Richard Pzena Adjusts Position in CNO Financial Group Inc

Recent Transaction Overview

Pzena Investment Management, LLC, led by value investing stalwart Richard Pzena (Trades, Portfolio), has recently made a notable adjustment to its holdings in CNO Financial Group Inc (NYSE:CNO). On December 31, 2023, the firm reduced its stake in CNO by 271,906 shares, resulting in a 3.75% decrease in its position. This transaction had a minor impact of -0.03% on the portfolio, with the trade executed at a price of $27.9 per share. Following the trade, Pzena Investment Management holds a total of 6,982,684 shares in CNO, which represents 0.84% of their portfolio and 6.20% of the company's shares outstanding.

Richard Pzena (Trades, Portfolio)'s Investment Profile

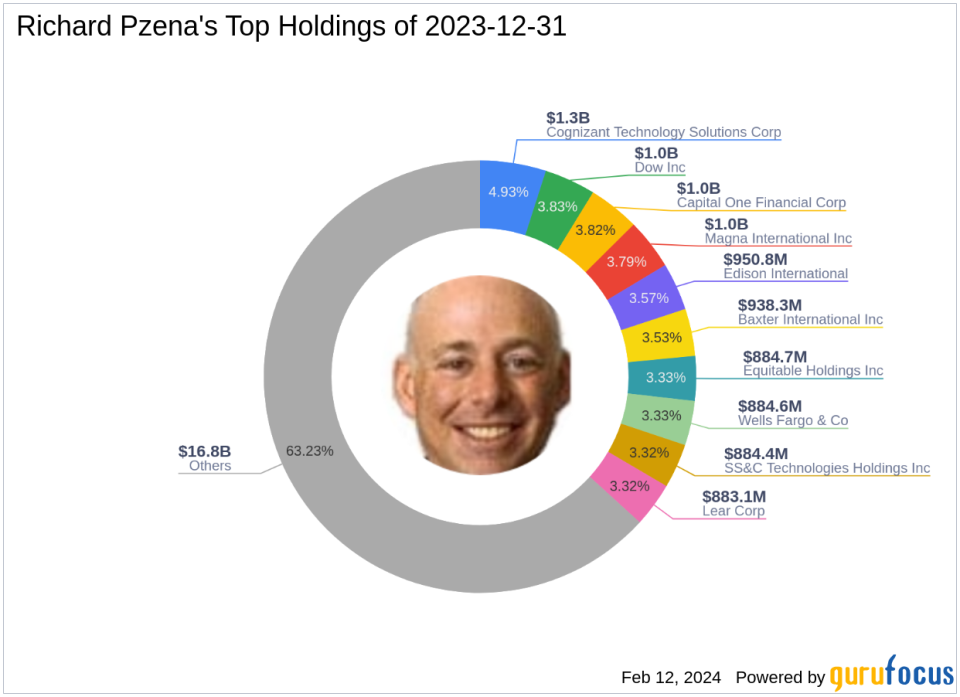

Richard Pzena (Trades, Portfolio), the founder and Co-Chief Investment Officer of Pzena Investment Management, LLC, has been a prominent figure in the investment community since establishing the firm in 1995. With a BS from the Wharton School and an MBA from the University of Pennsylvania, Pzena's investment philosophy centers on identifying undervalued companies based on their long-term earnings power. The firm's approach involves purchasing shares in fundamentally sound businesses at low prices, often during periods of temporary setbacks. Pzena Investment Management oversees an equity portfolio worth $26.6 billion, with top holdings in sectors such as Financial Services and Technology, including Cognizant Technology Solutions Corp (NASDAQ:CTSH), Capital One Financial Corp (NYSE:COF), and others.

Insight into CNO Financial Group Inc

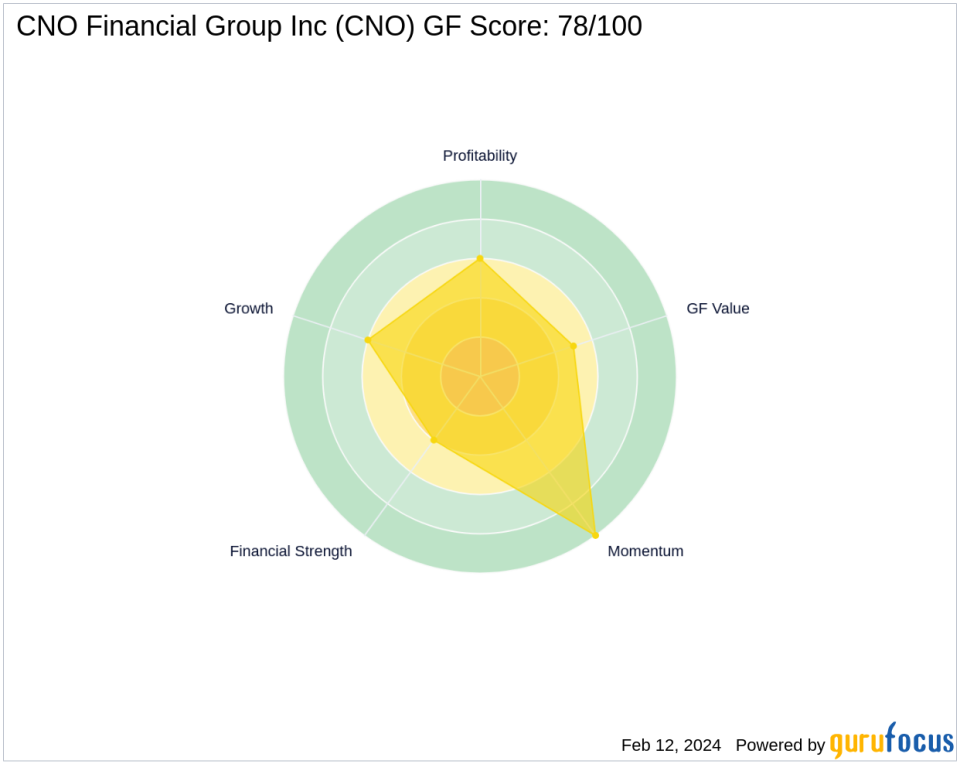

CNO Financial Group Inc, an insurance holding company, caters to middle-income American consumers through a variety of channels, including exclusive agents, independent producers, and direct marketing. With a market capitalization of $2.98 billion, CNO operates through segments such as annuity, health, and life insurance, with health product lines generating the most revenue. The company's stock is currently trading at $27.23, slightly below the trade price, and is deemed "Fairly Valued" with a GF Value of $26.99. CNO's financial metrics reveal a PE Ratio of 11.30, indicating profitability, and a GF Score of 78/100, suggesting a likely average performance.

Trade Impact Analysis

The recent trade by Pzena Investment Management has slightly reduced the firm's exposure to CNO Financial Group Inc, yet the company remains a significant holding within their portfolio. The trade's impact on the portfolio was minimal, and the position size in CNO still reflects a substantial investment by the firm. The share change represents a strategic adjustment rather than a major shift in Pzena's confidence in CNO's value proposition.

Market Valuation and Stock Performance

CNO Financial Group Inc's current market valuation aligns closely with its GF Value, indicating that the stock is fairly priced. The trade price of $27.9 is just above the GF Value of $26.99, with a Price to GF Value ratio of 1.01. Since the transaction, the stock has experienced a slight decline of -2.4%, and its year-to-date performance shows a decrease of -2.85%. However, since its IPO, CNO's stock price has appreciated by 36.15%.

Company Performance and Rankings

CNO Financial Group Inc boasts a GF Score of 78/100, reflecting potential for average performance. The company's financial strength, as indicated by its Financial Strength rank of 4/10, and interest coverage rank of 271, could be areas for improvement. However, CNO's Profitability Rank and Growth Rank both stand at a solid 6/10. The company's GF Value Rank and Momentum Rank are 5/10 and 10/10, respectively, indicating a balanced valuation and strong price momentum.

Sector Positioning and Peer Holdings

CNO Financial Group Inc fits well within Pzena Investment Management's top sector preferences, aligning with the firm's focus on Financial Services. Other notable gurus holding shares in CNO include HOTCHKIS & WILEY, Steven Scruggs (Trades, Portfolio), and Barrow, Hanley, Mewhinney & Strauss, demonstrating the stock's appeal among value investors.

Concluding Thoughts

Richard Pzena (Trades, Portfolio)'s recent trade in CNO Financial Group Inc reflects a minor adjustment in the firm's portfolio, consistent with its value investing strategy. The stock's fair valuation and solid financial rankings suggest that CNO remains a viable investment for those seeking value opportunities. As Pzena Investment Management continues to navigate the market, its moves are closely watched by value investors for insights into potential investment opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.