RLJ Lodging Trust (RLJ) Reports Growth in Revenue and Net Income for Q4 and Full Year 2023

Revenue Growth: Q4 total revenue increased by 5.8% to $319.7 million, and full-year revenue rose by 11.0% to $1.3 billion.

Net Income Surge: Net income attributable to common shareholders soared by 466.7% in Q4 and 205.4% for the full year.

Adjusted FFO Growth: Adjusted Funds From Operations (FFO) per diluted share increased by 22.1% year-over-year to $1.66.

RevPAR Improvement: Comparable Revenue per Available Room (RevPAR) grew by 5.2% in Q4 and 9.0% for the full year.

Share Repurchase: RLJ repurchased 7.6 million common shares for $77.2 million in 2023, reflecting confidence in its value proposition.

Dividend Declaration: A quarterly cash dividend of $0.10 per common share was declared in Q4.

Liquidity Position: Ended the year with $1.1 billion in liquidity, including $516.7 million in unrestricted cash.

On February 26, 2024, RLJ Lodging Trust (NYSE:RLJ) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, a real estate investment trust specializing in focused-service and compact full-service hotels, reported a robust increase in key financial metrics, including a significant rise in net income and revenue.

RLJ's portfolio, consisting of hotels across various states and the District of Columbia, operates under renowned brands such as Marriott, Hilton, and Hyatt. The company's revenue streams primarily derive from hotel operations, including room sales, food and beverage, and other property-related revenue.

Financial Performance and Strategic Initiatives

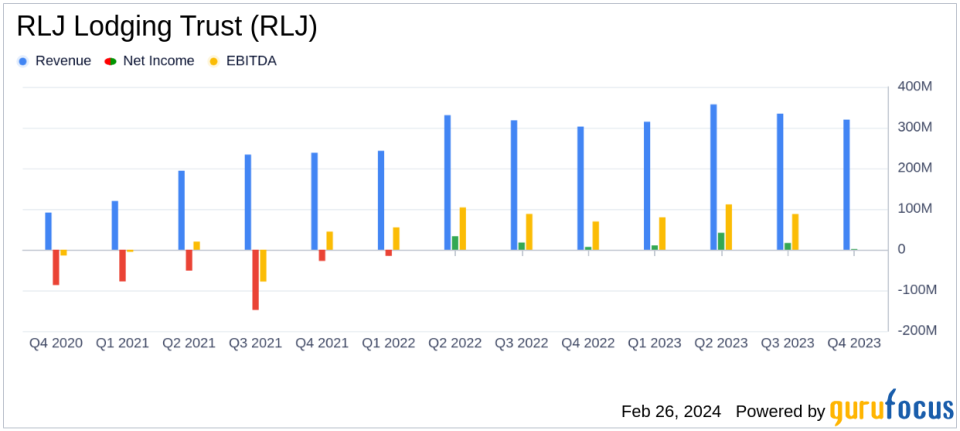

The company's fourth-quarter performance was marked by a 5.2% increase in Comparable RevPAR to $133.84, driven by a 1.5% rise in Average Daily Rate (ADR) and a 3.6% improvement in occupancy. Full-year Comparable RevPAR saw an even more impressive 9.0% growth. Total revenue for the quarter reached $319.7 million, a 5.8% increase from the previous year, while full-year revenue climbed to $1.3 billion, up 11.0%.

Net income attributable to common shareholders was $1.7 million for the quarter, representing a substantial increase from the prior year, and $51.3 million for the full year, up 205.4%. Adjusted EBITDA for the quarter was relatively flat at $79.2 million, while full-year Adjusted EBITDA increased by 8.3% to $364.5 million. Adjusted FFO per diluted common share and unit rose by 3.0% to $0.34 for the quarter and by 22.1% to $1.66 for the full year.

President and CEO Leslie D. Hale commented on the company's success, stating,

We are pleased to have achieved top-quartile RevPAR growth, capping off a very successful year of outperformance for RLJ."

Hale highlighted the strategic positioning of RLJ's urban-centric portfolio and the tailwinds expected to continue into 2024.

Capital Allocation and Balance Sheet Strength

Throughout 2023, RLJ executed multiple capital allocation initiatives, including the acquisition of the Wyndham Boston Beacon Hill and the repurchase of 7.6 million common shares for $77.2 million. The company ended the year with a strong liquidity position, boasting $1.1 billion in liquidity, including unrestricted cash and undrawn revolver capacity.

The company's balance sheet reflects a net investment in hotel properties of $4.1 billion and total assets of $4.9 billion. Debt stood at $2.2 billion, net of unrestricted cash and cash equivalents, which totaled $516.7 million.

Outlook and Dividends

Looking ahead to 2024, RLJ anticipates Comparable RevPAR growth between 2.5% and 5.5%, with Comparable Hotel EBITDA projected to be between $395.0 million and $425.0 million. Adjusted EBITDA is expected to range from $360.0 million to $390.0 million, with Adjusted FFO per diluted share estimated between $1.55 and $1.75.

The company's Board of Trustees declared a quarterly cash dividend of $0.10 per common share, reflecting confidence in RLJ's financial health and commitment to shareholder returns.

RLJ Lodging Trust's solid performance in 2023, strategic acquisitions, and capital allocation initiatives have positioned the company for continued success in the coming year. Investors and stakeholders can look forward to RLJ's sustained momentum, underpinned by a robust balance sheet and a strategic focus on urban markets.

Explore the complete 8-K earnings release (here) from RLJ Lodging Trust for further details.

This article first appeared on GuruFocus.