RingCentral Inc (RNG) Reports Solid Growth and Improved Margins in Q4 and Full Year 2023 Earnings

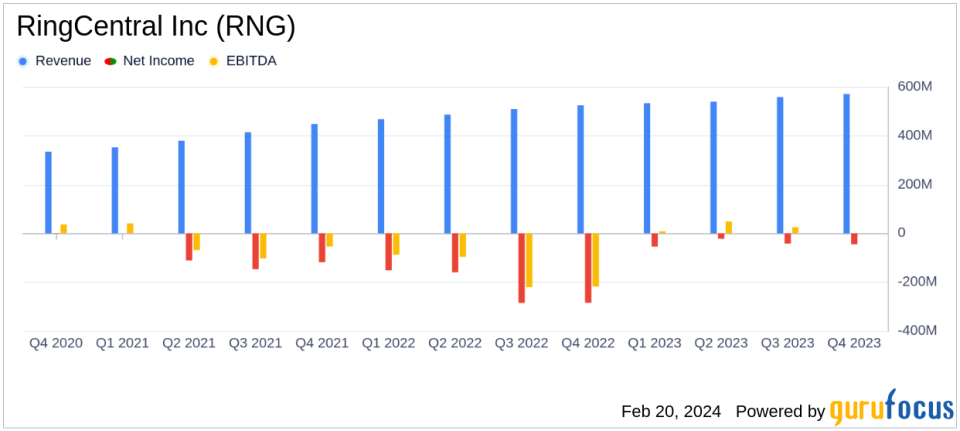

Total Revenue: Increased by 9% year-over-year to $571 million in Q4; 11% growth to $2.202 billion for full year 2023.

Subscription Revenue: Rose by 9% year-over-year to $547 million in Q4; 11% increase to $2.100 billion for full year.

GAAP Operating Margin: Improved significantly to (7.9)% in Q4 from (48.7)% in the prior year.

Non-GAAP Operating Margin: Increased to 20.5% in Q4, up 650 basis points year-over-year.

Net Cash Provided by Operating Activities: Reached a record $114 million in Q4, representing 19.9% of total revenue.

Adjusted EBITDA: Grew to $138 million in Q4, or 24.2% of total revenue.

Enterprise ARR: Surpassed $1 billion, with a 13% year-over-year increase.

On February 20, 2024, RingCentral Inc (NYSE:RNG) released its 8-K filing, announcing financial results for the fourth quarter and fiscal year ended December 31, 2023. The company, a leading provider of AI-driven cloud business communications, contact center, video, and hybrid event solutions, reported a solid increase in total revenue and subscription revenue, alongside significant improvements in operating margins and record cash flow.

Financial Performance Overview

For the fourth quarter, RingCentral Inc (NYSE:RNG) saw total revenue climb to $571 million, a 9% increase compared to the same period last year. Subscription revenue, which accounts for the bulk of total revenue, also rose by 9% to $547 million. The company's Annualized Exit Monthly Recurring Subscriptions (ARR) grew by 11% year-over-year to $2.329 billion, with the mid-market and enterprise segment contributing a 12% increase to $1.458 billion. Notably, the enterprise ARR saw a 13% rise, crossing the $1 billion mark.

RingCentral's GAAP operating margin for the quarter improved dramatically to (7.9)% from (48.7)% in the prior year. The non-GAAP operating margin expanded by 650 basis points to 20.5%, reflecting the company's focus on efficiency and productivity. Adjusted EBITDA also increased to $138 million, or 24.2% of total revenue, up from $93 million in the same period last year.

The company's net cash provided by operating activities reached a record $114 million in the fourth quarter, representing 19.9% of total revenue. This is a substantial increase from the $39 million, or 7.5% of total revenue, reported for the fourth quarter of 2022. Adjusted, unlevered free cash flow for the quarter was also a record $97 million, or 17.0% of total revenue.

Full Year 2023 Highlights

For the full year 2023, RingCentral Inc (NYSE:RNG) reported total revenue of $2.202 billion, an 11% increase from $1.988 billion in 2022. Subscription revenue for the year was $2.100 billion, representing an 11% year-over-year growth and accounting for over 95% of total revenue.

The GAAP operating loss for the year was ($199) million, compared to ($649) million in 2022. Non-GAAP operating income was $420 million, or 19.1% of total revenue, compared to $246 million, or 12.4% of total revenue, in 2022. Adjusted EBITDA for 2023 was $503 million, or 22.8% of total revenue, compared to $318 million, or 16.0% of total revenue, for 2022.

Net cash provided by operating activities for 2023 was a record $400 million, or 18.1% of total revenue, compared to $191 million, or 9.6% of total revenue, for 2022. Adjusted, unlevered free cash flow for 2023 was a record $325 million, or 14.8% of total revenue, compared to $103 million, or 5.2% of total revenue, for 2022.

Strategic Developments and Outlook

RingCentral's CEO, Vlad Shmunis, highlighted the company's progress in becoming an AI-first, multi-product company, delivering durable, profitable growth. The CFO, Sonalee Parekh, emphasized the record operating margin and free cash flow, indicating the company's potential for improved cash flow in the future.

For the full year 2024, RingCentral expects subscription revenue to range from $2.260 to $2.285 billion, representing an 8% to 9% annual growth. Total revenue is projected to be between $2.370 to $2.395 billion, with a non-GAAP operating margin of 21.0%. The company anticipates a non-GAAP EPS range of $3.50 to $3.58 based on 99.0 to 98.0 million fully diluted shares.

RingCentral's strong performance in 2023, particularly in the enterprise segment, and its continued investment in innovation and strategic partnerships, positions the company well for sustained growth in the unified communications market. The full financial details and additional highlights can be found in the company's 8-K filing.

Investors and interested parties can access the earnings webcast and additional financial information on RingCentral's investor relations website.

Explore the complete 8-K earnings release (here) from RingCentral Inc for further details.

This article first appeared on GuruFocus.