Robert Karr's Q2 2023 13F Filing Update: Top Trades and Portfolio Overview

Renowned investor Robert Karr has recently disclosed his firm's portfolio for the second quarter of 2023, which ended on June 30, 2023. Karr is known for his value-oriented investment philosophy, focusing on long-term capital appreciation by investing in a concentrated portfolio of companies that exhibit strong fundamentals and growth potential.

Portfolio Overview

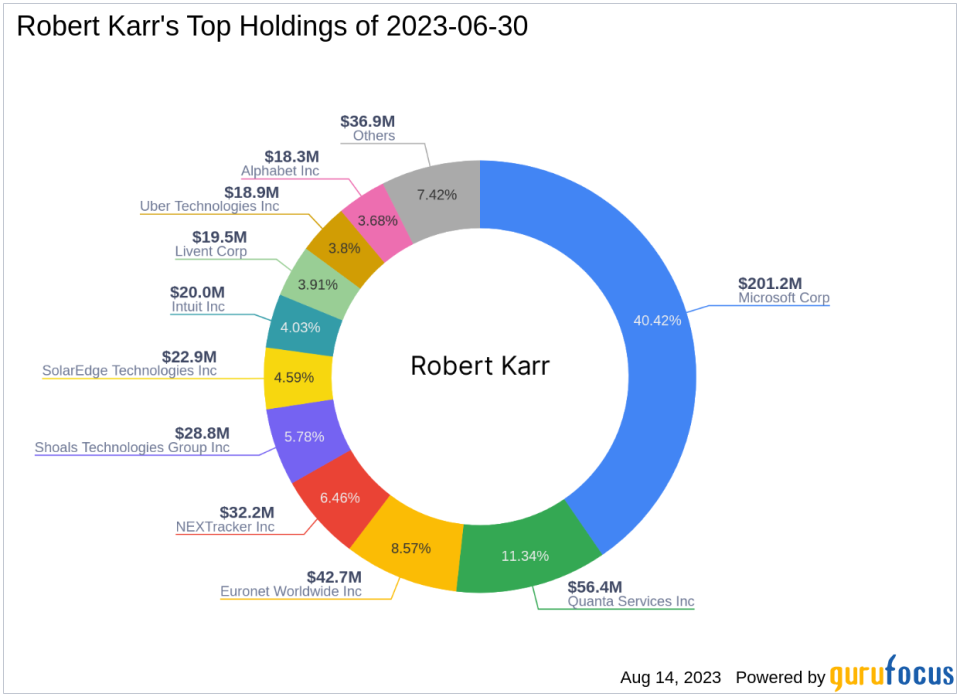

The firm's portfolio for Q2 2023 comprised 19 stocks with a total value of $498 million. The top holdings were Microsoft Corp (MSFT) with a portfolio weight of 40.42%, Quanta Services Inc (PWR) at 11.34%, and Euronet Worldwide Inc (EEFT) at 8.57%.

Top Trades of the Quarter

The following were the firm's top three trades of the quarter:

NEXTracker Inc (NAS:NXT)

Robert Karr (Trades, Portfolio)'s firm established a new position in NEXTracker Inc, purchasing 808,169 shares. This gave the stock a 6.46% weight in the equity portfolio. The shares traded for an average price of $36.65 during the quarter. As of August 14, 2023, NXT had a price of $42.15 and a market cap of $2.61 billion. The stock has returned 0.00% over the past year. GuruFocus gives the company a financial strength rating of 6 out of 10 and a profitability rating of 5 out of 10. NXT's valuation ratios include a price-earnings ratio of 16.21, a EV-to-Ebitda ratio of 10.88, and a price-sales ratio of 1.12.

Array Technologies Inc (NAS:ARRY)

The firm reduced its investment in Array Technologies Inc by 1,040,866 shares, impacting the equity portfolio by 5.86%. The stock traded for an average price of $21.42 during the quarter. As of August 14, 2023, ARRY had a price of $23.12 and a market cap of $3.49 billion. The stock has returned -0.77% over the past year. GuruFocus gives the company a financial strength rating of 6 out of 10 and a profitability rating of 3 out of 10. ARRY's valuation ratios include a price-earnings ratio of 45.33, a price-book ratio of 12.17, a EV-to-Ebitda ratio of 15.22, and a price-sales ratio of 1.94.

Livent Corp (NYSE:LTHM)

The firm also established a new position in Livent Corp, purchasing 710,000 shares. This gave the stock a 3.91% weight in the equity portfolio. The shares traded for an average price of $23.94 during the quarter. As of August 14, 2023, LTHM had a price of $22.16 and a market cap of $3.98 billion. The stock has returned -26.21% over the past year. GuruFocus gives the company a financial strength rating of 7 out of 10 and a profitability rating of 7 out of 10. LTHM's valuation ratios include a price-earnings ratio of 12.74, a price-book ratio of 2.41, a EV-to-Ebitda ratio of 8.45, and a price-sales ratio of 4.97.

In conclusion, Robert Karr (Trades, Portfolio)'s Q2 2023 portfolio shows a strategic mix of new positions and reductions, reflecting the firm's value-oriented investment philosophy. The portfolio's performance and the firm's top trades provide valuable insights for investors seeking to understand market trends and investment strategies.

This article first appeared on GuruFocus.