Robert Bruce's Q2 2023 13F Filing Update: Key Trades and Portfolio Overview

Robert Bruce (Trades, Portfolio), the founder of Bruce & Co, recently filed the firm's 13F report for the second quarter of 2023, which ended on June 30, 2023. Bruce & Co is an investment firm that serves as the advisor to the Bruce Fund (BRUFX), a fund primarily focused on common stock investments, high-yield and distressed debt. The fund, managed by Robert Bruce (Trades, Portfolio) and his son, Robert Jeffrey Bruce, may also invest in long-term U.S. government securities if attractive opportunities are not found elsewhere.

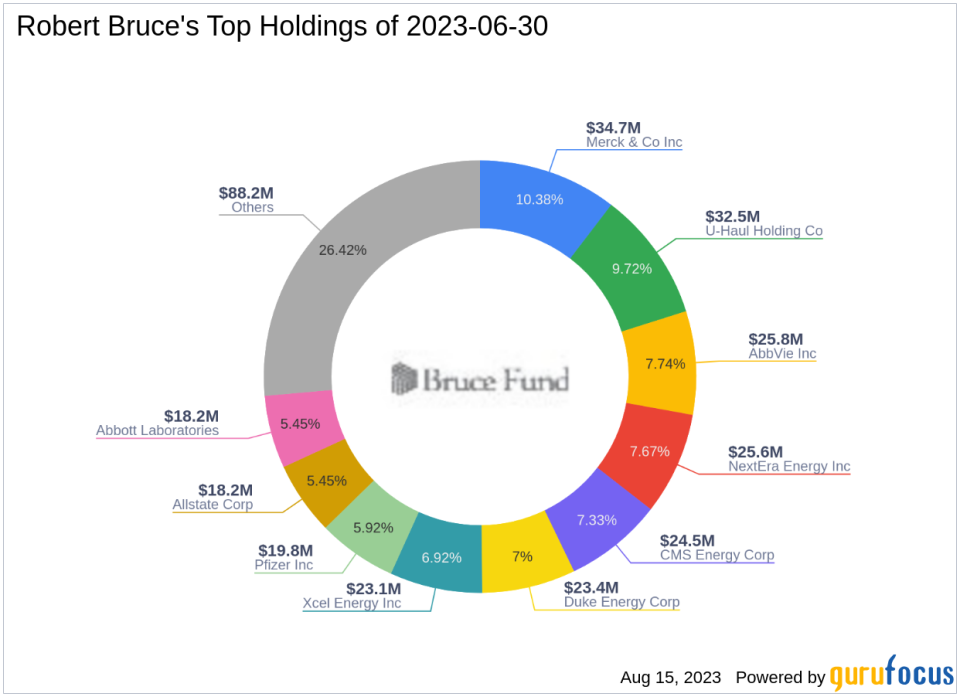

The firm's portfolio for Q2 2023 contained 34 stocks with a total value of $334 million. The top holdings were MRK (10.38%), UHAL.B (9.72%), and ABBV (7.74%).

Top Three Trades of the Quarter

The following were the firm's top three trades of the quarter:

Apple Inc (NASDAQ:AAPL)

Robert Bruce (Trades, Portfolio) reduced the firm's investment in Apple Inc (NASDAQ:AAPL) by 5,000 shares, impacting the equity portfolio by 0.24%. During the quarter, the stock traded for an average price of $174.1. As of August 15, 2023, Apple's stock price was $178.1, with a market cap of $2,784.46 billion. The stock has returned 3.33% over the past year. GuruFocus gives the company a financial strength rating of 7 out of 10 and a profitability rating of 10 out of 10. In terms of valuation, Apple has a price-earnings ratio of 29.93, a price-book ratio of 46.26, a price-earnings-to-growth (PEG) ratio of 1.72, a EV-to-Ebitda ratio of 22.48 and a price-sales ratio of 7.38.

Caribou Biosciences Inc (NASDAQ:CRBU)

During the quarter, Robert Bruce (Trades, Portfolio) bought 100,000 shares of Caribou Biosciences Inc (NASDAQ:CRBU), bringing the total holding to 200,000 shares. This trade had a 0.13% impact on the equity portfolio. The stock traded for an average price of $4.51 during the quarter. As of August 15, 2023, Caribou Biosciences' stock price was $6.56, with a market cap of $579.15 million. The stock has returned -34.38% over the past year. GuruFocus gives the company a financial strength rating of 7 out of 10. There is insufficient data to calculate the stocks profitability rating. In terms of valuation, Caribou Biosciences has a price-book ratio of 1.61, a EV-to-Ebitda ratio of -3.03 and a price-sales ratio of 28.17.

AT&T Inc (NYSE:T)

Robert Bruce (Trades, Portfolio) reduced the firm's investment in AT&T Inc (NYSE:T) by 10,000 shares, impacting the equity portfolio by 0.06%. During the quarter, the stock traded for an average price of $17.07. As of August 15, 2023, AT&T's stock price was $14.175, with a market cap of $101.34 billion. The stock has returned -18.05% over the past year. GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rating of 7 out of 10. In terms of valuation, AT&T has a price-book ratio of 0.99, a EV-to-Ebitda ratio of 12.28 and a price-sales ratio of 0.86.

In conclusion, Robert Bruce (Trades, Portfolio)'s Q2 2023 13F filing reveals a strategic approach to portfolio management, with a focus on both reducing and increasing investments in key stocks. The firm's top holdings and trades reflect a balanced mix of industries and risk profiles, demonstrating the firm's commitment to diversification and value investing.

This article first appeared on GuruFocus.