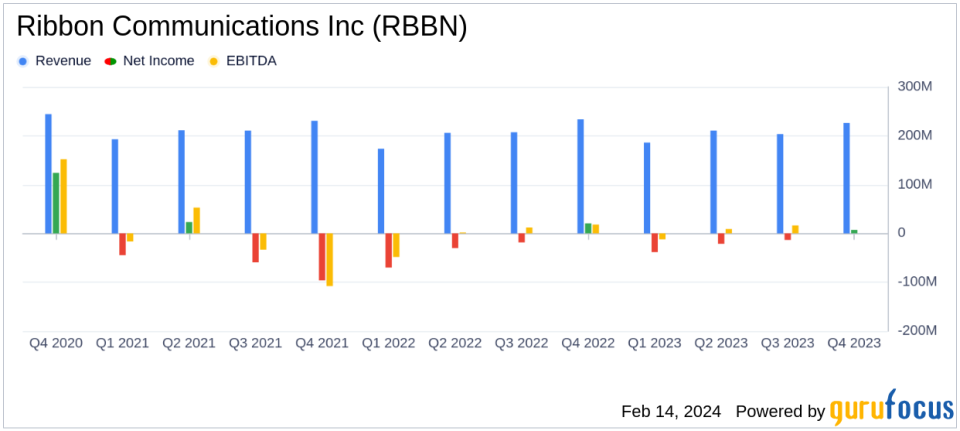

Revenue: Full year 2023 revenue increased to $826 million from $820 million in 2022.

Net Income: GAAP Net income improved to $7 million in Q4 2023 from a loss of $66 million for the full year.

Adjusted EBITDA: Increased by $27 million to $91 million for the full year 2023.

Earnings Per Share: GAAP diluted earnings per share for Q4 2023 were $0.04, improving from a full-year loss per share of $0.39.

Profitability: IP Optical Networks segment achieved profitability in the second half of 2023.

Operating Expenses: Reduced by 6% year-over-year, contributing to improved profitability.

2024 Outlook: Revenue projected to be between $840 million to $870 million with adjusted EBITDA between $110 million to $120 million.

Ribbon Communications Inc (NASDAQ:RBBN) released its 8-K filing on February 14, 2024, detailing its financial results for the fourth quarter and full year of 2023. The company, a global provider of real-time communications technology and IP optical networking solutions, reported a slight increase in annual revenue to $826 million, up from $820 million in the previous year. Despite a challenging operating environment, Ribbon Communications managed to improve its full-year GAAP Loss from Operations by $24 million to a loss of $24 million, while adjusted non-GAAP EBITDA also saw a significant improvement, increasing by $27 million to $91 million.

Financial Performance and Challenges

For the fourth quarter of 2023, Ribbon Communications reported revenue of $226 million, a decrease from $234 million in the same quarter of the previous year but an increase from $203 million in the third quarter of 2023. The company's President and CEO, Bruce McClelland, expressed satisfaction with the improved profitability, highlighting higher margins in both segments and reduced operating expenses. Adjusted EBITDA for the quarter was robust at $43 million, or 19% of revenue. The IP Optical Networks business segment was particularly successful, achieving profitability in the second half of the year with sales exceeding $100 million in the fourth quarter.

Strategic Financial Achievements

The company's strategic financial achievements are crucial in a competitive telecommunications industry that demands constant innovation and efficient capital management. Ribbon Communications' ability to reduce operating expenses by 6% in an inflationary environment while improving profitability is a testament to its effective cost control measures and operational efficiency. The company's focus on profitability in the IP Optical Networks segment aligns with the growing demand for broadband capacity, positioning it well for future growth.

Key Financial Metrics

Key financial metrics from the earnings report include a GAAP net income of $7 million for the fourth quarter, compared to a net loss of $66 million for the full year. Non-GAAP net income for the full year improved to $36 million from $17 million in 2022. The company's diluted earnings per share on a GAAP basis for the fourth quarter were $0.04, and on a non-GAAP basis, they were $0.12. The weighted average shares outstanding on a diluted basis increased slightly to 173 million from 172 million.

"We achieved our key goal of attaining profitability in the IP Optical Networks business segment for the second half of the year," stated Bruce McClelland.

Analysis of Company's Performance

Ribbon Communications' performance in 2023 demonstrates resilience in a challenging market. The company's focus on profitability, particularly in the IP Optical Networks segment, is commendable and indicates a strategic alignment with market demands. The reduction in operating expenses and the improvement in net income and adjusted EBITDA are positive signs for investors. The company's outlook for 2024 suggests confidence in its ability to continue this momentum, with projected revenue growth and further improvements in profitability.

For more detailed financial information and future projections, investors and interested parties are encouraged to visit Ribbon Communications' investor relations website.

Value investors and potential GuruFocus.com members looking for opportunities in the telecommunications sector may find Ribbon Communications Inc. (NASDAQ:RBBN) to be an intriguing prospect based on its latest earnings report and strategic positioning for future growth.

Explore the complete 8-K earnings release (here) from Ribbon Communications Inc for further details.

This article first appeared on GuruFocus.