Richard Pzena Adjusts Position in Equitable Holdings Inc

Recent Transaction Overview

On December 31, 2023, Pzena Investment Management, LLC, led by value investing stalwart Richard Pzena (Trades, Portfolio), made a notable adjustment to its investment in Equitable Holdings Inc (NYSE:EQH). The firm reduced its stake by 137,650 shares, resulting in a slight portfolio impact of -0.02%. Despite this reduction, Pzena Investment Management still holds a significant number of shares, totaling 26,764,910, which represents a 3.83% position in its portfolio and a 7.90% ownership of the company's outstanding shares. The transaction was executed at a price of $33.30 per share.

Richard Pzena (Trades, Portfolio)'s Investment Profile

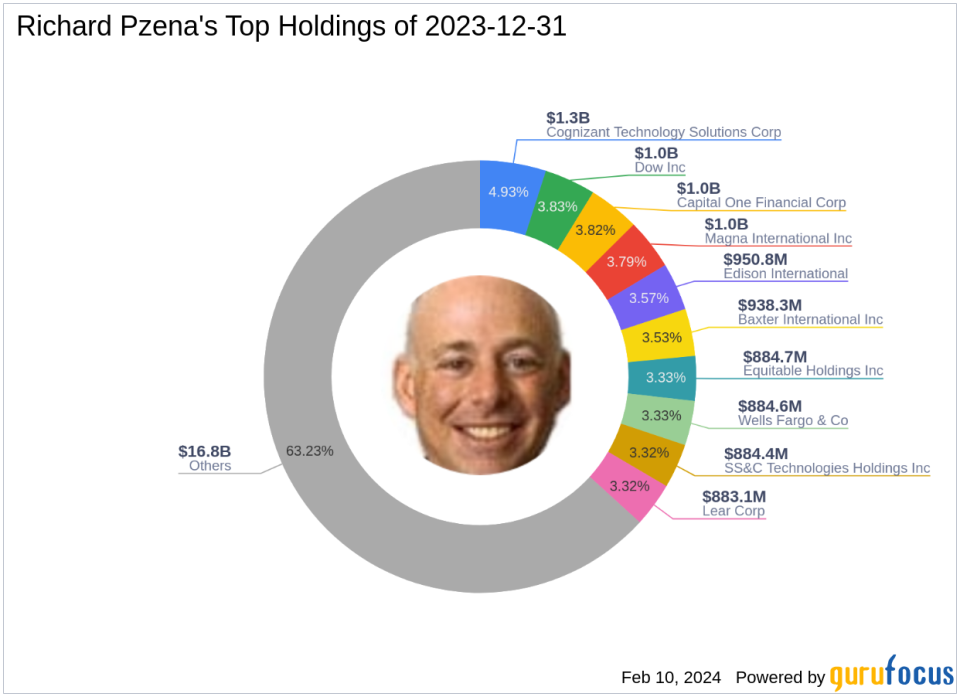

Richard Pzena (Trades, Portfolio) is the founder and Co-Chief Investment Officer of Pzena Investment Management, LLC, established in 1995. With a BS from the Wharton School and an MBA from the University of Pennsylvania, Pzena has built a reputation for a value-oriented investment approach. The firm focuses on identifying undervalued companies with long-term earnings potential, often capitalizing on temporary setbacks that depress share prices. Pzena Investment Management oversees an equity portfolio valued at $26.6 billion, with top holdings in sectors such as Financial Services and Technology, including Cognizant Technology Solutions Corp (NASDAQ:CTSH) and Capital One Financial Corp (NYSE:COF).

Equitable Holdings Inc at a Glance

Equitable Holdings Inc, trading under the symbol EQH, is a diversified financial services company based in the USA. Since its IPO on May 10, 2018, the company has offered a range of products and services, including variable annuities, retirement plans, and life insurance solutions. With a market capitalization of $11.26 billion and a current stock price of $33.74, Equitable Holdings operates through various segments, catering to individual and group retirement needs, investment management, and protection solutions.

Impact of the Trade on Pzena's Portfolio

The recent sale of Equitable Holdings shares by Pzena Investment Management has had a minimal impact on the firm's overall portfolio, given the small percentage change. However, the firm's continued substantial holding in EQH indicates a sustained confidence in the company's value proposition and future prospects.

Equitable Holdings' Market Performance

Equitable Holdings has shown a robust market performance since its IPO, with a price appreciation of 70.84%. The stock's year-to-date change stands at 1.87%, and it has gained 1.32% since the reported transaction. The company's stock is currently considered modestly undervalued with a GF Value of $38.64 and trades at a price to GF Value ratio of 0.87.

Financial Health and Valuation Metrics

Equitable Holdings boasts a GF Score of 81/100, indicating good potential for outperformance. The company's financial strength and profitability are rated at 5/10, while its growth rank is higher at 7/10. The GF Value Rank and Momentum Rank are both impressive at 7/10 and 10/10, respectively. The stock's Piotroski F-Score is 2, and it has an Altman Z-Score of 0.00, which may raise concerns about financial stability. However, the company's interest coverage ratio of 4.24 and a cash to debt ratio of 1.46 suggest a reasonable ability to manage debt obligations.

Comparative Guru Holdings

Other notable investment gurus holding Equitable Holdings stock include T Rowe Price Equity Income Fund (Trades, Portfolio), HOTCHKIS & WILEY, and Keeley-Teton Advisors, LLC (Trades, Portfolio). Pzena Investment Management remains the largest guru shareholder, underscoring the firm's conviction in EQH's value.

Concluding Thoughts on Pzena's Trade

The recent transaction by Richard Pzena (Trades, Portfolio)'s firm reflects a strategic adjustment rather than a significant shift in investment stance. For value investors, Pzena's continued substantial holding in Equitable Holdings Inc suggests a belief in the company's intrinsic value and potential for long-term growth. As market conditions evolve, Pzena Investment Management's moves will be closely watched for insights into the firm's value investing strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.