Richard Pzena Adjusts Position in Hooker Furnishings Corp

Recent Transaction Overview

Pzena Investment Management, LLC, led by value investing stalwart Richard Pzena (Trades, Portfolio), has recently made a notable adjustment to its investment in Hooker Furnishings Corp (NASDAQ:HOFT). On December 31, 2023, the firm reduced its stake in the company by 67,908 shares, which equated to a -4.55% change in its holdings. This transaction had a minor impact of -0.01% on the portfolio, with the shares being traded at a price of $26.08 each. Following this transaction, Pzena Investment Management holds 1,426,039 shares of Hooker Furnishings Corp, representing a 13.40% ownership of the company and a 0.16% position in the firm's investment portfolio.

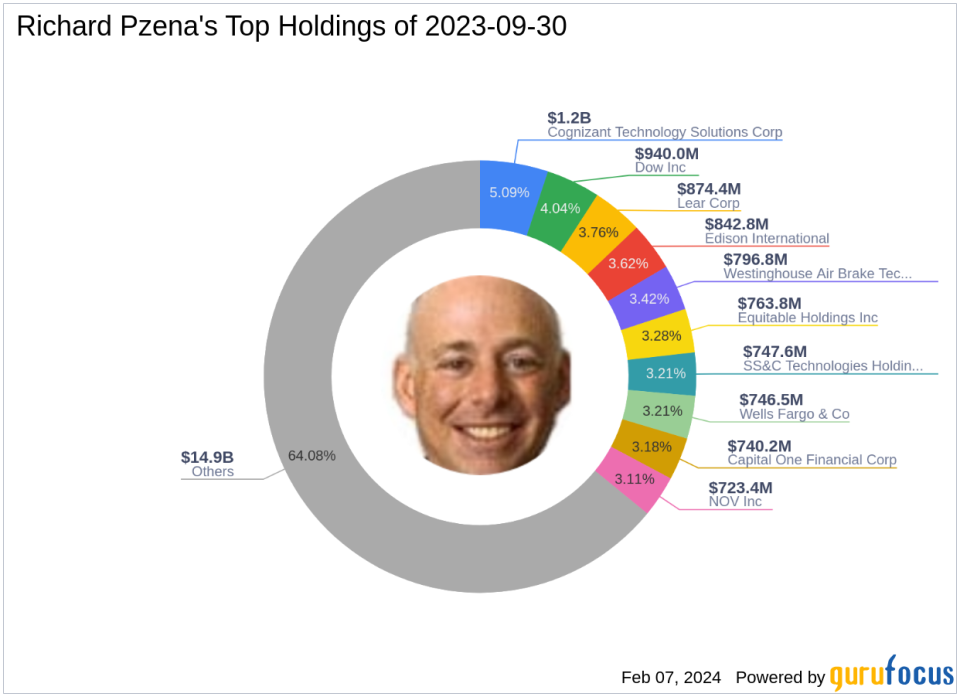

Richard Pzena (Trades, Portfolio)'s Investment Profile

Richard Pzena (Trades, Portfolio) is the founder and Co-Chief Investment Officer of Pzena Investment Management, LLC, established in 1995. With a BS summa cum laude from the Wharton School and an MBA from the University of Pennsylvania, Pzena's investment philosophy centers on identifying undervalued companies by comparing their current share price to their normal long-term earnings power. The firm's approach involves purchasing shares in fundamentally sound businesses at low prices, often during periods of temporary setbacks. Pzena Investment Management currently manages an equity portfolio valued at $23.28 billion, with top holdings in sectors such as Financial Services and Technology, including companies like Cognizant Technology Solutions Corp (NASDAQ:CTSH) and Edison International (NYSE:EIX).

Hooker Furnishings Corp at a Glance

Hooker Furnishings Corp, operating in the USA since its IPO on June 27, 2002, is a key player in the Furnishings, Fixtures & Appliances industry. The company specializes in designing, marketing, and importing a variety of furniture products for residential, hospitality, and contract markets. With segments including Hooker Branded and Home Meridian, the company has a market capitalization of $248.76 million. Despite being currently assessed as modestly overvalued with a GF Value of $18.05 and a price to GF Value ratio of 1.29, Hooker Furnishings Corp has experienced a stock price decline of -10.62% since the trade date, with a year-to-date performance also in the negative at -10.89%.

Impact of the Trade on Pzena's Portfolio

The recent reduction in Hooker Furnishings Corp shares by Pzena Investment Management has slightly altered the composition of the firm's portfolio. Despite the small percentage change, the firm maintains a significant position in HOFT, with the stock constituting a 0.16% portion of its total investments. The trade reflects Pzena's strategic portfolio adjustments, possibly in response to the company's current valuation and market performance.

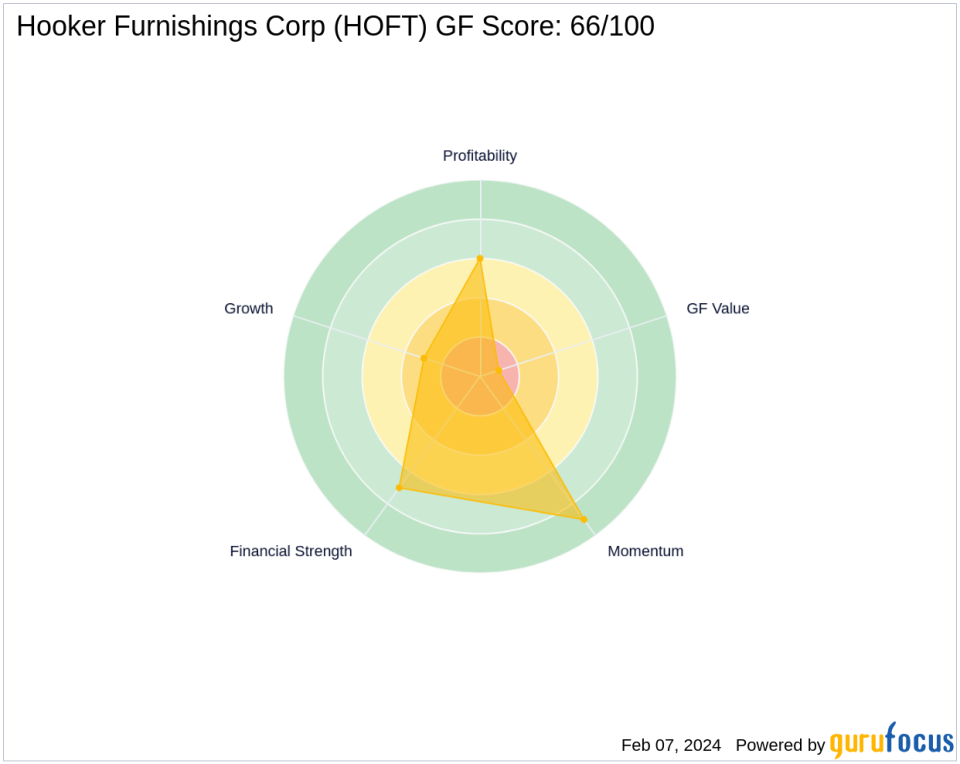

Hooker Furnishings Corp's Market Performance

Since its IPO, Hooker Furnishings Corp has seen a price increase of 133.1%, indicating long-term growth. However, the company's recent market performance has been less favorable, with a GF Score of 66/100, suggesting potential challenges ahead. The GF Score, which is a composite ranking based on financial strength, profitability, growth, valuation, and momentum, indicates that Hooker Furnishings may have poor future performance potential. The company's financial strength and profitability are moderate, with ranks of 7/10 and 6/10 respectively, but its growth and GF Value ranks are low at 3/10 and 1/10, respectively. The momentum rank is high at 9/10, which could signal a potential turnaround in the stock's performance.

Industry and Peer Context

Pzena Investment Management's top holdings are primarily in the Financial Services and Technology sectors, with Hooker Furnishings Corp representing a diversification into the Furnishings, Fixtures & Appliances industry. This sector has its unique market dynamics, and Pzena's stake in HOFT showcases a strategic investment in a niche market. Other notable investors in Hooker Furnishings Corp include Donald Smith & Co, although Pzena Investment Management remains the largest guru shareholder in the company.

Conclusion

In summary, Richard Pzena (Trades, Portfolio)'s recent transaction in Hooker Furnishings Corp reflects a minor adjustment in Pzena Investment Management's portfolio. While the firm's investment philosophy emphasizes value buying, the current market performance and valuation of HOFT suggest a cautious approach. Investors and market watchers will be keen to see how this trade aligns with Pzena's long-term strategy and the future trajectory of Hooker Furnishings Corp in the competitive furnishings industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.