Rise in Customized Financing Aid Ares Capital (ARCC), Costs Ail

Ares Capital Corporation’s ARCC total investment income is expected to continue to rise, driven by the increase in the demand for customized financing. An increase in investment commitments is likely to support financials.

The Zacks Consensus Estimate for the company’s current-year earnings has been revised marginally higher over the past 60 days. This reflects that analysts are optimistic about its earnings growth potential.

However, while the company’s expansion plans are expected to enhance growth prospects, they might lead to an increase in expenses. Elevated expenses will thus hurt the bottom line to an extent in the near term. Thus, ARCC currently carries a Zacks Rank #3 (Hold).

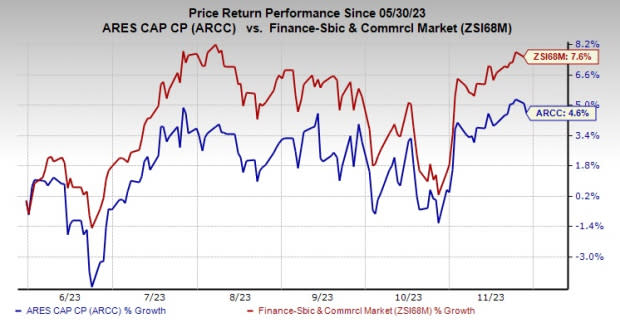

In the past six months, shares of the company have gained 4.6% compared with the industry’s growth of 7.6%.

Image Source: Zacks Investment Research

Looking at its fundamentals, while Ares Capital’s total investment income declined in 2020, it recorded a three-year (2019-2022) compound annual growth rate (CAGR) of 11.1%. The increase was primarily driven by the acquisition of American Capital, which boosted investment income substantially. The upward trend persisted in the first nine months of 2023.

Given the regulatory changes and rising demand for customized financing, ARCC is expected to continue to witness a rise in investment income in the quarters ahead. Our estimate for total investment income suggests seeing a CAGR of 6.7% over the three years ended 2025.

Moreover, we are encouraged by the company’s concentrated focus on its credit performance. In 2022, 2021, 2020 and 2019, ARCC originated $9.9 billion, $15.6 billion, $6.7 billion and $7.3 billion, respectively, in gross investment commitments to new and existing portfolio companies.

Ares Capital’s capital distribution policy seems impressive. In order to maintain its RIC status, the company distributes approximately 90% of its taxable income. In October 2022, it announced a dividend hike of 11.6%, which followed a 2.4% hike in July, a 2.4% rise in February, a 2.5% increase in July 2021 and 2.6% growth in February 2019.

Also, it has a share repurchase program in place. In April 2023, the company announced an increase in its share repurchase authorization to $1 billion. As of Sep 30, 2023, the entire authorization remained available.

However, Ares Capital’s expenses have witnessed a CAGR of 9.1% over the three years ended 2022. This was mainly due to a rise in interest and credit facility fees, and income-based fees. The upward trend in costs continued in the first nine months of 2023. Overall costs are likely to remain elevated in the near term as the company continues to expand. We project total expenses to see a CAGR of 16.8% by 2025.

To comply with regulatory requirements, Ares Capital invests primarily in the United States-based companies and, to a lesser extent, in foreign ones. Persistent regulatory constraints may lead to increased costs of funding and, thereby, limit the company’s access to capital markets.

Stocks Worth a Look

A couple of better-ranked stocks from the finance space are Prospect Capital Corporation PSEC and Horizon Technology Finance Corporation HRZN.

Earnings estimates for PSEC have been revised 8.1% upward for the current fiscal year over the past 60 days. The company’s share price has decreased 7.4% over the past three months. PSEC currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Horizon Technology also flaunts a Zacks Rank of 1. Its earnings estimates have been revised upward by 7.6% for the current year over the past 60 days. In the past three months, HRZN’s share price has increased 2.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ares Capital Corporation (ARCC) : Free Stock Analysis Report

Horizon Technology Finance Corporation (HRZN) : Free Stock Analysis Report

Prospect Capital Corporation (PSEC) : Free Stock Analysis Report