Richard Pzena Adjusts Position in MRC Global Inc

Overview of Richard Pzena (Trades, Portfolio)'s Recent Trade

On December 31, 2023, Pzena Investment Management, LLC, led by value investing stalwart Richard Pzena (Trades, Portfolio), made a notable adjustment to its investment in MRC Global Inc (NYSE:MRC). The firm reduced its stake in the company, selling 446,311 shares at a price of $11.01 each. This transaction resulted in a slight portfolio impact of -0.02%, leaving the firm with a total of 7,001,859 shares in MRC Global Inc, which now comprises 0.33% of its investment portfolio and represents an 8.30% ownership of the traded company.

Richard Pzena (Trades, Portfolio)'s Investment Firm and Philosophy

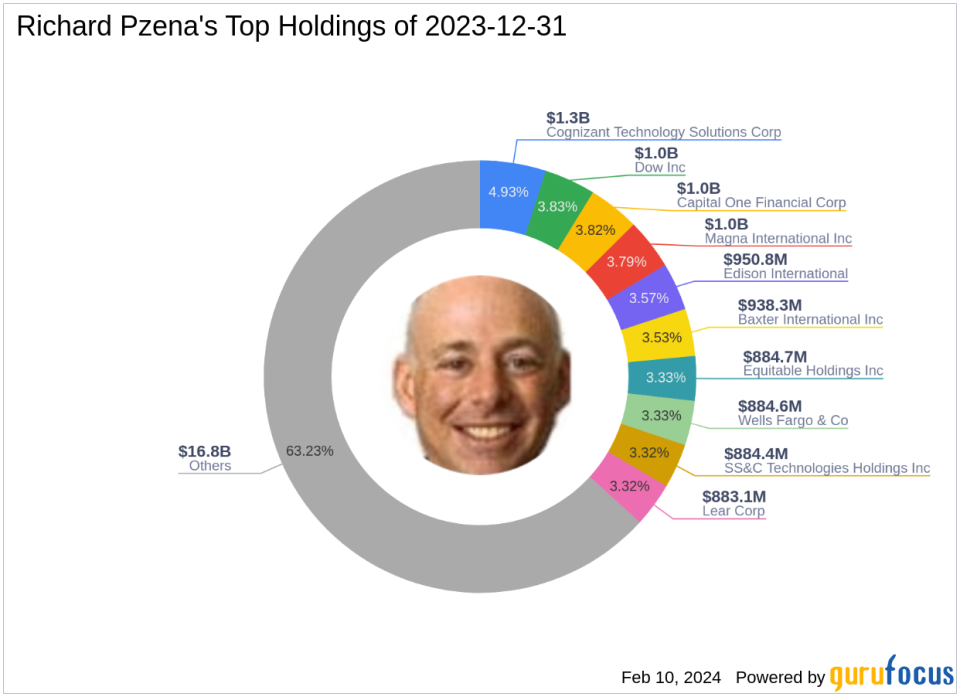

Richard Pzena (Trades, Portfolio) founded Pzena Investment Management, LLC in 1995 and has since been recognized for a rigorous value investing approach. Pzena, a Wharton School graduate, focuses on identifying undervalued companies with strong business fundamentals. The firm's strategy involves purchasing shares of good businesses at low prices, typically when they face temporary setbacks. With a portfolio equity of $26.6 billion, Pzena's top holdings include names like Cognizant Technology Solutions Corp (NASDAQ:CTSH) and Capital One Financial Corp (NYSE:COF), with a preference for the Financial Services and Technology sectors.

MRC Global Inc at a Glance

MRC Global Inc, trading under the symbol MRC in the United States, went public on April 12, 2012. The company is a key distributor of pipes, valves, fittings, and related products and services to the energy sector. MRC Global's offerings are critical in extreme operating conditions, where they control the flow and pressure of fluids and gases. The company's diverse product segments include Carbon Fittings and Flanges, Gas products, and Valves, among others, complemented by specialized services to strengthen client relationships.

Impact of the Trade on Pzena's Portfolio

The recent reduction in MRC Global Inc shares by Pzena Investment Management reflects a minor change in the firm's portfolio, with a -5.99% change in the position. Despite the sell-off, the firm maintains a significant stake in the company, indicating a sustained belief in its value proposition.

Current Valuation and Performance of MRC Global Inc

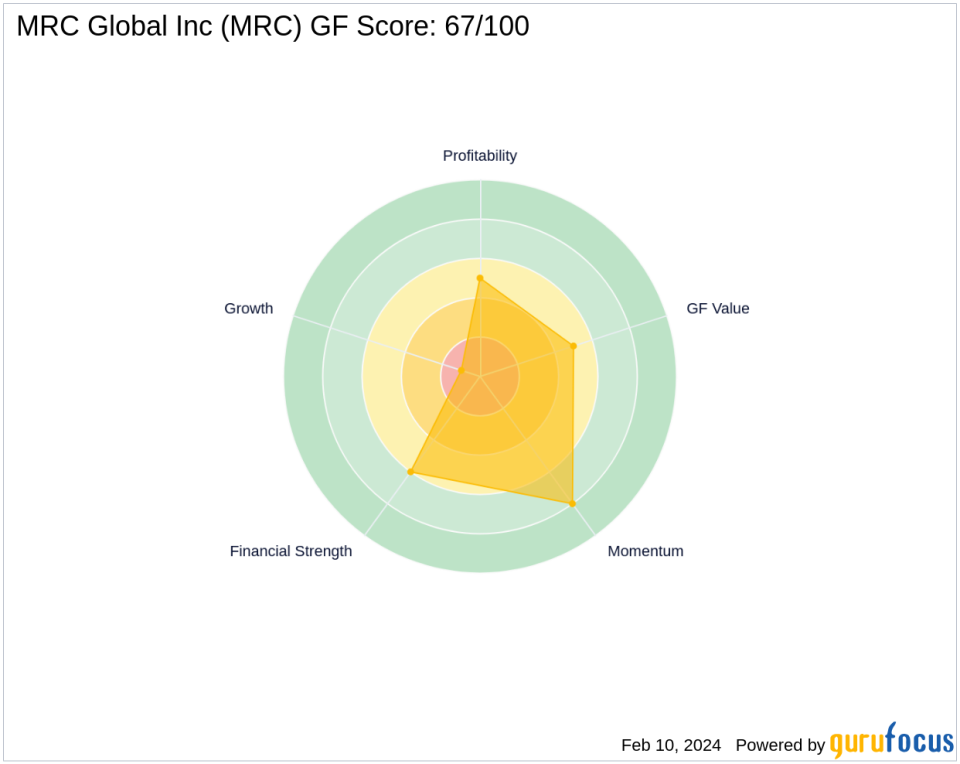

MRC Global Inc currently holds a market capitalization of $901.187 million, with a stock price of $10.69 and a PE ratio of 10.18. According to GuruFocus valuation metrics, the stock is considered Fairly Valued with a GF Value of $10.62 and a Price to GF Value ratio of 1.01. The stock has experienced a -2.91% price change since the transaction and a -47.85% change since its IPO. Year-to-date, the stock's performance has decreased by -4.72%. The GF Score for MRC Global Inc stands at 67/100, indicating moderate future performance potential.

Financial Health and Growth Prospects of MRC Global Inc

The company's financial health, as indicated by its Financial Strength, is ranked at 6/10, with an interest coverage of 5.88. The Profitability Rank is at 5/10, while the Growth Rank is low at 1/10. The company's GF Value Rank and Momentum Rank are at 5/10 and 8/10, respectively, with a Piotroski F-Score of 6, indicating a stable financial situation.

Other Notable Investors in MRC Global Inc

Aside from Pzena Investment Management, other notable investment firms such as HOTCHKIS & WILEY and Barrow, Hanley, Mewhinney & Strauss also hold shares in MRC Global Inc, demonstrating the company's appeal to value-oriented investors.

Conclusion

The recent transaction by Richard Pzena (Trades, Portfolio)'s firm in MRC Global Inc aligns with the firm's value investment philosophy, despite the reduction in shares. The trade reflects a strategic adjustment rather than a shift in conviction about the company's long-term value. For value investors, Pzena's continued interest in MRC Global Inc, coupled with the company's fair valuation and moderate GF Score, may warrant attention as part of a diversified investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.