RLI Expects Q3 Cat Loss of $65-$75M From Hawaii Wildfire

RLI Corporation RLI estimates catastrophe losses from Hawaiian wildfires of $65 million to $75 million. This loss is likely to be reflected in the third-quarter results.

Per a report published in CNN Business, Moody’s RMS estimated up to $6 billion in economic losses from the wildfires in Hawaii. The risk modeling agency also stated that about 75% of the losses will be covered by the insurance because of the island’s high insurance penetration rates.

RLI has been incurring catastrophe loss stemming from earthquakes that primarily hit the West Coast and damages to commercial properties throughout the Gulf and East Coast, as well as to homes, which were damaged by hurricanes in the Gulf and East Coast and Hawaii. Exposure to catastrophes is a lingering concern as natural disasters are unpredictable and induce volatility in a company’s earnings. In the first half of 2023, the company incurred $22 million of pretax storm losses, wider than the year-ago pretax storm losses of $5 million.

Nevertheless, RLI is one of the industry’s most profitable P&C writers, with an impressive track record of delivering 27 consecutive years of underwriting profitability. In the first half of 2023, underwriting income was $109 million. A strong local branch office network, a broad range of product offerings and a focus on specialty insurance lines should continue contributing to its superior profitability.

Combined ratio, which reflects its underwriting profitability, of this specialty property-casualty (P&C) underwriter that caters primarily to niche markets has been exemplary. RLI has maintained a combined ratio below 100 for 26 consecutive years, averaging 88.4, and below 90 for 14 straight years. Combined ratio is expected to improve to 82% in 2023. This solid track record of maintaining the combined ratio at favorable levels even in the toughest operating environment reflects its superior underwriting discipline. In the first half of 2023, combined ratio was 82.7.

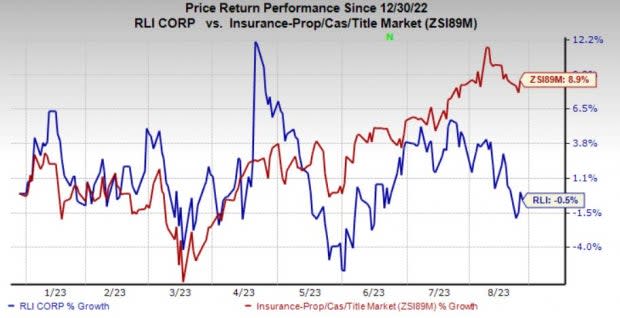

RLI presently carries a Zacks Rank #3 (Hold). Shares of RLI have lost 0.5% year to date against the industry’s increase of 8.9%. A compelling product portfolio, rate increases, sufficient liquidity and effective capital deployment should help it retain momentum.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the property and casualty insurance industryare Arch Capital Group Ltd. ACGL, Axis Capital Holdings Limited AXS and Kinsale Capital Group, Inc. KNSL. While Arch Capital and Axis Capital sport a Zacks Rank #1 (Strong Buy) each, Kinsale Capital carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Arch Capital has a solid track record of beating earnings estimates in each of the last trailing four quarters, the average being 26.83%. In the past year, ACGL has gained 18.8%.

The Zacks Consensus Estimate for ACGL’s 2023 and 2024 earnings per share is pegged at $6.58 and $7.25, indicating a year-over-year increase of 35.1% and 10.2%, respectively.

Axis Capital has a solid track record of beating earnings estimates in three of the last four quarters and missing in one, the average being 9.75%. In the past year, AXS has lost 0.2%.

The Zacks Consensus Estimate for AXS’ 2023 and 2024 earnings per share is pegged at $8.18 and $9.17, indicating a year-over-year increase of 40.7% and 12.1%, respectively.

Kinsale Capital beat estimates in each of the last four quarters, the average being 14.88%. In the past year, KNSL has gained 42.1%.

The Zacks Consensus Estimate for 2023 and 2024 earnings has moved 3.3% and 3.1% north, respectively, in the past seven days, reflecting analysts’ optimism.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL) : Free Stock Analysis Report

Kinsale Capital Group, Inc. (KNSL) : Free Stock Analysis Report