Riley Exploration Permian Inc (REPX) Reports Robust 2023 Results and Sets 2024 Growth Targets

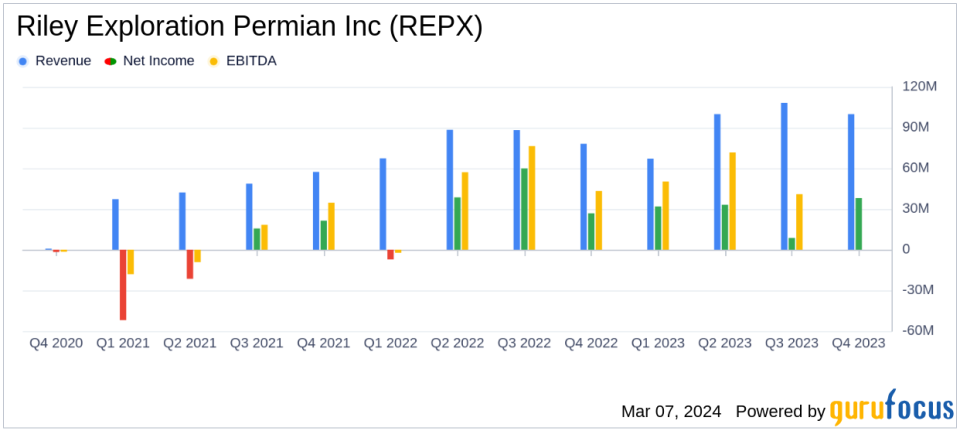

Revenue: Increased to $372.6 million for the full year 2023.

Net Income: Rose to $112 million, or $5.58 per diluted share for 2023.

Production Growth: Achieved a 49% growth in oil production year-over-year.

Free Cash Flow: Generated $70 million in 2023, a 26% increase year-over-year.

Dividends: Paid $1.38 per share in 2023, totaling $28 million.

Debt Reduction: Reduced total debt by $30 million in Q4 2023.

2024 Guidance: Targets 10-15% growth in oil production and a 10% reduction in capital expenditures.

Riley Exploration Permian Inc (REPX) released its 8-K filing on March 6, 2024, detailing its financial and operational performance for the fourth quarter and full year ended December 31, 2023. The company, which is engaged in oil and natural gas exploration and production with operations in Kansas and Tennessee, reported significant growth in production and reserves, along with robust financial results.

Financial and Operational Performance

For the fourth quarter of 2023, REPX achieved an average production of 19.9 MBoe/d, generating $66 million in operating cash flow and $33 million in Free Cash Flow. The company also paid dividends of $0.36 per share for a total of $7 million and reduced its debt outstanding by $30 million. Full-year highlights include a 49% growth in oil production and a 62% total production growth year-over-year, with the New Mexico Acquisition contributing to the company's performance for three quarters in 2023.

REPX's CEO, Bobby D. Riley, highlighted the company's "outstanding operational and financial performance for 2023," emphasizing the 49% growth in oil production and 62% total production growth year-over-year. He also noted the company's focus on executing efficient operations and implementing cost-saving measures for 2024.

We had outstanding operational and financial performance for 2023. This success continues to demonstrate our established track record of growth through both organic development and strategic acquisitions," said Bobby D. Riley.

Financial Achievements and Challenges

REPX's financial achievements in 2023 are significant for the oil and gas industry, where production growth and efficient capital expenditure management are critical. The company's ability to generate Free Cash Flow and reduce debt while paying dividends is indicative of its strong financial health and operational efficiency. However, the challenges ahead include maintaining production growth and continuing to reduce capital expenditures, as outlined in the 2024 guidance.

For the full year 2023, revenues totaled $375 million, with net income reaching $112 million, or $5.58 per diluted share. Adjusted EBITDAX was $246 million, and the company reported a $6 million gain on derivatives. The average realized prices for oil, natural gas, and natural gas liquids were $76.85 per barrel, $0.66 per Mcf, and $7.40 per barrel, respectively.

Balance Sheet and Cash Flow Statement Highlights

As of December 31, 2023, REPX had $356 million of total debt, with $185 million drawn on its revolving credit facility and $171 million of senior unsecured notes. Shareholders equity increased by 26% year-over-year to $422 million. The company's reserve replacement ratio was 543% for the year, with proved reserves increasing by 39% to 108 MMBoe.

The company's balance sheet reflects a solid financial position, with an increase in total assets to $945.7 million as of December 31, 2023, up from $515.3 million the previous year. The increase in shareholder's equity and the reduction in total debt demonstrate REPX's commitment to financial stability and shareholder value.

Looking Ahead

For 2024, REPX has set guidance for oil production of 14.0 15.0 MBbls/d and total production of 21.0 22.5 MBoe/d, representing significant year-over-year growth. The company also plans to reduce activity-based investing expenditures before acquisitions to $115 - 130 million, reflecting a focus on cost efficiency.

REPX's strategic approach to growth and efficiency positions it well for continued success in the competitive oil and gas industry. Investors and potential GuruFocus.com members interested in the oil and gas sector may find REPX's performance and future plans particularly compelling.

For more detailed information on Riley Exploration Permian Inc's financial results and operational updates, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Riley Exploration Permian Inc for further details.

This article first appeared on GuruFocus.