Ring Energy Inc (REI) Posts Record Q4 and Full-Year 2023 Results

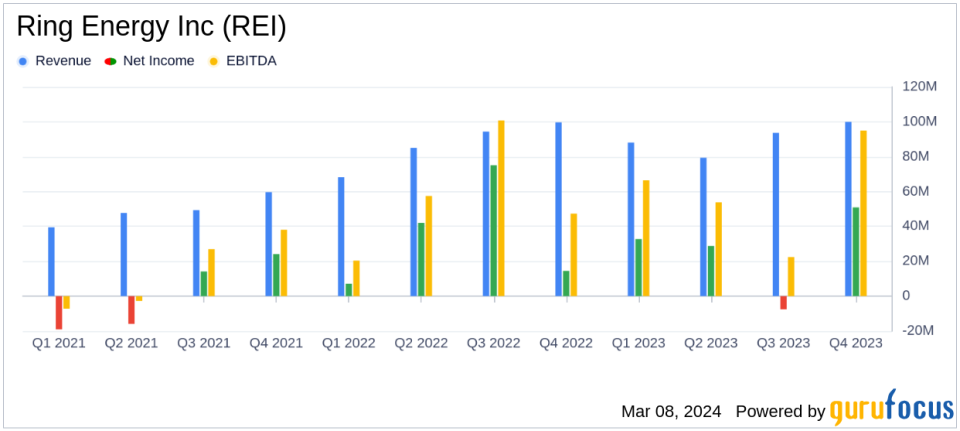

Record Sales Volumes: Q4 total sales volumes surged 11% to 19,397 Boe/d, with full-year volumes up 47% to 18,119 Boe/d.

Net Income Growth: Q4 net income reached $50.9 million, with full-year net income at $104.9 million.

Adjusted EBITDA: Achieved record Q4 Adjusted EBITDA of $65.4 million, a 12% increase from Q3, and a 21% year-over-year growth to $236.0 million.

Cost Reduction: All-in Q4 cash operating costs decreased by 4% from Q3, contributing to a 6% full-year reduction.

Debt Reduction: Paid down $3.0 million of debt in Q4 and $30.0 million since the Founders Acquisition in August 2023.

Proved Reserves: Ended 2023 with 129.8 MMBoe in proved reserves and a PV-10 of $1.6 billion.

Capital Expenditures: Full-year capital expenditures totaled $152.0 million, funding the drilling and completion of 31 wells.

On March 7, 2024, Ring Energy Inc (REI) released its 8-K filing, announcing record operational and financial results for the fourth quarter and full year 2023. The independent exploration and production company, operating primarily in the Permian Basin of Texas, has demonstrated significant growth in sales volumes and a strong commitment to cost efficiency.

Financial and Operational Performance

Ring Energy's performance in the fourth quarter was marked by an 11% increase in total sales volumes, reaching a record 19,397 barrels of oil equivalent per day (Boe/d). This growth was even more pronounced on an annual basis, with a 47% increase in total sales volumes to 18,119 Boe/d. The company's net income for the fourth quarter stood at $50.9 million, translating to $0.26 per diluted share. For the full year, net income was reported at $104.9 million, or $0.54 per diluted share.

The company's Adjusted EBITDA for the fourth quarter was a record $65.4 million, a 12% increase from the third quarter and a 16% increase from the fourth quarter of the previous year. Full-year Adjusted EBITDA grew by 21% to a record $236.0 million. Ring Energy also reported a significant reduction in all-in cash operating costs, which decreased by 4% from the third quarter and by 6% for the full year.

Strategic Achievements and Financial Health

Ring Energy's financial achievements in 2023 reflect the successful execution of its strategic initiatives, including the integration of two acquisitions made over the past 18 months and a high rate-of-return drilling and recompletion programs. The company's focus on reducing costs has also contributed to its robust financial performance.

During the fourth quarter, Ring Energy paid down $3.0 million of debt and reduced its total debt by $30.0 million since the Founders Acquisition in August 2023. The company entered 2024 with liquidity of approximately $175 million and exited 2023 with $425 million of borrowings and a Leverage Ratio of 1.62x.

Ring Energy ended 2023 with proved reserves of 129.8 million barrels of oil equivalent (MMBoe) and a present value discounted at 10% (PV-10) of $1.6 billion. The company's capital expenditures for the year totaled $152.0 million, which funded the drilling and completion of 31 wells.

Management Commentary

"We ended 2023 with record fourth quarter and full year operational and financial results on multiple fronts. Year-over-year, we achieved a 47% increase in sales volumes, a 21% increase in Adjusted EBITDA, and a 30% increase in Adjusted Free Cash Flow. Driving our results was the successful execution and integration of the two acquisitions made over the past 18 months, the success of our high rate-of-return drilling and recompletion programs, and our continuing focus on reducing costs. The hard work, dedication, and commitment of our workforce to our value focused, proven strategy delivered these outstanding results and we continue to believe staying the course will build near and long-term value for our stockholders. On behalf of our Board of Directors and management team, I would like to thank our employees for their efforts in making 2023 a very good year," said Mr. Paul D. McKinney, Chairman of the Board and Chief Executive Officer.

Ring Energy's focus for 2024 remains on disciplined capital spending, debt reduction, and pursuing accretive acquisitions to further enhance its balance sheet and return meaningful capital to stockholders.

For a detailed analysis of Ring Energy Inc's financial performance, including income statements, balance sheets, and cash flow statements, readers are encouraged to review the full 8-K filing.

Ring Energy will hold a conference call on March 8, 2024, to discuss its fourth quarter and full year 2023 operational and financial results. Interested parties can access the call and an updated investor presentation on the company's website.

For additional insights and detailed financial analysis, visit GuruFocus.com and explore the comprehensive investment tools and resources available to value investors and potential GuruFocus.com members.

Explore the complete 8-K earnings release (here) from Ring Energy Inc for further details.

This article first appeared on GuruFocus.