Rio Tinto PLC's Dividend Analysis

Assessing the Upcoming Dividend and Historical Performance of Rio Tinto PLC

Rio Tinto PLC (NYSE:RIO) recently announced a dividend of $2.58 per share, payable on 2024-04-18, with the ex-dividend date set for 2024-03-07. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Rio Tinto PLC's dividend performance and assess its sustainability.

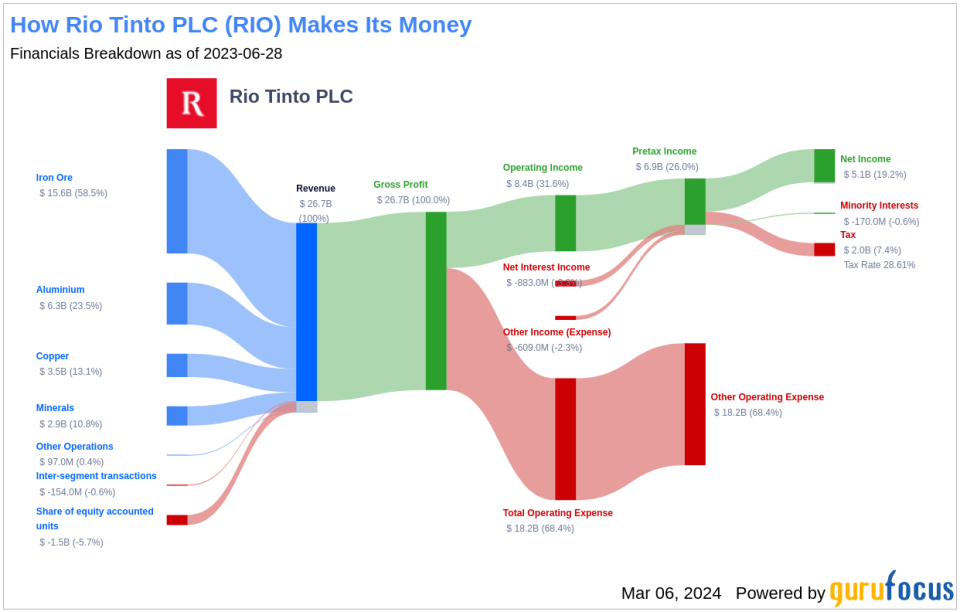

What Does Rio Tinto PLC Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Rio Tinto is a global diversified miner. Iron ore is the dominant commodity, with significantly lesser contributions from copper, aluminum, diamonds, gold, and industrial minerals. The 1995 merger of RTZ and CRA, via a dual-listed structure, created the present-day company. The two operate as a single business entity, with shareholders in each company having equivalent economic and voting rights. Major assets included the Pilbara iron ore operations, a 30% stake in the Escondida copper mine, 66%-ownership of the Oyu Tolgoi copper mine in Mongolia, the Weipa and Gove bauxite mines in Australia, and six hydro-powered aluminum smelters in Canada.

A Glimpse at Rio Tinto PLC's Dividend History

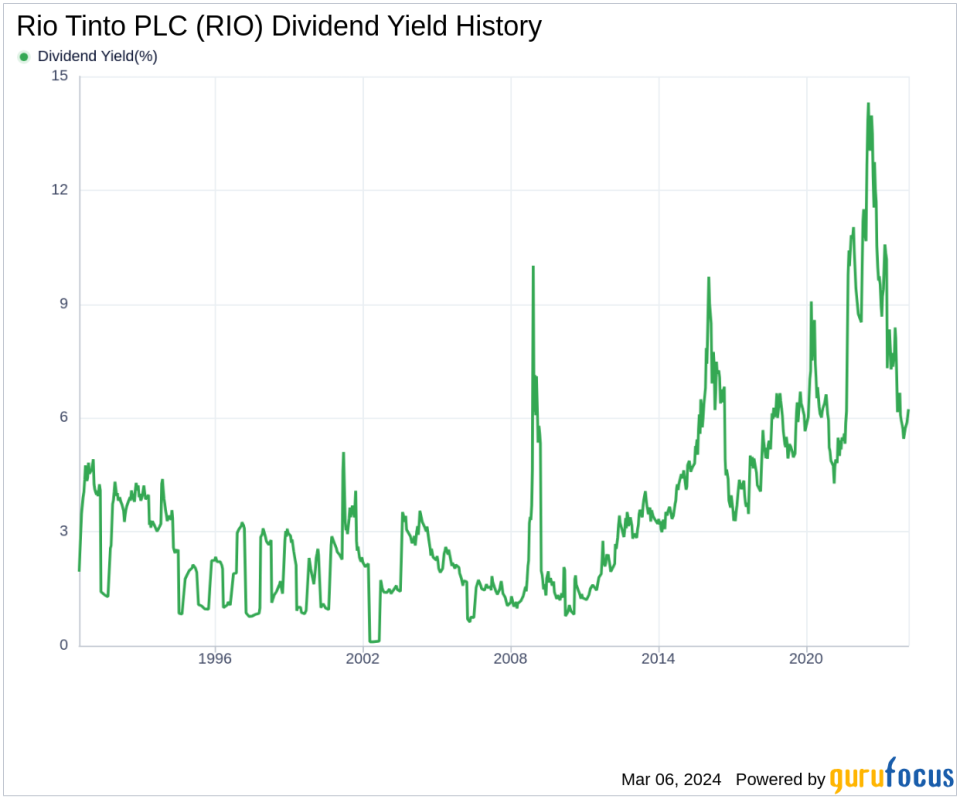

Rio Tinto PLC has maintained a consistent dividend payment record since 1985. Dividends are currently distributed on a bi-annual basis. Below is a chart showing annual Dividends Per Share for tracking historical trends.

Breaking Down Rio Tinto PLC's Dividend Yield and Growth

As of today, Rio Tinto PLC currently has a 12-month trailing dividend yield of 6.30% and a 12-month forward dividend yield of 6.84%. This suggests an expectation of increased dividend payments over the next 12 months. Over the past three years, Rio Tinto PLC's annual dividend growth rate was 3.80%. Extended to a five-year horizon, this rate increased to 13.00% per year. And over the past decade, Rio Tinto PLC's annual dividends per share growth rate stands at an impressive 16.70%.

Based on Rio Tinto PLC's dividend yield and five-year growth rate, the 5-year yield on cost of Rio Tinto PLC stock as of today is approximately 11.61%.

The Sustainability Question: Payout Ratio and Profitability

To assess the sustainability of the dividend, one needs to evaluate the company's payout ratio. The dividend payout ratio provides insights into the portion of earnings the company distributes as dividends. A lower ratio suggests that the company retains a significant part of its earnings, thereby ensuring the availability of funds for future growth and unexpected downturns. As of 2023-12-31, Rio Tinto PLC's dividend payout ratio is 0.61.

Rio Tinto PLC's profitability rank, offers an understanding of the company's earnings prowess relative to its peers. GuruFocus ranks Rio Tinto PLC's profitability 8 out of 10 as of 2023-12-31, suggesting good profitability prospects. The company has reported net profit in 9 years out of past 10 years.

Growth Metrics: The Future Outlook

To ensure the sustainability of dividends, a company must have robust growth metrics. Rio Tinto PLC's growth rank of 8 out of 10 suggests that the company's growth trajectory is good relative to its competitors. Rio Tinto PLC's revenue has increased by approximately 8.70% per year on average, a rate that underperforms approximately 56.07% of global competitors. The company's 3-year EPS growth rate showcases its capability to grow its earnings, a critical component for sustaining dividends in the long run. During the past three years, Rio Tinto PLC's earnings increased by approximately 2.00% per year on average, a rate that underperforms approximately 59.71% of global competitors. Lastly, the company's 5-year EBITDA growth rate of 6.50%, which underperforms approximately 61.63% of global competitors.

Next Steps

In light of Rio Tinto PLC's consistent dividend payments, robust dividend growth rate, reasonable payout ratio, and strong profitability, the company appears to be a compelling choice for income-focused investors. While growth metrics present a mixed picture, the company's historical ability to generate profit and its strategic asset base may provide a cushion against short-term market fluctuations. Investors should consider these factors in their overall assessment of Rio Tinto PLC's dividend sustainability and future prospects. For those seeking to expand their portfolio with high-dividend yield stocks, GuruFocus Premium users can utilize the High Dividend Yield Screener to discover potential opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.