Riding the Wave of Luxury With LVMH

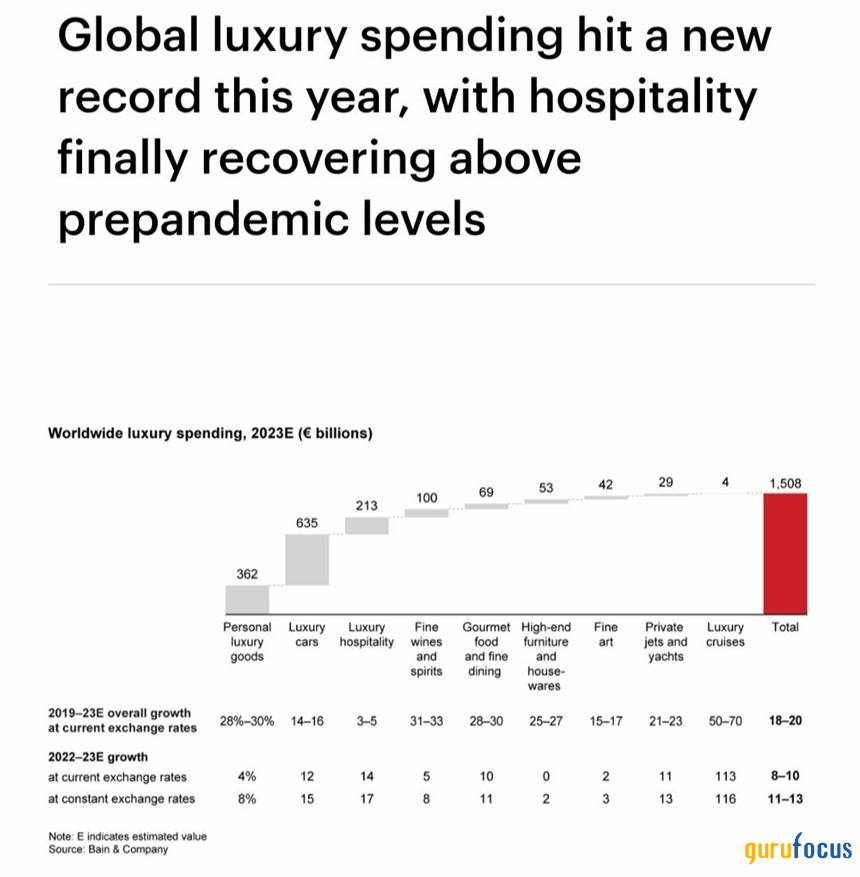

The annual Bain-Altagamma Luxury Goods Worldwide Market Study, which was released on Jan. 18, showed that global luxury spending hit a new record. Global luxury spending reached its peak in 2023 with remarkable 8% to 10% growth, reaching a staggering 1.50 trillion euros ($1.60 trillion).

Source: Bain-Altagamma Luxury Goods Worldwide Market Study

Between 2019 and 2023, the study found the total luxury industry grew 18% to 20% while personal luxury goods experienced 28% to 30% overall growth. The fine wines and spirits market also grew between 31% and 33% over the same period.Interestingly, LVMH Moet Hennessy Louis Vuitton SE (LVMHF) (MIL:LVMH), a leading player in the luxury goods space, saw its revenue surge by an impressive 72.68% during this period, jumping from $53.67 billion in 2019 to $92.68 billion at the end of 2023. The company surpassed its industry, which grew around 20%.

Looking ahead, we expect the revenue of LVMH to continue growing along with the overall luxury industry as spending growth rises from an estimated 1.5 trillion euros today to 2.5 trillion euros by 2030.

According to some market studies, there are some main factors that will profoundly shape the luxury goods market leading up to 2030:

Chinese consumers that represent 35% of global purchases of luxury goods will regain the spending power they had prior to the pandemic and become the dominant nationality for luxury goods. The next biggest luxury markets globally are America and Europe (24% to 26% respectively of global purchases).

Younger generations, like millennials and gen Z, are increasingly embracing luxury goods, driven by self-expression and a desire for quality experiences. And these generations are projected to become the biggest buyers of luxury by far, representing nearly 85% of global purchases.

So the world of luxury is booming, and LVMH stands at the forefront, strategically positioned with its diverse portfolio of iconic brands to reap the rewards of this upswing.

About LVMH

LVMH is a French multinational corporation founded in 1987 from the merger of Moet Hennessy and Louis Vuitton. It is one of the world's leading luxury goods conglomerates that owns and operates over 70 brands across various sectors of the luxury market.

Some brands under LVMH include Louis Vuitton, Fendi, Celine, Givenchy, Kenzo, Loewe, Bulgari, Chaumet, Fred, Hublot, Tag Heuer, Hennessy, Moet & Chandon, Dom Perigno and many more.

LVMH's strength lies in its diverse portfolio of strong brands that cater to a specific segment of the luxury market. It also focuses on quality and craftsmanship with high-quality materials and attention to detail. The company sucessfully maintains the image and desirability of its brands through marketing and communication and has a well-established distribution network with thousands of stores and online channels worldwide.

Strong organic revenue growth is happening across all business groups except Wines and Spirits, and is seeing market share gains worldwide. Double-digit organic revenue growth is occurring in Europe, Japan and Asia.

LVMH's profitability further underscores its success

Market research confirms the sector's growth still has legs. Seizing the opportunity to profit from this enduring surge by adding LVMH to your portfolio might be a good decision.

Accoding to LVMH's investor relations, the company had a good year in 2023. Its revenue jumped 13% to a whopping 86.15 billion euros compared to 79.18 billion euros in 2022. Even though the fine wine and spirits business wasn't as bubbly, other areas like Fashion and Leather Goods, which makes up half of the revenue, continued to shine with sustained double-digit organic growth.

All other business segments also contributed to the positive results, particularly in Europe, Japan and the rest of Asia. The total stores also increased around the globe, reaching 6,097 stores in 2023 compared to ony 5,500 locations in 2022 and 2021.

The company's Fashion and Leather Goods segment reigns supreme as the largest contributor, generating a whopping 49.55% of the total revenue. This segment boasts impressive growth, surging from 30.89 billion euros in 2021 to 38.89 billion euros in 202 and 42.16 billion euros in 2023. Powerhouses like Louis Vuitton, Dior and Celine fuel this success, solidifying the segment's dominant position.

Selective Retailing is the second-largest contributor. Sales skyrocketed by a whopping 52%, jumping from 11.73 billion euros in 2021 to 12.85 billion euros in 2022 and finally hitting 17.88 billion euros last year. Meanwhile, Perfumes & Cosmetics and Watches & Jewelry contribute a combined 30.31% of total revenue, experiencing moderate growth.

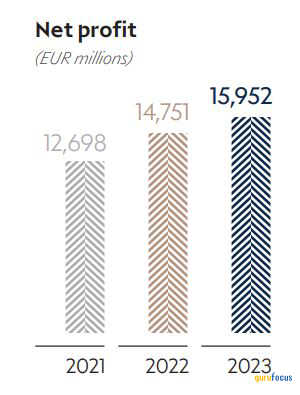

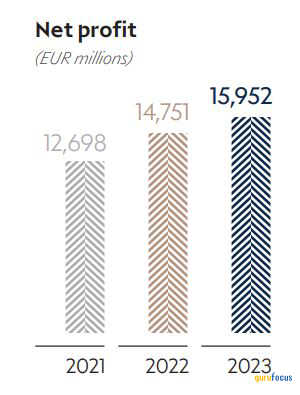

Net profit increased from 12.6 billion euors in 2021 to 15.95 billion euors in 2023. The average annual net profit margin is 18.62%.

Source: LVMH's Financial Documents - Dec. 31, 2023

LVMH's financial health is also commendable. The company has been managing its debt effectively, with its debt-to-equity ratio declining from 0.69 in 2019 to 0.66 in 2023. This indicates a healthy balance sheet, positioning it for sustainable growth in the future.

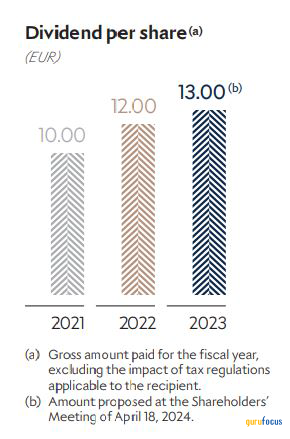

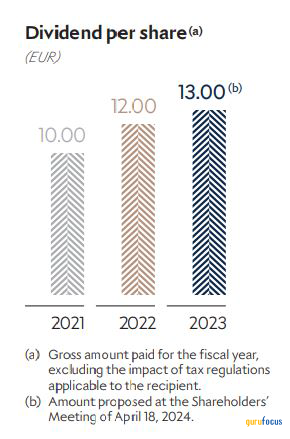

More than that, LVMH also rewarded shareholders with a consistent dividend payout ratio of 38%, with the latest dividend per share amounting to 13 euros, offering a respectable yield of 1.86%.

Source: LVMH's Financial Documents - Dec. 31, 2023

LVMH is not just showing off impressive sales growth - it is rewarding shareholders. With a steady increase in dividends from 10 euors per share in 2021 to 13 euros in 2023, is is showing respect for investors and a commitment to sharing in their success. This rising payout highlights the company's financial strength and confidence in its future, making it an even more attractive prospect for value-seeking investors.

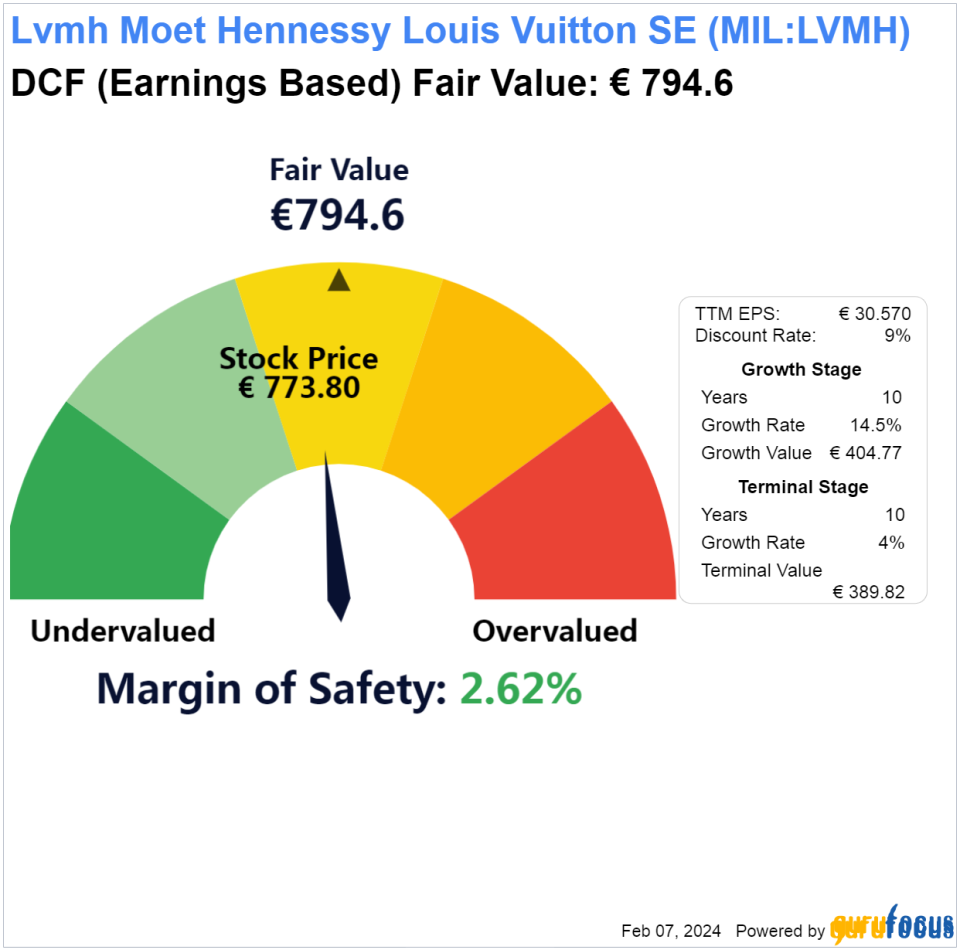

Valuation

The compound annual growth rate of its revenue for the past five years stands at 11.70%. With a current price of 773.80 euros per share, LVMH appears to be nearing its discounted cash flow fair value of 794.60 euros per share.

While LVMH's stock price may be nearing its fair value, the luxury market itself is on fire. Generations X and Y are in their peak income years, representing the bulk of luxury purchases and the key pool of income growth in the near future. However, gen Z is positioned at the forefront of social and cultural change, inspiring other generations' value systems with a strong desire for lived experiences and a quest for meaning. By 2030, gen Z will account for 25% to 30% of luxury market purchases, while millennials will account for 50% to 55%.

We shall expect more from LVMH as it has already outpaced the growth of its industry, meaning its brands are dominant in the luxury space. It has tripled the expansion of its industry within the span of five years. This stellar performance underscores the company's dominant position and suggests its potential has not reached its peak.

Do not be misled by its current valuation, however, as its potential extends far beyond its near-term price tag. The company's commitment to shareholder value through increasing dividends and its consistent industry outperformance paint a compelling picture for long-term investors seeking sustained growth. Just when you think LVMH has reached its limit, it seems it is only getting started.

Risk

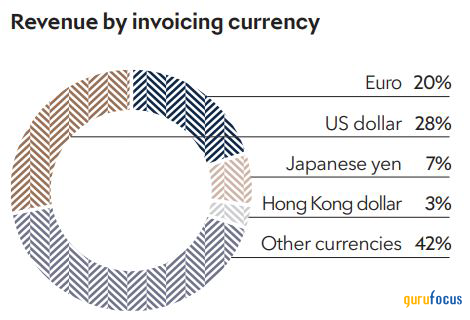

While LVMH conquers the world of luxury, its global reach exposes it to a hidden enemy: currency fluctuations. In the second half of 2023, unfavorable exchange rates put a damper on its progress, highlighting the risk inherent in its international performance.

Source: LVMH's Financial Documents - Dec. 31, 2023

This currency impact serves as a reminder that even for a giant like LVMH, navigating the unpredictable tides of global finance remains a constant challenge. However, the company uses hedging strategies to partially offset potential currency losses. Moreover, it has a strong financial position and can absorb some currency impact without significant strain.

Conclusion

While the luxury industry continues to expand, LVMH is rocketing past the competition, fueled by a rising tide of demand from the coveted millennial and gen Z demographic. This generation's growing appetite for luxury bodes well for the company's continued dominance, suggesting its growth story is just beginning.

LVMH isn't just another investment; it's a front-row seat to a booming market driven by iconic brands, unwavering growth and robust financials. The luxury king shows no signs of slowing down, riding the crest of a wave predicted to keep surging. Adding LVMH to your portfolio will help you ride the wave of luxury industry even better. We may not only enjoy the potential capital appreciation, but can savor regular dividend payouts. This is a buy opportunity you will not want to miss.

This article first appeared on GuruFocus.