Richard Snow Adds to Apple, Buys General Dynamics

- By Tiziano Frateschi

Richard Snow (Trades, Portfolio), the founder and chief investment officer of Snow Capital Management, bought shares of the following stocks during the first quarter.

Warning! GuruFocus has detected 2 Warning Sign with AAPL. Click here to check it out.

The intrinsic value of AAPL

The guru added 71.79% to his Apple Inc. (AAPL) holding. The trade had an impact of 1.31% on the portfolio.

The consumer electronic devices manufacturer has a market cap of $869.60 billion and an enterprise value of $902.14 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 49.91% and return on assets of 15.90% are outperforming 94% of companies in the Consumer Electronics industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.71 is below the industry median of 1.26.

The company's largest guru shareholder is Warren Buffett (Trades, Portfolio) with 5.42% of outstanding shares, followed by Ken Fisher (Trades, Portfolio) with 0.28% and Pioneer Investments (Trades, Portfolio) with 0.22%.

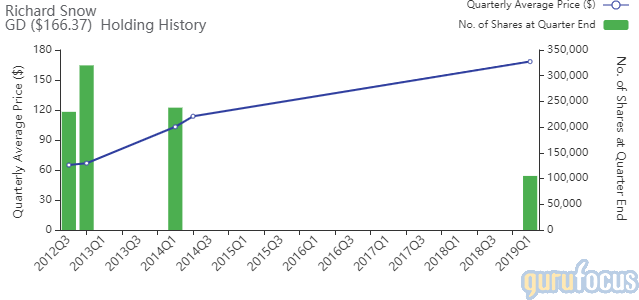

The investor established a new position in General Dynamics Corp. (GD), buying 105,136 shares. The trade had an impact of 1.12% on the portfolio.

The company, which manufactures submarines, armored vehicles and information technology systems, has a market cap of $48.06 billion and an enterprise value of $60.93 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 27.20% and return on assets of 7.34% are outperforming 84% of companies in the Aerospace and Defense industry. Its financial strength is rated 5 out of 10. The equity-asset ratio of 0.05 is below the industry median of 0.53.

The company's largest guru shareholder is Barrow, Hanley, Mewhinney & Strauss with 0.85% of outstanding shares, followed by PRIMECAP Management (Trades, Portfolio) with 0.24%, Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.23% and Tom Gayner (Trades, Portfolio) with 0.13%.

Snow added 65.43% to his JetBlue Airways Corp. (JBLU) stake. The portfolio was impacted by 0.92%.

The airline has a market cap of $5.36 billion and an enterprise value of $6.02 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 3.09% and return on assets of 1.36% are outperforming 68% of companies in the Airlines industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.57 is above the industry median of 0.54.

The largest guru shareholder of the company is PRIMECAP Management with 7.48% of outstanding shares, followed by Donald Smith (Trades, Portfolio) with 3.0%, Simons' firm with 2.01% and Snow's firm with 0.74%.

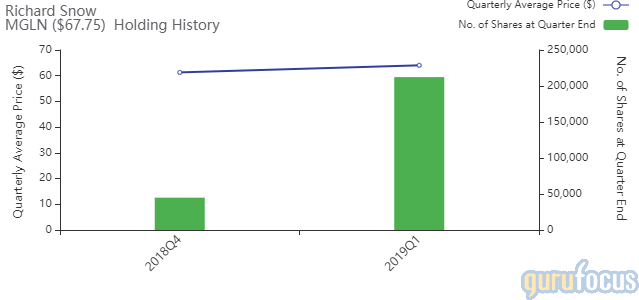

The investor boosted his Magellan Health Inc. (MGLN) holding by 373.05%, impacting the portfolio by 0.69%.

The health care management services provider has a market cap of $1.63 billion and an enterprise value of $1.73 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. While the return on equity of 1.01% is underperforming the sector, the return on assets of 0.43% is outperforming 50% of companies in the Health Care Plans industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.86 is below the industry median of 1.15.

The largest guru shareholder of the company is Simons' firm with 2.87% of outstanding shares, followed by Steven Cohen (Trades, Portfolio) with 2.77% and Fisher with 1.18%.

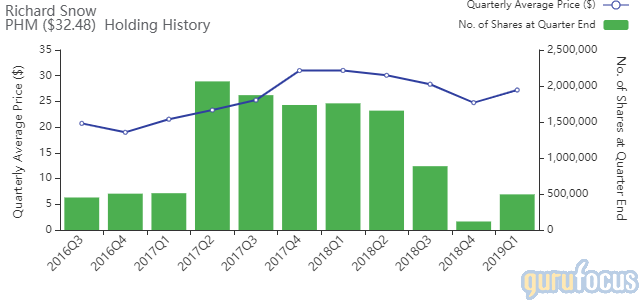

The PulteGroup Inc. (PHM) holding was boosted by 318.54%. The portfolio was impacted by 0.66%.

The homebuilder has a market cap of $9 billion and an enterprise value of $10.87 billion.

GuruFocus gives the holding company a profitability and growth rating of 9 out of 10. The return on equity of 21.63% and return on assets of 10.19% are outperforming 82% of companies in the Residential Construction industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 0.43 is above the industry median of 0.35.

The largest guru shareholder of the company is Simons' firm with 0.88% of outstanding shares, followed by Pioneer Investments with 0.29% and Ray Dalio (Trades, Portfolio) with 0.24%.

The guru increased his DowDuPont Inc. (DWDP) position by 24.6%, impacting the portfolio by 0.29%.

The chemical company has a market cap of $69.57 billion and an enterprise value of $101.53 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of 3.37% and return on assets of 1.73% are underperforming 79% of companies in the Chemicals industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.28 is below the industry median of 0.72.

The largest guru shareholder of the company is Barrow, Hanley, Mewhinney & Strauss with 1.08% of outstanding shares, followed by Daniel Loeb (Trades, Portfolio) with 0.39% and the T Rowe Price Equity Income Fund (Trades, Portfolio) with 0.33%.

Snow added 103.56% to his Goldman Sachs Group Inc. (GS) position. The portfolio was impacted by 0.17%.

The investment bank has a market cap of $72.23 billion and an enterprise value of $285.20 billion.

GuruFocus gives the company a profitability and growth rating of 3 out of 10. The return on equity of 10.64% and return on assets of 1.04% are underperforming 68% of companies in the Capital Markets industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.30 is below the industry median of 5.11.

The largest guru shareholder of the company is Buffett with 5.02% of outstanding shares, followed by Dodge & Cox with 3.11% and Hotchkis & Wiley with 0.81%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Michael Price Trims Bunge, Exits XPO Logistics

Insiders Roundup: vTV Therapeutics, The Hershey

David Tepper Exits Altantica Yield, Allstate

N ot a Premium Member of GuruFocus? Sign up for a free 7-day trial here .

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 2 Warning Sign with AAPL. Click here to check it out.

The intrinsic value of AAPL