Richard Pzena Adjusts Stake in NOV Inc

Overview of Richard Pzena (Trades, Portfolio)'s Recent NOV Inc Transaction

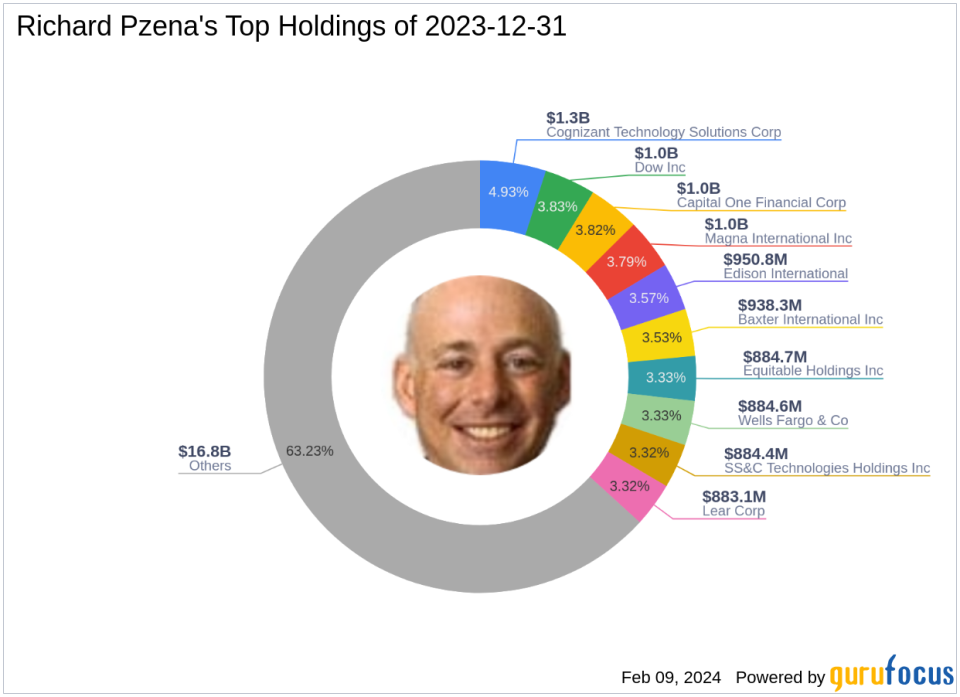

On December 31, 2023, Pzena Investment Management, LLC, led by value investing stalwart Richard Pzena (Trades, Portfolio), made a notable adjustment to its investment in NOV Inc. The firm reduced its holdings in the oil and gas industry supplier by 3,242,104 shares, which resulted in a 9.37% decrease from its previous stake. This transaction had a -0.28% impact on the firm's portfolio, with the shares being traded at a price of $20.28 each. Following the trade, Pzena Investment Management holds a total of 31,371,893 shares in NOV Inc, representing a significant 2.74% of the portfolio and an 8.00% ownership of the traded company.

Investment Philosophy of Richard Pzena (Trades, Portfolio)

Richard Pzena (Trades, Portfolio), the founder and Co-Chief Investment Officer of Pzena Investment Management, LLC, is renowned for a disciplined value investing approach. Since establishing the firm in 1995, Pzena has focused on identifying undervalued companies with strong business fundamentals. The investment strategy involves purchasing shares of reputable businesses at prices that are below their intrinsic value, often during times when these companies face temporary setbacks. Pzena's philosophy has consistently sought to determine whether the issues causing a stock's undervaluation are transient or permanent, aiming to capitalize on market overreactions.

NOV Inc: A Leader in Oil and Gas Equipment

NOV Inc, with its stock symbol NOV, is a prominent player in the oil and gas industry, providing essential equipment and services for drilling operations. Since its IPO on October 29, 1996, the company has expanded its global footprint, with international markets accounting for a significant portion of its revenue. NOV Inc operates through various segments, including Completion & Production Solutions, Rig Technologies, and Wellbore Technologies, catering to the diverse needs of the energy sector.

NOV Inc's Financial Health and Valuation

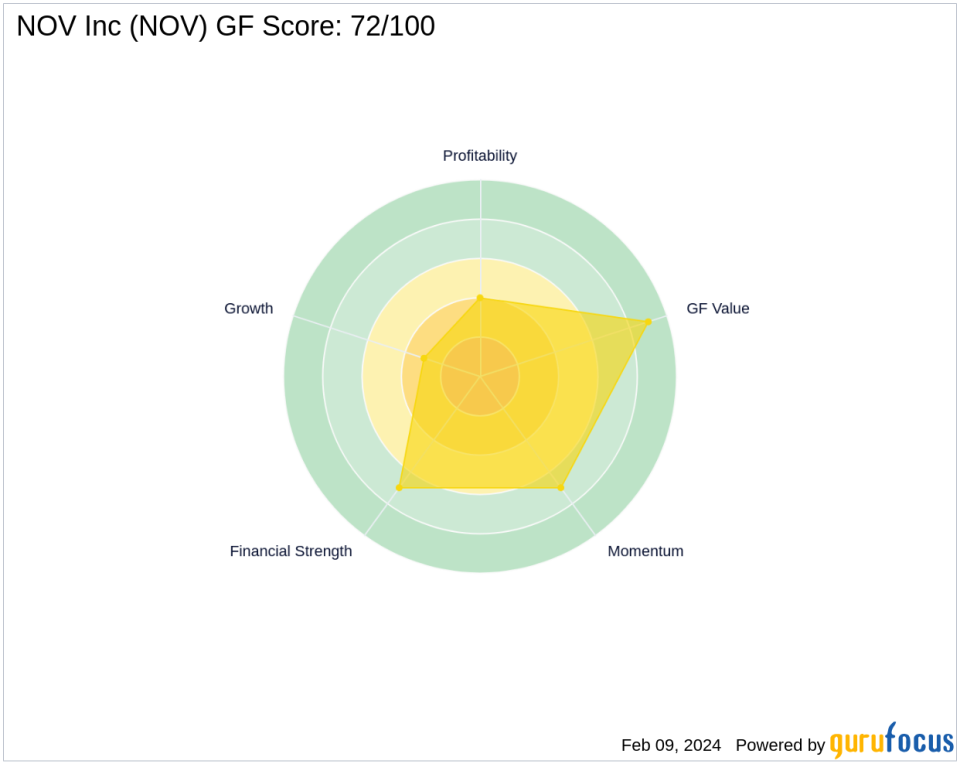

As of the latest data, NOV Inc boasts a market capitalization of $6.78 billion, with a current stock price of $17.20. The company's PE Percentage stands at 6.85, indicating profitability. GuruFocus has labeled NOV as "Modestly Undervalued" with a GF Value of $22.51 and a Price to GF Value ratio of 0.76. Despite a recent -15.19% decline in stock price since the transaction date, NOV Inc has experienced a substantial 279.69% increase since its IPO and a -14.68% change year-to-date.

NOV Inc's Performance and Rankings

NOV Inc's GF Score is a robust 72 out of 100, suggesting a likely average performance in the future. The company's financial health is reflected in its Balance Sheet Rank of 7/10 and a Profitability Rank of 4/10. However, its Growth Rank is a lower 3/10. The GF Value Rank stands at an impressive 9/10, while the Momentum Rank is 7/10. NOV Inc also holds a strong Piotroski F-Score of 8 and an Altman Z-Score of 2.13, indicating financial stability.

Impact of Pzena's Trade on Investment Portfolio

The recent reduction in NOV Inc shares by Pzena Investment Management has slightly decreased the firm's exposure to the oil and gas sector. However, with over 31 million shares remaining, NOV Inc continues to be a significant holding within Pzena's portfolio. The firm's investment strategy, which emphasizes financial services and technology sectors, still maintains a diversified approach, with NOV Inc playing a key role in the energy component of the portfolio.

Oil & Gas Industry Context and Other Investors

The oil and gas industry, where NOV Inc operates, is currently facing various challenges and opportunities. The sector's performance can significantly influence NOV's stock, which is closely monitored by several notable investors. First Eagle Investment (Trades, Portfolio) Management, LLC is the largest guru shareholder, while other prominent gurus, including HOTCHKIS & WILEY and John Rogers (Trades, Portfolio), also maintain positions in NOV Inc. These investments underscore the industry's relevance and the potential these gurus see in NOV Inc.

Conclusion

Richard Pzena (Trades, Portfolio)'s recent transaction involving NOV Inc shares reflects a strategic adjustment within the firm's value-driven investment portfolio. While the reduction in NOV's stake is noteworthy, the company's solid financial metrics and favorable GF Score suggest that it remains an attractive investment for those with a long-term perspective. As the oil and gas industry evolves, Pzena Investment Management's stake in NOV Inc will continue to be an area of interest for value investors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.