Robert Bruce's Investment Strategy Leads to Notable Changes in Portfolio, Highlighting Merck ...

Insight into the Latest 13F Filing Reveals Key Stock Adjustments by Value Investing Firm Bruce & Co

Renowned for his value investing approach, Robert Bruce (Trades, Portfolio), the founder of Bruce & Co., has recently disclosed his firm's 13F holdings for the third quarter of 2023. Bruce & Co., which advises the Bruce Fund (BRUFX), is a family-run firm with Robert Bruce (Trades, Portfolio) and his son, Robert Jeffrey Bruce, at the helm. The fund's strategy is to invest in common stocks, high-yield and distressed debt, and occasionally long-term U.S. government securities when other attractive opportunities are scarce. With a penchant for small- to mid-cap stocks, convertible and distressed bonds, the Bruces are known for their long-term holding strategy, particularly in securities of distressed companies they believe are poised for a turnaround.

New Additions to the Portfolio

During the third quarter, Robert Bruce (Trades, Portfolio) strategically expanded the portfolio with two new stock additions:

Darling Ingredients Inc (NYSE:DAR) emerged as the most significant new holding, with 70,000 shares valued at $3.65 million, making up 1.31% of the portfolio.

Vicor Corp (NASDAQ:VICR) was the second notable addition, comprising 20,000 shares, which represent 0.42% of the portfolio, with a total value of $1.18 million.

Increased Stakes in Existing Holdings

Robert Bruce (Trades, Portfolio) also bolstered positions in existing holdings, with a noteworthy increase in:

IGM Biosciences Inc (NASDAQ:IGMS), where an additional 65,000 shares were acquired, bringing the total to 120,000 shares. This represents a substantial 118.18% increase in share count, impacting the portfolio by 0.2%, and a total value of $1.002 million.

Complete Exits from Certain Stocks

The third quarter also saw a complete exit from:

Paratek Pharmaceuticals Inc (NASDAQ:PRTK), with the sale of all 1,556,247 shares, leading to a -1.03% impact on the portfolio.

Significant Reductions in Key Holdings

Concurrently, Robert Bruce (Trades, Portfolio) reduced positions in 21 stocks, with the most significant changes being:

A reduction in Merck & Co Inc (NYSE:MRK) by 79,672 shares, resulting in a -26.52% decrease in shares and a -2.75% impact on the portfolio. The stock traded at an average price of $107.78 during the quarter and has seen a -4.15% return over the past three months and -5.92% year-to-date.

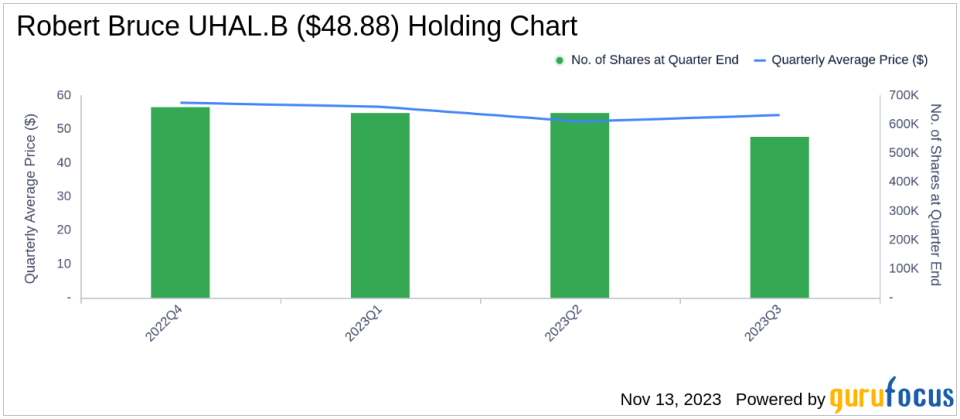

A reduction in U-Haul Holding Co (NYSE:UHAL.B) by 82,830 shares, leading to a -12.93% reduction in shares and a -1.26% impact on the portfolio. The stock's average trading price was $54.26 during the quarter, with a -9.74% return over the past three months and -10.95% year-to-date.

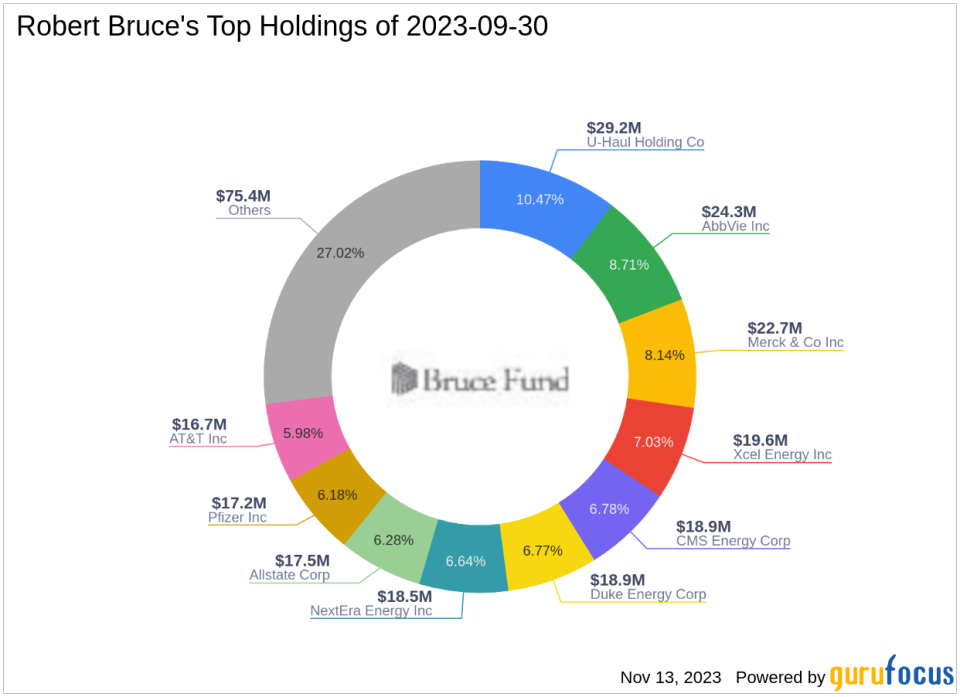

Portfolio Overview and Sector Allocation

As of the third quarter of 2023, Robert Bruce (Trades, Portfolio)'s portfolio comprised 35 stocks. The top holdings included 10.47% in U-Haul Holding Co (NYSE:UHAL.B), 8.71% in AbbVie Inc (NYSE:ABBV), 8.14% in Merck & Co Inc (NYSE:MRK), 7.03% in Xcel Energy Inc (NASDAQ:XEL), and 6.78% in CMS Energy Corp (NYSE:CMS). The investments are predominantly concentrated across eight industries: Healthcare, Utilities, Industrials, Communication Services, Financial Services, Technology, Basic Materials, and Consumer Defensive.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.