Rimini Street Inc (RMNI) Reports Growth in Revenue and Net Income for Q4 and Full Year 2023

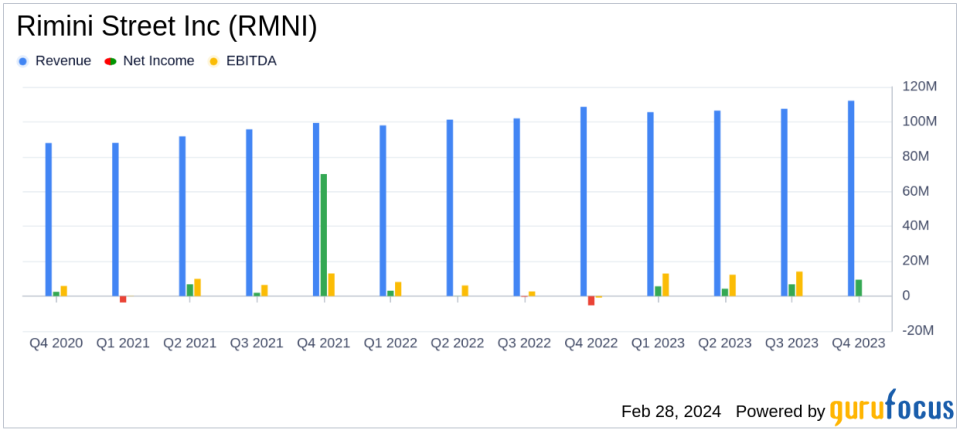

Revenue: Q4 revenue rose to $112.1 million, marking a 3.2% increase year-over-year.

Net Income: Q4 net income was $9.4 million, compared to a net loss of $5.3 million in the same period last year.

Annualized Recurring Revenue: Reached $432.3 million in Q4, a 2.9% increase from the previous year.

Gross Margin: Slightly decreased to 61.0% in Q4 from 64.5% year-over-year.

Operating Income: Improved significantly to $11.5 million in Q4 from an operating loss of $5.6 million in the prior year.

Adjusted EBITDA: Increased to $21.3 million in Q4, up from $18.3 million year-over-year.

Earnings Per Share: Basic and diluted earnings per share were $0.10 for Q4, a positive shift from a loss per share of $0.06 last year.

Rimini Street Inc (NASDAQ:RMNI), a global provider of enterprise software support services, released its 8-K filing on February 28, 2024, detailing its financial performance for the fourth quarter and full fiscal year ended December 31, 2023. The company, known for its support for Oracle and SAP software products, as well as partnerships with Salesforce and AWS, has reported a year-over-year increase in revenue and a significant improvement in net income, indicating a strong fiscal position as it moves into the new year.

Financial Performance Overview

Rimini Street's revenue for the fourth quarter of 2023 was $112.1 million, a 3.2% increase from $108.6 million in the same quarter of the previous year. The company's annualized recurring revenue also saw growth, reaching $432.3 million, up by 2.9% from the prior year. This growth reflects the company's ability to maintain and expand its client base, which stood at 3,038 active clients by the end of 2023, a slight increase from 3,020 in the previous year.

Despite a slight decrease in gross margin from 64.5% to 61.0% in the fourth quarter, Rimini Street achieved a substantial turnaround in operating income, reporting $11.5 million compared to an operating loss of $5.6 million for the same period last year. This improvement is further underscored by the company's net income for the quarter, which was $9.4 million, a significant shift from a net loss of $5.3 million in the fourth quarter of 2022.

Annual Financial Highlights and Challenges

For the full year 2023, Rimini Street's revenue increased by 5.3% to $431.5 million from $409.7 million in 2022. The company's operating income for the year was $43.8 million, a remarkable increase from $8.1 million in the previous year. Net income for 2023 was reported at $26.1 million, compared to a net loss of $2.5 million in 2022, reflecting a strong year-over-year performance and the company's ability to convert revenue growth into profitability.

Adjusted EBITDA for the year also increased to $71.9 million from $52.3 million in 2022, indicating the company's efficient operational management and cost control measures. However, the company faces challenges, including a competitive software support services industry and the need to continually innovate and expand its service offerings to maintain and grow its client base.

Key Financial Metrics and Commentary

The company's balance sheet as of December 31, 2023, shows total assets of $393.8 million, with cash and cash equivalents of $115.4 million. The total liabilities stood at $433.3 million, with a stockholders' deficit of $39.5 million. These figures reflect the company's financial health and its ability to meet short-term obligations.

"We are pleased with our fourth quarter and full-year 2023 results, which demonstrate our commitment to providing exceptional support and services to our clients," said a Rimini Street spokesperson. "Our continued revenue growth and improved profitability underscore the value of our offerings in the enterprise software space."

The company's performance is particularly noteworthy given the competitive nature of the software industry and the challenges associated with maintaining high retention rates and client satisfaction. Rimini Street's focus on expanding its service offerings, as evidenced by the introduction of Rimini Consult for Salesforce, positions the company to capitalize on new market opportunities and drive future growth.

Outlook and Investor Relations

Rimini Street has suspended guidance due to ongoing litigation with Oracle, awaiting more clarity on the potential impacts. However, the company's strong financial results and operational achievements in 2023 provide a solid foundation for future growth. Investors and stakeholders can access the webcast and conference call discussing the Q4 and full-year results through the Rimini Street Investor Relations site.

For detailed financial tables and a reconciliation of GAAP to non-GAAP financial measures, readers are encouraged to view the full 8-K filing.

Value investors and potential GuruFocus.com members interested in enterprise software support services may find Rimini Street Inc (NASDAQ:RMNI)'s latest financial results to be a compelling study in operational efficiency and growth amidst industry challenges.

Explore the complete 8-K earnings release (here) from Rimini Street Inc for further details.

This article first appeared on GuruFocus.