Richard Pzena Trims Stake in Phibro Animal Health Corp

Overview of Richard Pzena (Trades, Portfolio)'s Recent Transaction

Richard Pzena (Trades, Portfolio)'s investment firm, Pzena Investment Management, LLC, has recently adjusted its holdings in Phibro Animal Health Corp (NASDAQ:PAHC). On December 31, 2023, the firm reduced its stake in PAHC, signaling a strategic portfolio realignment. This move involved the sale of 79,428 shares at a price of $11.58 per share, which has impacted the firm's investment in PAHC but did not significantly alter its overall portfolio composition.

Investment Philosophy of Pzena Investment Management

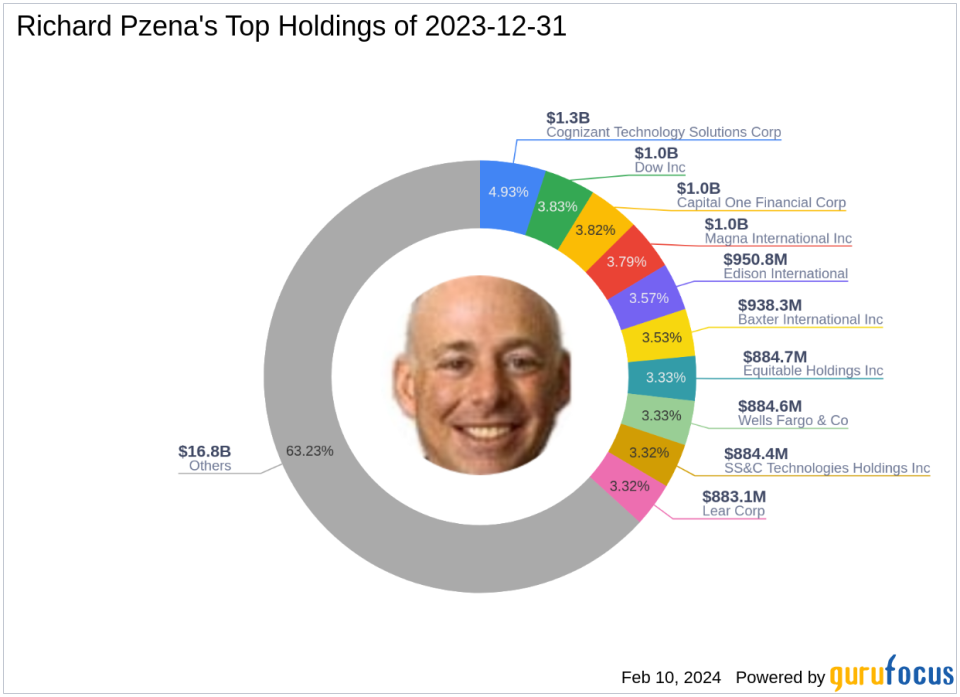

Pzena Investment Management, founded by Richard Pzena (Trades, Portfolio) in 1995, is known for its value-oriented investment approach. The firm focuses on acquiring shares of reputable businesses at prices that are lower than their normal long-term earnings power. Pzena's strategy involves identifying companies whose stock prices have dropped due to temporary issues, providing an attractive entry point for investment. The firm's top holdings include Cognizant Technology Solutions Corp (NASDAQ:CTSH), Capital One Financial Corp (NYSE:COF), and Edison International (NYSE:EIX), among others, with a strong presence in the Financial Services and Technology sectors. The firm's equity portfolio is valued at $26.6 billion, reflecting its significant market influence.

Details of Pzena's Trade Action

The transaction carried out by Pzena Investment Management on the last day of 2023 resulted in a 3.84% reduction in their position in PAHC. The trade did not have a notable impact on the firm's portfolio, with PAHC shares constituting a mere 0.1% of the total holdings. However, the firm still maintains a significant 9.80% stake in the company, indicating continued confidence in its investment despite the reduction.

Phibro Animal Health Corp's Market Presence

Phibro Animal Health Corp, operating in the Drug Manufacturers industry, is a diversified entity focusing on animal health and mineral nutrition. Since its IPO on April 11, 2014, PAHC has been serving the food animal sector with a range of products, including antibacterials and vaccines. The company's three main segments are Animal Health, Mineral Nutrition, and Performance Products, with the Animal Health segment being the primary revenue driver. Currently, PAHC has a market capitalization of $469.032 million and is considered significantly undervalued with a GF Value of $21.21, while the stock trades at $11.58.

Phibro Animal Health Corp's Financial Health

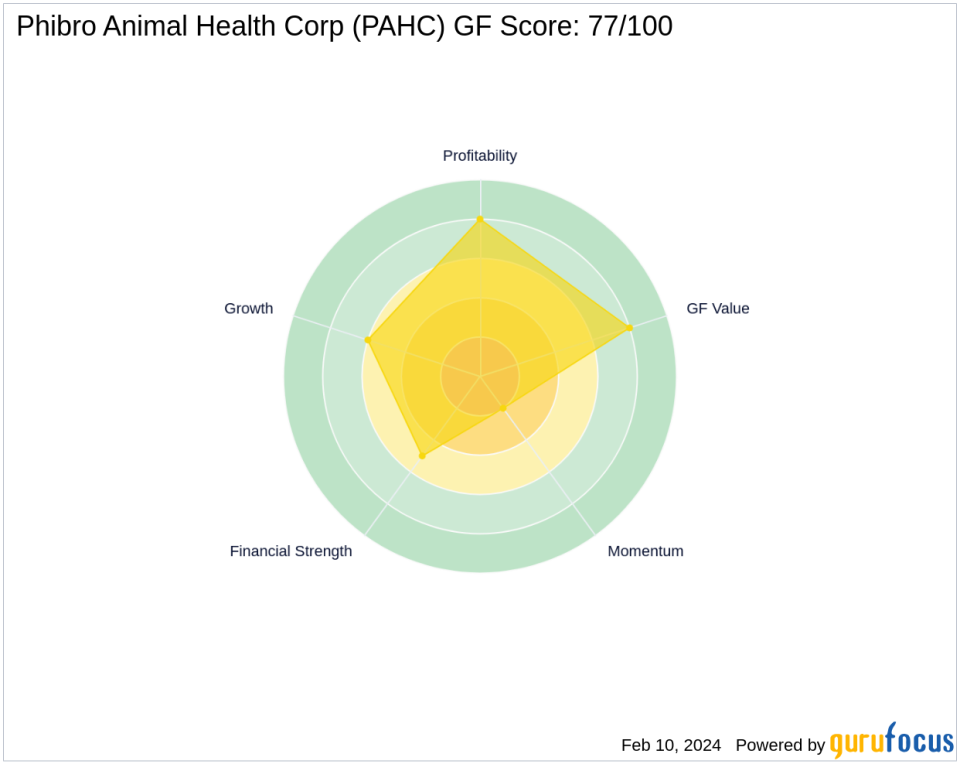

PAHC's financial and performance metrics reveal a mixed picture. The company holds a GF Score of 77/100, indicating a strong potential for future performance. Its Profitability Rank stands at 8/10, while the Growth Rank is 6/10, suggesting a stable financial trajectory. The GF Value Rank is high at 8/10, yet the Momentum Rank is low at 2/10, reflecting recent market challenges. PAHC's Piotroski F-Score is a solid 7, but the Altman Z-Score of 2.48 and interest coverage of 2.91 indicate areas that require investor attention.

Richard Pzena (Trades, Portfolio)'s Portfolio and Market Position

Richard Pzena (Trades, Portfolio)'s portfolio is diverse, with significant investments across various sectors. The firm's top holdings reflect a strategic emphasis on Financial Services and Technology, aligning with its value investment philosophy. Despite the recent reduction in PAHC shares, Pzena's portfolio remains robust, with PAHC still being a notable holding.

Comparative Guru Holdings in PAHC

Brandes Investment is currently the largest guru shareholder in PAHC, while other notable investment firms like HOTCHKIS & WILEY also maintain positions in the company. This collective interest from multiple gurus suggests a general consensus on the potential value of PAHC within the investment community.

Conclusion and Transaction Implications

The recent sale of PAHC shares by Richard Pzena (Trades, Portfolio)'s firm may reflect a strategic decision to reallocate resources within the portfolio. While the reduction does not significantly impact the firm's overall holdings, it does adjust its exposure to the animal health sector. For value investors, this move by Pzena Investment Management could signal a moment for careful analysis of PAHC's current market valuation and future prospects.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.