Richard Pzena Increases Stake in TrueBlue Inc

Overview of Richard Pzena (Trades, Portfolio)'s Latest Investment Move

On December 31, 2023, Pzena Investment Management, LLC, led by value investing stalwart Richard Pzena (Trades, Portfolio), bolstered its position in TrueBlue Inc (NYSE:TBI), a prominent staffing and workforce management solutions provider. The firm added 661,496 shares to its holdings, marking a significant 27.21% increase in its stake. This transaction impacted the firm's portfolio by 0.04%, with the shares purchased at an average price of $15.34. Following this addition, Pzena Investment Management now holds a total of 3,092,337 shares in TrueBlue Inc, representing a 9.90% ownership of the company.

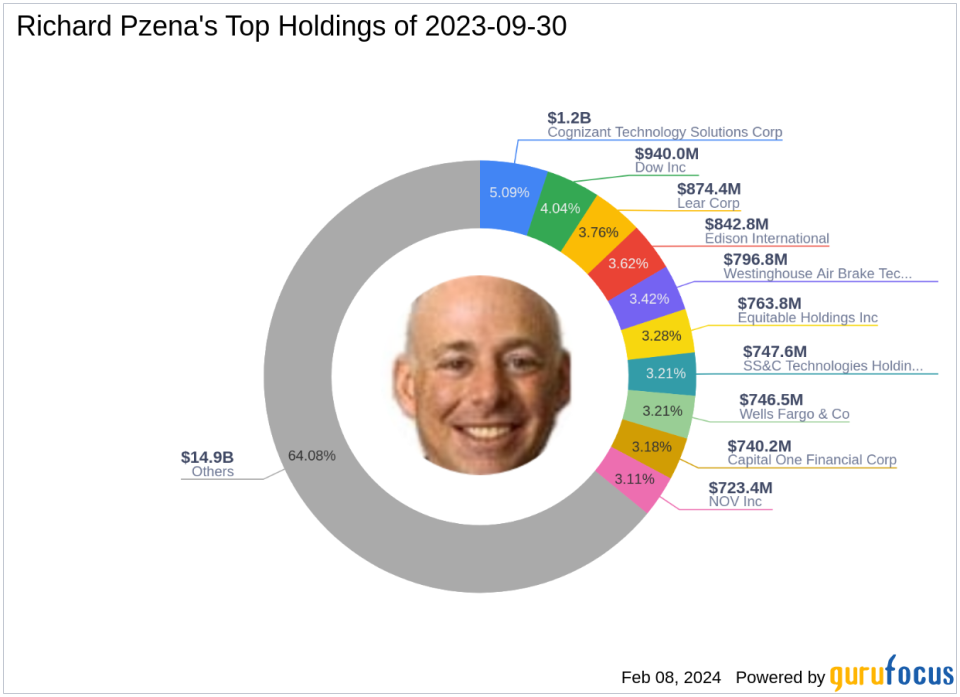

Richard Pzena (Trades, Portfolio)'s Investment Expertise

Richard Pzena (Trades, Portfolio), the founder and Co-Chief Investment Officer of Pzena Investment Management, LLC, has been a notable figure in the investment community since the firm's inception in 1995. With a BS summa cum laude from the Wharton School and an MBA from the University of Pennsylvania, Pzena's investment philosophy centers on identifying undervalued companies based on their long-term earnings power. The firm seeks out good businesses at low prices, often capitalizing on temporary issues that depress share prices. Pzena Investment Management oversees an equity portfolio worth $23.28 billion, with top holdings in sectors such as Financial Services and Technology, including companies like Cognizant Technology Solutions Corp (NASDAQ:CTSH) and Edison International (NYSE:EIX).

TrueBlue Inc at a Glance

TrueBlue Inc, traded under the symbol TBI in the USA, has been a player in the staffing industry since its IPO on March 26, 1990. The company operates through segments such as PeopleReady, PeopleManagement, and PeopleScout, with PeopleReady being the largest revenue generator. Despite a market capitalization of $407.308 million, TrueBlue's stock performance has been underwhelming, with a current valuation suggesting it may be a possible value trap. The stock is trading at $13.08, which is significantly below its GF Value of $21.04, indicating a price to GF Value ratio of 0.62. However, the stock has experienced a decline of 14.73% since Pzena's purchase.

Impact of Pzena's Trade on Portfolio

The recent acquisition of TrueBlue Inc shares by Pzena Investment Management has a modest yet strategic impact on the firm's portfolio. With a 0.2% position in the portfolio, the trade reflects Pzena's confidence in TrueBlue's potential for recovery and growth. The trade price of $15.34 contrasts with the current stock price of $13.08, suggesting that Pzena sees long-term value beyond short-term market fluctuations.

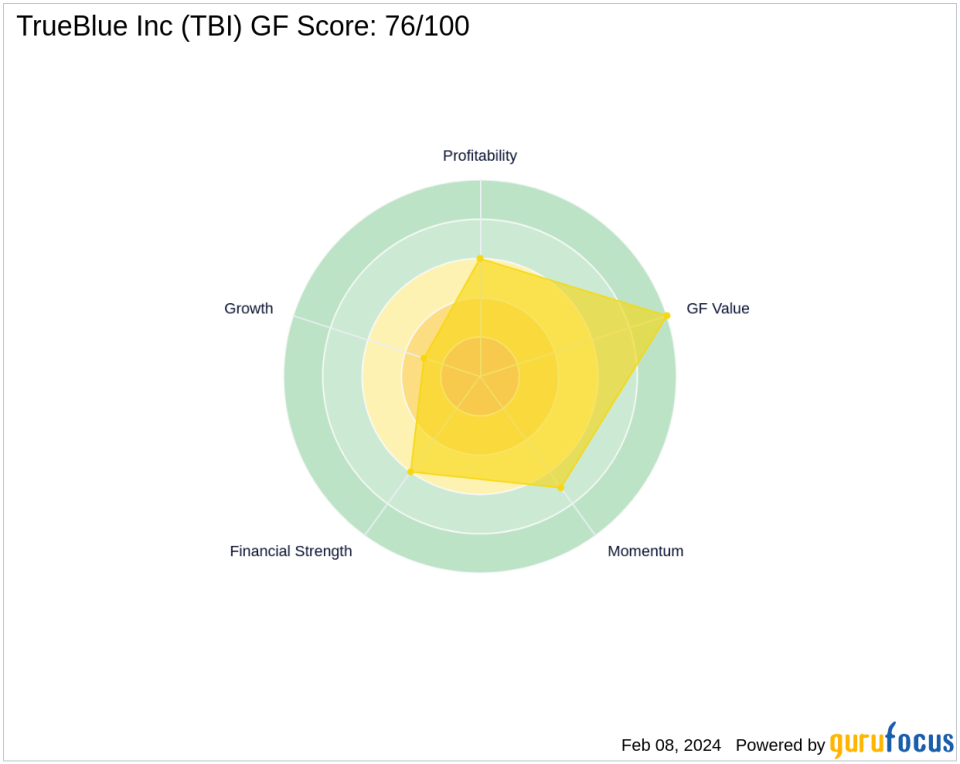

TrueBlue's Financial Position and Market Performance

TrueBlue Inc's financial health is a mixed bag, with a GF Score of 76/100, indicating a potential for above-average performance. The company's Financial Strength and Profitability Rank both stand at 6/10, while its Growth Rank is lower at 3/10. TrueBlue's GF Value Rank is at the highest possible score of 10/10, suggesting that the stock is significantly undervalued. The company's Momentum Rank is 7/10, reflecting some positive market trends despite recent price declines.

Industry and Market Context

Richard Pzena (Trades, Portfolio)'s investment in TrueBlue Inc aligns with the firm's broader strategy of seeking value in various sectors. TrueBlue's positioning within the Business Services industry is notable, as the sector often provides essential services that can weather economic fluctuations. Pzena's top sectors include Financial Services and Technology, indicating a diversified approach to value investing.

Other Notable Investors in TrueBlue

Pzena Investment Management is not the only notable firm with a stake in TrueBlue Inc. Other gurus, such as HOTCHKIS & WILEY, also hold shares in the company. However, with a 9.90% share percentage, Pzena is one of the largest investors in TrueBlue, demonstrating significant confidence in the company's prospects.

Concluding Thoughts on Pzena's TrueBlue Investment

The recent transaction by Richard Pzena (Trades, Portfolio)'s firm in TrueBlue Inc is a testament to the firm's value-driven investment approach. Despite the current market valuation and stock performance, Pzena's increased stake in TrueBlue suggests a belief in the company's intrinsic value and potential for future growth. For value investors, this move may signal an opportunity to consider TrueBlue Inc as a potential addition to their portfolios, especially given its undervalued status and the backing of a seasoned investor like Pzena.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.