Richard Pzena Bolsters Position in ScanSource Inc

Overview of Richard Pzena (Trades, Portfolio)'s Recent Portfolio Addition

On December 31, 2023, Pzena Investment Management, LLC, led by value investing stalwart Richard Pzena (Trades, Portfolio), expanded its investment in ScanSource Inc (NASDAQ:SCSC), a notable player in the specialty technology market. The firm added 89,103 shares to its holdings, increasing its stake by 4.94%. This transaction had a modest impact of 0.02% on the portfolio, bringing the total share count to 1,893,151 and representing a 7.50% ownership in the company. The shares were acquired at a price of $39.61, reflecting a strategic move by the firm to capitalize on the company's potential.

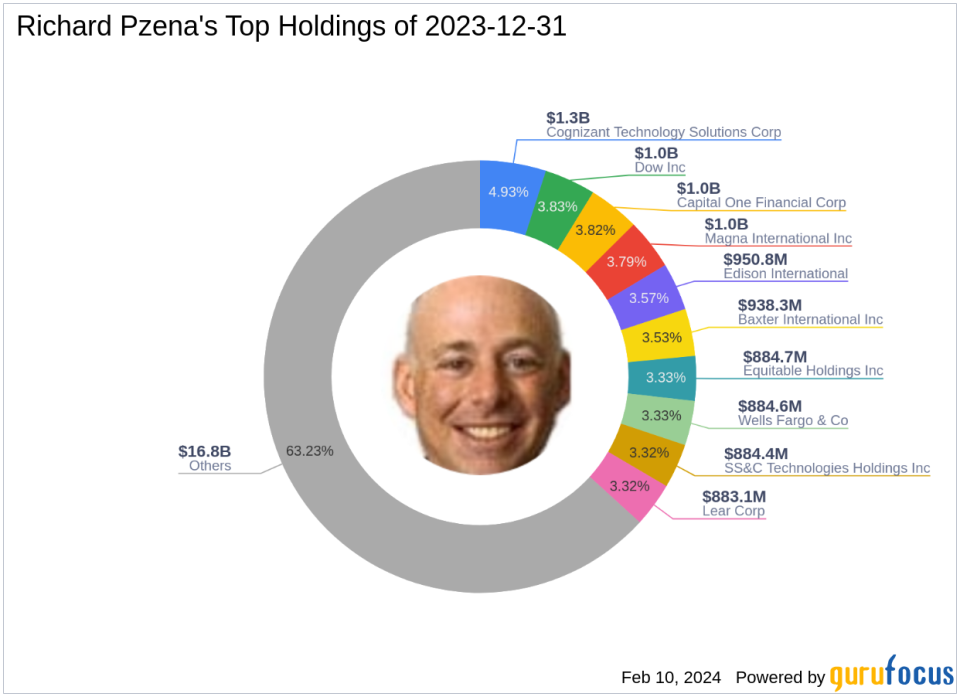

Insight into Richard Pzena (Trades, Portfolio)'s Investment Approach

Richard Pzena (Trades, Portfolio), the founder and Co-Chief Investment Officer of Pzena Investment Management, LLC, has been a prominent figure in the investment community since establishing the firm in 1995. With a BS from the Wharton School and an MBA from the University of Pennsylvania, Pzena's investment philosophy hinges on identifying undervalued companies based on their long-term earnings power. The firm's approach is to invest in quality businesses at low prices, often during times of temporary setbacks, with the belief that these issues are not permanent. Pzena Investment Management oversees an equity portfolio of $26.6 billion, with top holdings in sectors such as Financial Services and Technology.

ScanSource Inc: A Snapshot

ScanSource Inc, with its headquarters in the USA, has been a part of the technology distribution landscape since its IPO on March 18, 1994. The company operates through two segments: Specialty Technology Solutions and Modern Communications & Cloud. It primarily serves the United States market, offering value-added services to technology manufacturers and resellers. With a market capitalization of $1 billion, ScanSource Inc is recognized for its contribution to the hardware industry.

Examining the Impact of Pzena's Trade

The recent acquisition by Pzena Investment Management has increased its position in ScanSource Inc to 0.32% of the portfolio. The trade price of $39.61 is closely aligned with the current stock price of $39.86, which is considered modestly overvalued according to the GF Value of $33.87. The stock's price to GF Value ratio stands at 1.18, with a slight gain of 0.63% since the transaction date.

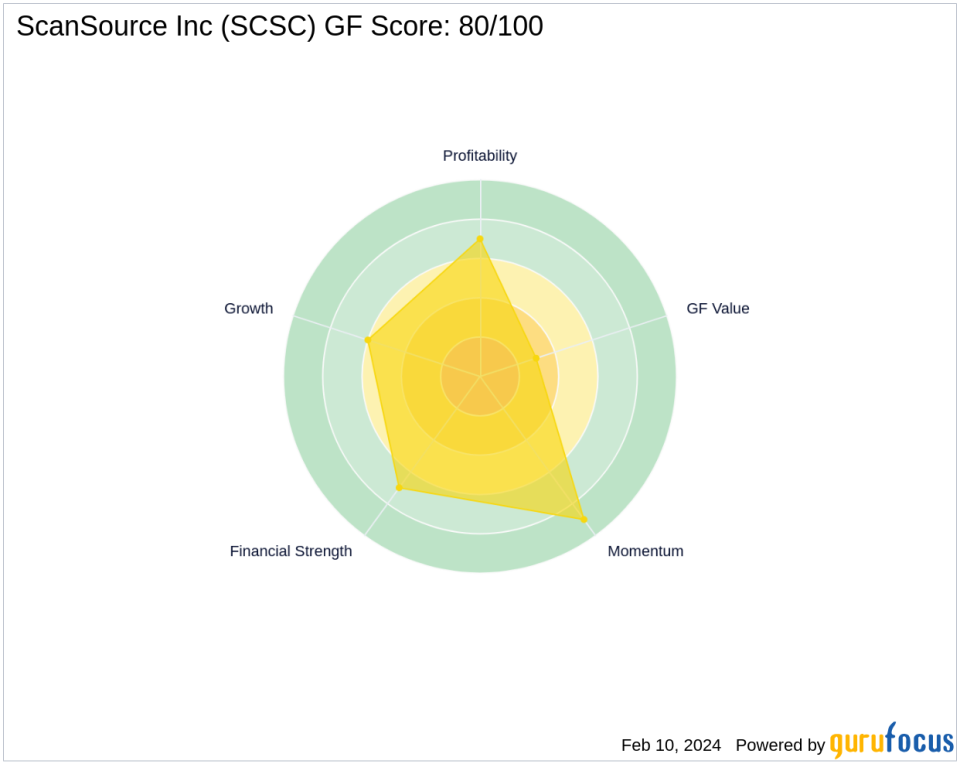

Market Performance and Valuation Metrics

ScanSource Inc's stock performance is reflected in its PE Percentage of 11.45, indicating profitability. The company's GF Score of 80/100 suggests good outperformance potential. Despite a year-to-date price change ratio of -0.05%, the stock has experienced significant growth since its IPO, with an IPO Percent of 2,217.44. The company's financial strength and profitability are further underscored by its Financial Strength and Profitability Rank, both at 7/10.

Industry Position and Comparative Analysis

Within the hardware industry, ScanSource Inc holds a competitive position. Pzena's investment in the company complements its top sectors, Financial Services and Technology. Other notable investors, such as HOTCHKIS & WILEY and Barrow, Hanley, Mewhinney & Strauss, also maintain positions in SCSC, although Pzena Investment Management LLC remains the largest guru shareholder.

Conclusion: Pzena's Strategic Move

Richard Pzena (Trades, Portfolio)'s recent trade in ScanSource Inc signifies a calculated addition to the firm's diverse portfolio. The alignment with the current stock price and the GF Value suggests a belief in the company's intrinsic value and potential for growth. For value investors, this move by Pzena Investment Management may indicate a favorable outlook on ScanSource Inc, warranting consideration for those seeking opportunities in the technology distribution sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.