Richard Pzena Bolsters Position in SS&C Technologies Holdings Inc

Introduction to the Transaction

Richard Pzena (Trades, Portfolio)'s investment firm, Pzena Investment Management, LLC, has recently increased its stake in SS&C Technologies Holdings Inc (NASDAQ:SSNC), a notable player in the software and financial services industry. On December 31, 2023, the firm added 390,007 shares to its holdings at a trade price of $61.11 per share. This transaction has expanded Pzena's total share count in SSNC to 14,619,455, marking a significant move in the firm's investment strategy.

Profile of Richard Pzena (Trades, Portfolio)

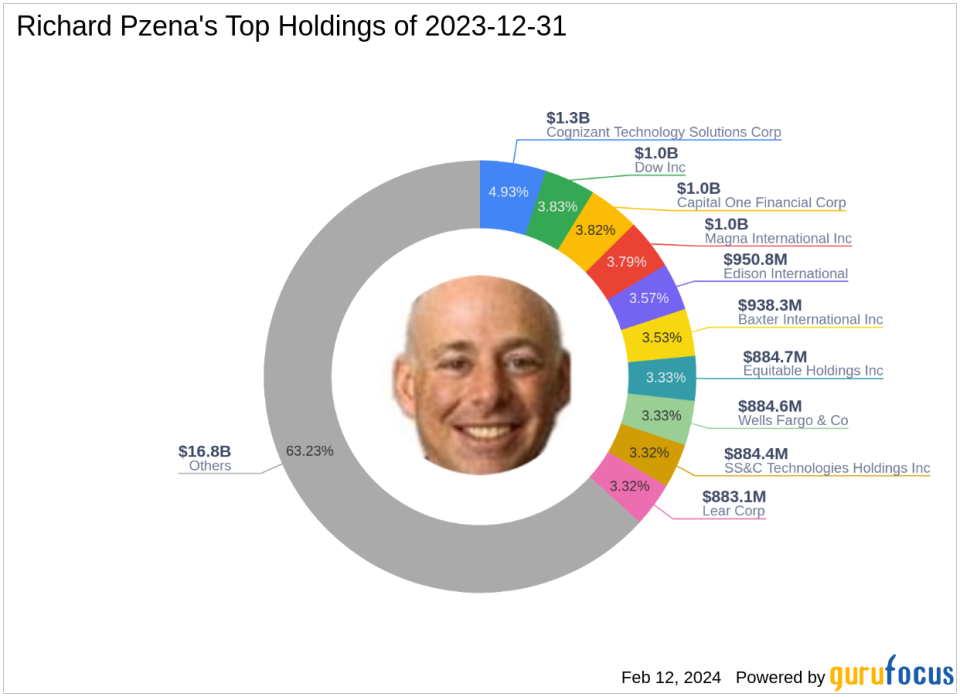

Richard Pzena (Trades, Portfolio), the founder and Co-Chief Investment Officer of Pzena Investment Management, LLC, is a respected figure in the investment community. Since establishing the firm in 1995, Pzena has adhered to a value investment philosophy, focusing on acquiring shares in reputable businesses at prices that are lower than their normal long-term earnings power. The firm's approach is to identify and capitalize on temporary issues that have caused share prices to drop, distinguishing between transient and permanent setbacks. With an equity portfolio of $26.6 billion, Pzena's top holdings include Cognizant Technology Solutions Corp (NASDAQ:CTSH), Capital One Financial Corp (NYSE:COF), and Edison International (NYSE:EIX), among others, with a strong inclination towards the Financial Services and Technology sectors.

Overview of SS&C Technologies Holdings Inc

SS&C Technologies is a comprehensive provider of software products and software-enabled services, catering primarily to the financial services sector, with a growing presence in healthcare. The company's offerings include fund administration services, portfolio accounting, and management, as well as banking and lending software solutions. SS&C's strategic acquisitions, such as Intralinks and DST Systems, have solidified its position in the market. With a market capitalization of $15.09 billion and a stock price of $60.98, SS&C Technologies is considered modestly undervalued with a GF Value of $72.63 and a Price to GF Value ratio of 0.84.

Analysis of the Trade Impact

The recent acquisition by Pzena Investment Management has a moderate impact on the firm's portfolio, with a 0.1% trade impact. The addition of shares has increased the firm's position in SSNC to 3.83% of the portfolio, while Pzena's holdings in SSNC now represent 5.90% of the company's outstanding shares. This move reflects Pzena's confidence in SS&C Technologies' potential for growth and recovery.

Market Context and Stock Valuation

SS&C Technologies' current market capitalization stands at $15.09 billion, with a stock price slightly below the GF Value, indicating a modest undervaluation. The stock's PE Ratio is at 25.19%, and the Price to GF Value ratio is 0.84, suggesting that the stock may be a reasonable buy according to GuruFocus valuation metrics. Despite a minor price decrease of 0.21% since the transaction, the stock has experienced a significant increase of 659.4% since its IPO and a year-to-date change of 0.93%.

Performance Metrics and Rankings

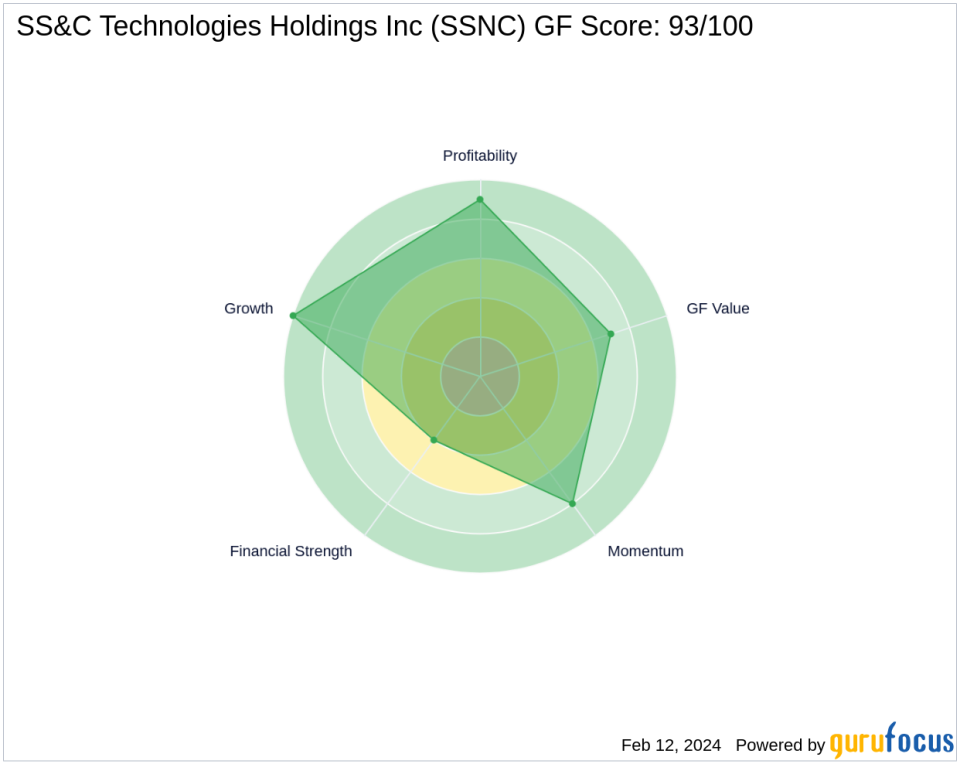

SS&C Technologies boasts a strong GF Score of 93/100, indicating a high potential for outperformance. The company's financial health is reflected in its Financial Strength rank of 4/10, while its Profitability Rank stands at an impressive 9/10. The Growth Rank is at the maximum of 10/10, showcasing the company's robust growth prospects. Additionally, SS&C Technologies has a GF Value Rank of 7/10 and a Momentum Rank of 8/10, further emphasizing its solid market position.

Sector and Peer Comparison

Within Pzena's portfolio, Technology and Financial Services are the top sectors, with SS&C Technologies aligning well with these preferences. Other notable gurus holding SSNC include Seth Klarman (Trades, Portfolio), Ron Baron (Trades, Portfolio), and Charles Brandes (Trades, Portfolio), indicating the stock's appeal among value investors.

Conclusion

The recent addition of SS&C Technologies shares to Richard Pzena (Trades, Portfolio)'s portfolio underscores the firm's strategy of investing in undervalued companies with strong growth potential. SS&C's position within the software industry, combined with its financial health and growth prospects, makes it a compelling investment. As Pzena Investment Management continues to adjust its holdings, the performance of SS&C Technologies will be an important factor to watch.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.