Robert Half Inc (RHI) Reports Decline in Q4 and Full-Year Earnings Amid Economic Headwinds

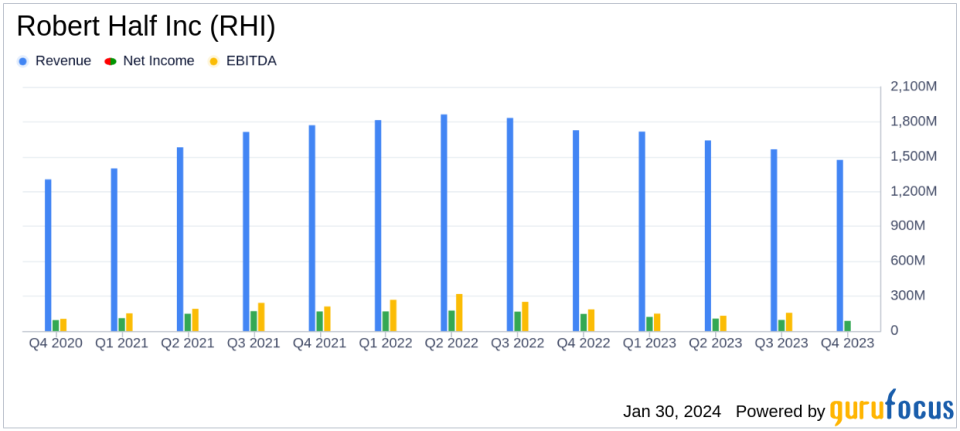

Revenue: Q4 revenue decreased to $1.473 billion from $1.727 billion in the same period last year.

Net Income: Q4 net income fell to $87 million, or $0.83 per share, compared to $148 million, or $1.37 per share, year-over-year.

Annual Performance: 2023 full-year net income was $411 million on revenues of $6.393 billion, down from $658 million on revenues of $7.238 billion in 2022.

Segment Performance: Protiviti led Q4 performance, with contract talent solutions and permanent placement also contributing to earnings.

Balance Sheet: Cash and cash equivalents stood at $731.74 million, with total assets at $3.01 billion as of December 31, 2023.

On January 30, 2024, Robert Half Inc (NYSE:RHI) released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a global leader in specialized talent solutions and business consulting, reported a decrease in both quarterly and annual revenue and net income compared to the previous year, reflecting the challenging economic conditions that have impacted the staffing industry.

Company Overview

Founded in 1948, Robert Half Inc (NYSE:RHI) has established itself as a premier provider of staffing solutions, offering temporary, permanent, and outcome-based staffing across various fields including finance, accounting, technology, legal, marketing, and administrative roles. Its consulting arm, Protiviti, specializes in technology, risk, auditing, and compliance. With most of its sales generated in the U.S., Robert Half stands as one of the largest specialized staffing firms in the highly fragmented U.S. staffing industry, boasting annual revenues around $7 billion.

Financial Performance and Challenges

For the fourth quarter, Robert Half Inc (NYSE:RHI) reported net income of $87 million, or $0.83 per share, on revenues of $1.473 billion. This represents a significant decline from the $148 million, or $1.37 per share, on revenues of $1.727 billion reported in the same period last year. The full-year figures also saw a downturn, with net income at $411 million, or $3.88 per share, on revenues of $6.393 billion, compared to $658 million, or $6.03 per share, on revenues of $7.238 billion for the previous year.

The company's President and CEO, M. Keith Waddell, acknowledged the above-consensus top- and bottom-line results for the fourth quarter, led by Protiviti. He noted the resilience of global labor demand and persistent talent shortages, albeit at levels modestly below their peaks. Waddell expressed optimism about the company's growth prospects and its ability to navigate the current climate, citing the industry-leading brand, technology, and unique business model that encompasses both professional staffing and business consulting services.

"We delivered above-consensus top- and bottom-line results for the fourth quarter, with Protiviti leading the way. Global labor demand continues to be resilient, and talent shortages persist, although both are modestly below their peaks. We are encouraged that our improving weekly revenue trends that began in the third quarter and continued into the fourth quarter are approaching a positive inflection point," said M. Keith Waddell.

Financial Achievements and Industry Impact

Despite the year-over-year decline, Robert Half Inc (NYSE:RHI) managed to achieve several financial milestones. The company's contract talent solutions and permanent placement segments contributed to the earnings, with Protiviti leading the fourth-quarter performance. The company's ability to maintain a strong balance sheet, with significant cash reserves and a solid equity position, is crucial in the Business Services industry, where financial stability is essential for ongoing operations and growth.

Detailed Financials

Robert Half Inc (NYSE:RHI)'s balance sheet as of December 31, 2023, showed cash and cash equivalents of $731.74 million and net accounts receivable of $860.87 million. Total assets were reported at $3.01 billion, with total current liabilities at $1.24 billion and total stockholders' equity at $1.59 billion. These figures reflect the company's solid financial position despite the challenging economic environment.

The company's segment income as a percentage of revenue for contract talent solutions was 5.7%, for permanent placement talent solutions 8.5%, and for Protiviti 11.4%. These segments are critical to understanding the company's operational efficiency and profitability.

Analysis of Performance

Robert Half Inc (NYSE:RHI)'s performance in the fourth quarter and full year of 2023 indicates the impact of economic headwinds on the staffing industry. The decline in revenue and net income year-over-year highlights the challenges faced by the company. However, the firm's strategic focus on its core staffing and consulting services, combined with its strong balance sheet, positions it well to navigate the uncertain economic landscape and capitalize on market opportunities as they arise.

The company's management remains confident in their ability to manage the current climate and is optimistic about future growth, supported by their industry-leading brand and diversified business model. This resilience and adaptability are key factors that value investors may find appealing as they consider the long-term prospects of Robert Half Inc (NYSE:RHI).

For more detailed information and to access the full earnings report, please visit the Investor Center of the Robert Half website or access the 8-K filing.

Explore the complete 8-K earnings release (here) from Robert Half Inc for further details.

This article first appeared on GuruFocus.