Risks To Shareholder Returns Are Elevated At These Prices For AerCap Holdings N.V. (NYSE:AER)

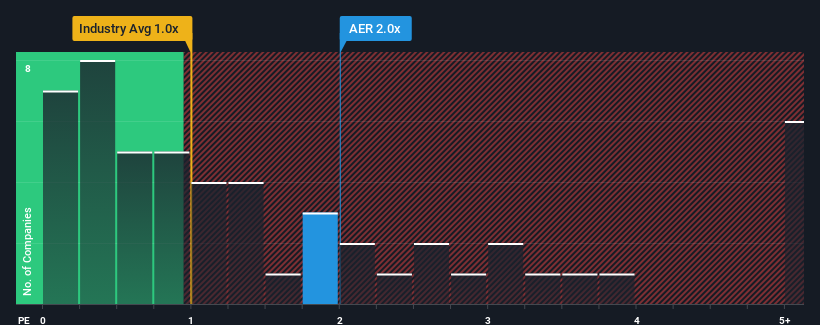

When close to half the companies in the Trade Distributors industry in the United States have price-to-sales ratios (or "P/S") below 1x, you may consider AerCap Holdings N.V. (NYSE:AER) as a stock to potentially avoid with its 2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for AerCap Holdings

What Does AerCap Holdings' P/S Mean For Shareholders?

AerCap Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on AerCap Holdings will help you uncover what's on the horizon.

Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, AerCap Holdings would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. Pleasingly, revenue has also lifted 58% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 3.6% as estimated by the eight analysts watching the company. With the industry predicted to deliver 4.6% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that AerCap Holdings' P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Bottom Line On AerCap Holdings' P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that AerCap Holdings currently trades on a higher than expected P/S. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware AerCap Holdings is showing 3 warning signs in our investment analysis, and 2 of those are a bit unpleasant.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.