Richard Pzena Trims Stake in Newell Brands Inc

Overview of Richard Pzena (Trades, Portfolio)'s Recent Stock Transaction

Richard Pzena (Trades, Portfolio)'s investment firm, Pzena Investment Management, LLC, has recently adjusted its holdings in Newell Brands Inc (NASDAQ:NWL), a notable player in the consumer goods sector. On December 31, 2023, the firm reduced its stake in Newell Brands, signaling a strategic shift in its investment portfolio. This transaction reflects the firm's ongoing assessment and reallocation of its assets to align with its investment philosophy.

Profile of Richard Pzena (Trades, Portfolio)

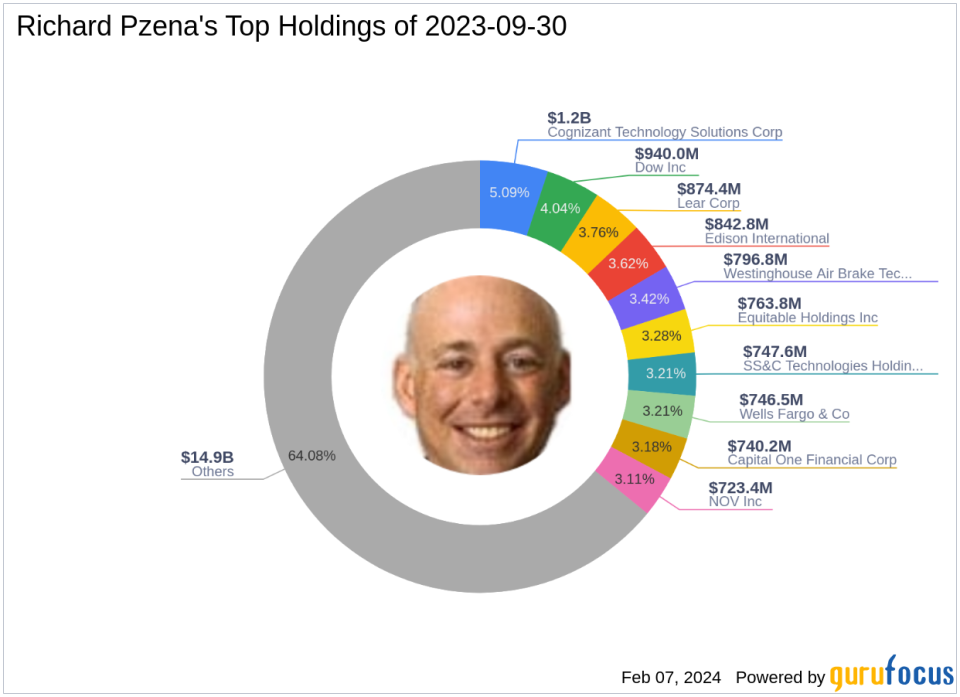

Richard Pzena (Trades, Portfolio), the founder and Co-Chief Investment Officer of Pzena Investment Management, LLC, is a respected figure in the investment community. Since establishing the firm in 1995, Pzena has adhered to a value investing philosophy, focusing on acquiring shares of quality businesses at discounted prices. The firm's approach involves a meticulous analysis of companies' long-term earnings power relative to their current share prices, seeking opportunities that arise from temporary market dislocations. Pzena Investment Management's portfolio includes top holdings such as Cognizant Technology Solutions Corp (NASDAQ:CTSH) and Edison International (NYSE:EIX), with a strong presence in the Financial Services and Technology sectors, and an equity portfolio valued at $23.28 billion.

Details of the Trade Action

The transaction, executed on the last day of 2023, saw Pzena Investment Management reduce its position in Newell Brands by 277,368 shares, resulting in a slight portfolio impact of -0.01%. The shares were traded at a price of $8.68 each, leaving the firm with a total of 54,518,863 shares in Newell Brands, which now represents 2.03% of its portfolio and 13.20% of the company's holdings.

Newell Brands Inc Company Overview

Newell Brands Inc, with its diverse portfolio of consumer goods, operates through segments including Home and Commercial Solutions, Learning and Development, and Outdoor and Recreation. The Learning and Development segment is particularly significant, contributing substantially to the company's revenue. Despite a market capitalization of $3.28 billion, Newell Brands has faced challenges, reflected in its current stock price of $7.92, which is below the GF Value of $16.75, indicating a potential value trap situation for investors.

Financial Analysis of Newell Brands Inc

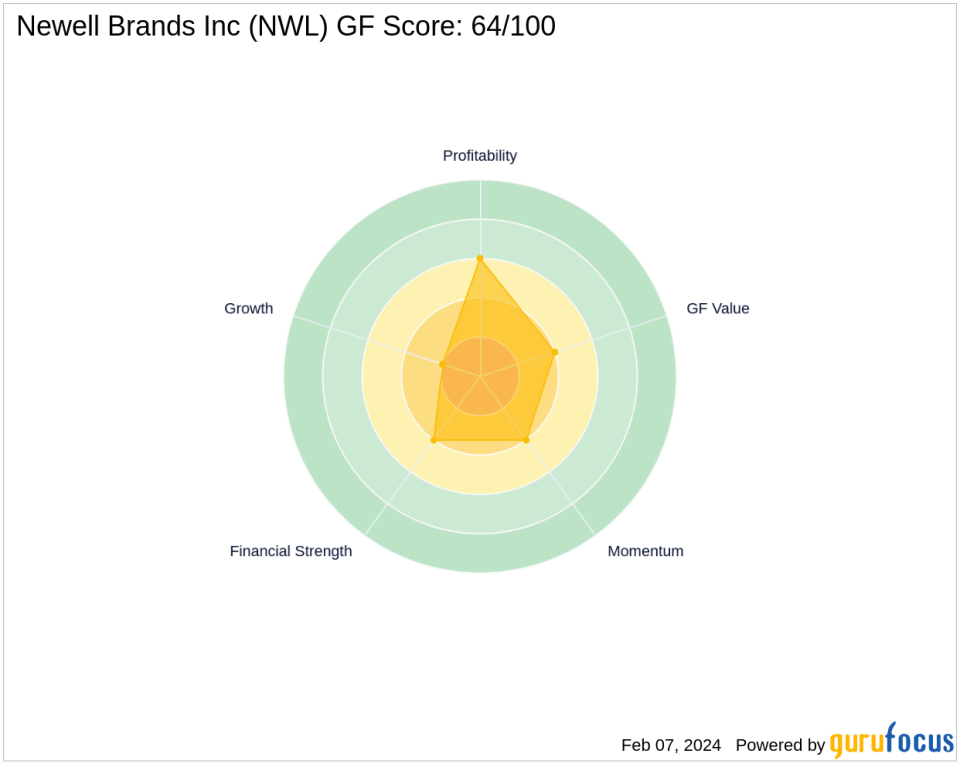

With a stock price to GF Value ratio of 0.47, Newell Brands Inc's valuation status is concerning, as the current stock price suggests the market may be skeptical about the company's future prospects. The firm's financial health is further underscored by a Financial Strength rank of 4/10 and a Profitability Rank of 6/10. However, its Growth Rank and GF Value Rank are both at a lower 2/10 and 4/10, respectively, indicating potential concerns about its growth trajectory and intrinsic value.

Comparative Guru Holdings

Pzena Investment Management's position in Newell Brands Inc is significant when compared to other notable investors. Both Carl Icahn (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio) also hold shares in NWL, although their positions are not as substantial as Pzena's. This collective interest from multiple investment gurus suggests a recognition of value in Newell Brands, despite its current market challenges.

Market Context and Performance Metrics

Since its IPO in 1987, Newell Brands Inc's stock has seen a price change ratio of 306.15%. However, the year-to-date performance has been less impressive, with a -9.38% change. Post-transaction, the stock has experienced a -8.76% price change. The GF Score of 64/100 indicates a poor future performance potential, which aligns with the stock's current market sentiment.

Conclusion

The recent reduction in Newell Brands Inc by Richard Pzena (Trades, Portfolio)'s firm may reflect a strategic reassessment of the investment's alignment with the firm's value-driven philosophy. Given the company's current valuation status and mixed financial indicators, this trade could be indicative of Pzena's cautious outlook on Newell Brands' future performance. Investors will be watching closely to see how this adjustment influences the firm's portfolio and whether Newell Brands can overcome its market challenges to realize its intrinsic value.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.