Rithm (RITM) Affiliate to Aid Great Ajax's Management Transition

Rithm Capital Corp. RITM recently announced that it has struck a strategic deal with a real estate investment trust, Great Ajax Corp., involving a loan agreement and a management change of the latter. The transaction also includes Great Ajax issuing warrants and shares to Rithm.

A subsidiary of Rithm has entered into a one-year term loan agreement with AJX for up to $70 million, which will be used by Great Ajax in its outstanding convertible notes’ repayments. As part of the loan agreement, Great Ajax is expected to terminate its external manager, Thetis Asset Management and enter into an agreement with a subsidiary of Rithm for serving as an external manager.

The change in management is expected to enable AJX to capitalize on commercial real estate investment opportunities. The strategic transaction is expected to boost Rithm’s asset management platform. It is expected to play a key role in Great Ajax’s commercial real estate-focused strategy and help it thrive in a dynamic commercial real estate market.

Per the deal, Great Ajax is expected to issue five-year warrants to Rithm. These will be exercisable for AJX’s common shares. Moreover, it is expected to issue $14 million common shares for Rithm through a securities purchase agreement.

Moves like these will help Rithm to boost its top line. Its fourth-quarter 2023 revenues amounted to $709 million, which tumbled 7% year over year. However, its adjusted earnings of 51 cents per share outpaced the Zacks Consensus Estimate by a whopping 45.7% thanks to improved asset management revenues and continuous acquisition of customer loans.

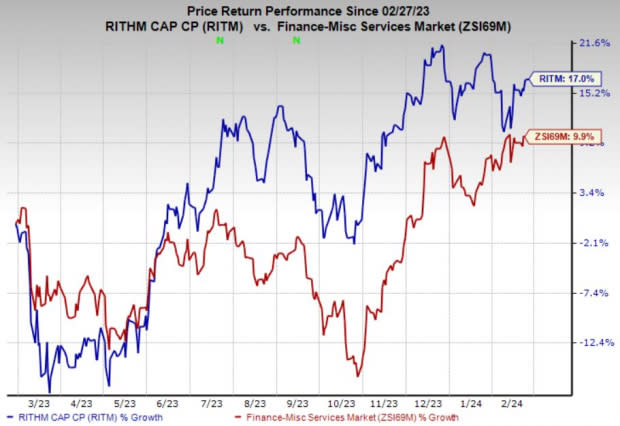

Price Performance

Rithm’s shares have gained 17% in the past year compared with the industry’s rise of 9.9%.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

The company currently has a Zacks Rank #2 (Buy). Some other top-ranked players in the broader Finance space are Axos Financial, Inc. AX, Euronet Worldwide, Inc. EEFT and American Express Company AXP. While Axos Financial currently sports a Zacks Rank #1 (Strong Buy), Euronet Worldwide and American Express carry a Zacks Rank #2 each. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Axos Financial’s current-year earnings indicates 42.4% year-over-year growth. Also, the consensus mark for AX’s revenues in the current fiscal year suggests 22.4% year-over-year growth.

The Zacks Consensus Estimate for Euronet Worldwide’s current year earnings indicates a 12.7% increase from the year-ago period. In the past month, EEFT has witnessed four upward estimate revisions against none in the opposite direction. The consensus mark for the company’s revenues in 2024 suggests a 7.1% year-over-year jump.

The consensus mark for American Express’ current-year earnings suggests 14.2% year-over-year growth. It has witnessed 12 upward estimate revisions in the past 30 days against two downward movements. AXP beat earnings estimates twice in the past four quarters and missed on other occasions, with the average surprise being 1.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Express Company (AXP) : Free Stock Analysis Report

Euronet Worldwide, Inc. (EEFT) : Free Stock Analysis Report

AXOS FINANCIAL, INC (AX) : Free Stock Analysis Report

Rithm Capital Corp. (RITM) : Free Stock Analysis Report