Richard Pzena Trims Stake in Steelcase Inc

Overview of Richard Pzena (Trades, Portfolio)'s Recent Transaction

On December 31, 2023, Pzena Investment Management, LLC, led by value investing stalwart Richard Pzena (Trades, Portfolio), adjusted its holdings in Steelcase Inc (NYSE:SCS) by reducing its stake. The transaction saw a decrease of 2,026,798 shares, which equates to a 20.53% change in the firm's holdings in the company. This move had a -0.12% impact on Pzena's portfolio, with the shares being traded at a price of $13.52. Following the transaction, the firm's total share count in Steelcase Inc stood at 7,843,245, representing a significant 8.40% position in the company and accounting for 0.46% of Pzena's investment portfolio.

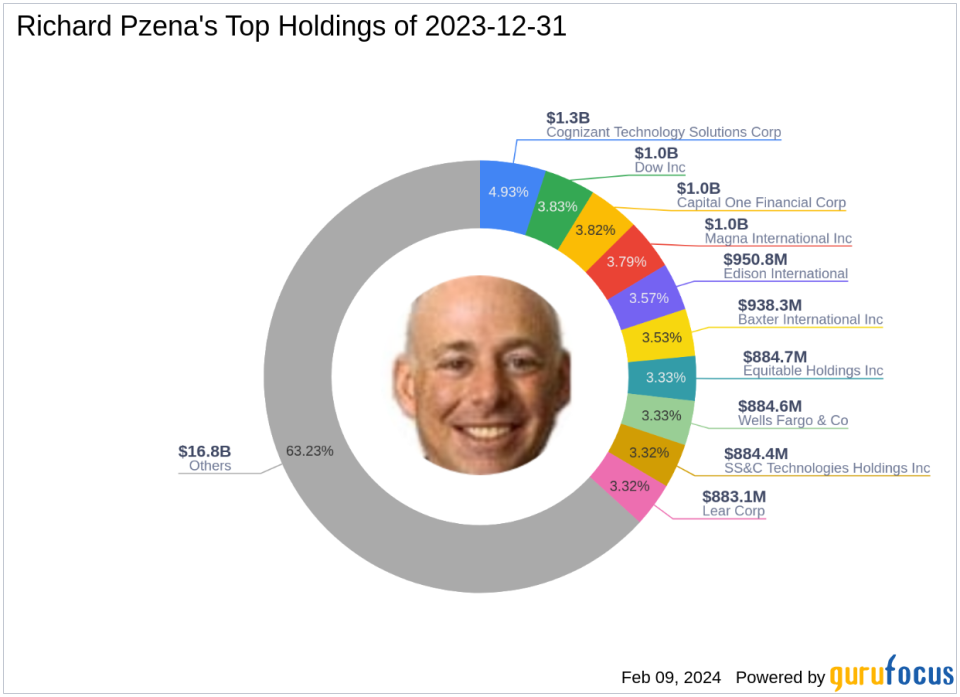

Richard Pzena (Trades, Portfolio)'s Investment Profile

Richard Pzena (Trades, Portfolio) is the founder and Co-Chief Investment Officer of Pzena Investment Management, LLC, established in 1995. With a BS summa cum laude from the Wharton School and an MBA from the University of Pennsylvania, Pzena's investment philosophy centers on purchasing shares in quality businesses at low prices, often during times of market disfavor. The firm's approach involves a rigorous valuation process to determine if a stock's price drop is due to temporary issues or permanent impairment. Pzena Investment Management oversees an equity portfolio valued at $26.6 billion, with top holdings in diverse sectors such as Financial Services and Technology.

Steelcase Inc at a Glance

Steelcase Inc, with the stock symbol SCS, is a prominent furniture company based in the USA, having gone public on February 18, 1998. The company specializes in office furniture, technology, and space solutions, operating primarily through its Americas and EMEA segments. Steelcase's product range includes desking, benching, systems, storage, and seating solutions. Despite a challenging market, the company maintains a market capitalization of $1.48 billion and a current stock price of $12.94.

Impact of the Trade on Pzena's Portfolio

The recent sale of Steelcase shares by Pzena Investment Management has slightly reduced the firm's exposure to the industrial products sector. With the trade price at $13.52 and the current stock price at $12.94, the firm has witnessed a -4.29% change in the stock's value post-transaction. Despite this, Steelcase Inc still holds a meaningful position in Pzena's portfolio, indicating a continued belief in the company's value proposition.

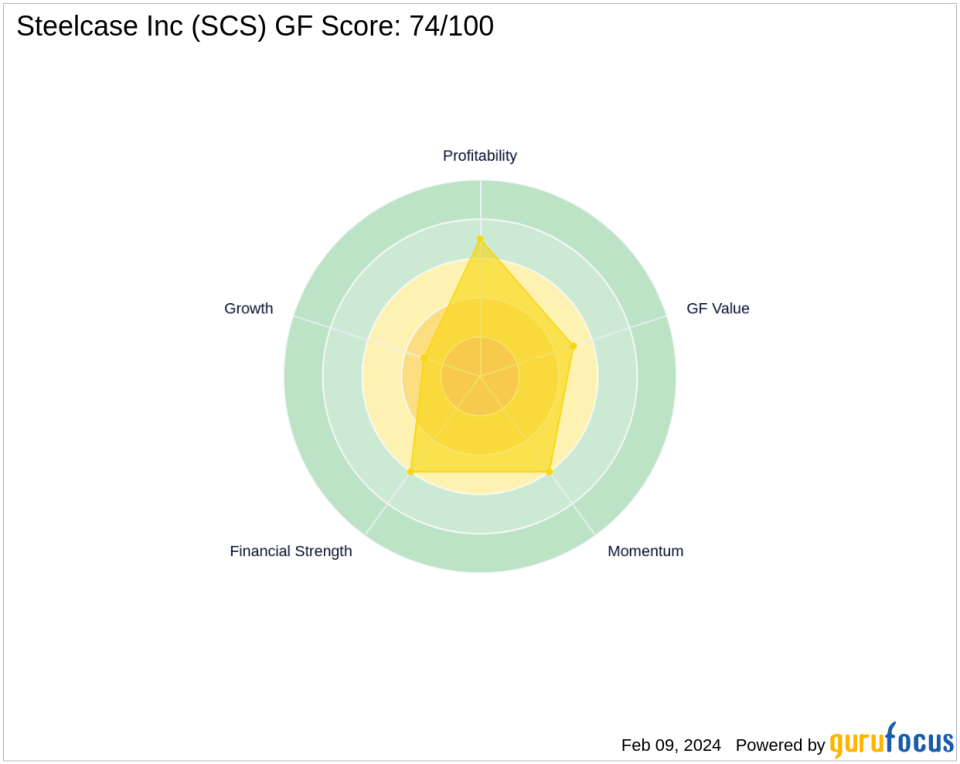

Steelcase Inc's Financial Health and Market Performance

Steelcase Inc's financial health is reflected in its GF Score of 74/100, indicating a strong potential for future performance. The company's balance sheet is rated 6/10, while its profitability rank stands at 7/10. However, its growth rank is a modest 3/10, and the GF Value Rank is at 5/10. The stock's current valuation is deemed "Fairly Valued" with a GF Value of $12.78 and a Price to GF Value ratio of 1.01. Despite these mixed signals, the company's Piotroski F-Score of 8 and Altman Z-Score of 3.00 suggest a stable financial condition.

Comparative Valuation and Market Sentiment

Steelcase Inc's stock valuation is in line with historical multiples, as indicated by its Price to GF Value ratio. The market sentiment, gauged by RSI and Momentum Index, shows a neutral position with RSI 14 Day at 51.75. Other notable gurus, including Joel Greenblatt (Trades, Portfolio) and Barrow, Hanley, Mewhinney & Strauss, also hold positions in Steelcase Inc, reflecting a diverse interest in the stock among value investors.

Conclusion

Richard Pzena (Trades, Portfolio)'s recent reduction in Steelcase Inc shares is a strategic move that aligns with the firm's value investing philosophy. While the transaction has slightly decreased the firm's stake in the company, Steelcase Inc remains a notable holding within Pzena's portfolio. Considering the company's fair valuation, stable financial scores, and the interest of other prominent gurus, Steelcase Inc may continue to be a significant player in the portfolios of value investors looking for opportunities in the industrial products sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.