Robert Olstein's Strategic Exits and Acquisitions in Q4 2023: Spotlight on WestRock Co

Insights into the Investment Moves of a Financial Reporting Expert

Renowned for his expertise in corporate financial disclosure and inferential financial screening, Robert A. Olstein, Chairman and CIO of Olstein Financial Alert Fund, has made notable changes to his portfolio in the fourth quarter of 2023. Olstein's investment philosophy is deeply rooted in a "defense first" approach, emphasizing financial strength and potential downside risk over mere appreciation potential. His recent 13F filing reveals strategic exits, including a significant sell-off in WestRock Co, and new acquisitions that align with his stringent criteria for cash flow generation, accounting practices, and balance sheet fundamentals.

Summary of New Buys

Robert Olstein (Trades, Portfolio)'s portfolio welcomed a new entrant in the fourth quarter:

Vontier Corp (NYSE:VNT) emerged as a significant addition with 106,000 shares, constituting 0.62% of the portfolio and a total value of $3.66 million.

Key Position Increases

Olstein didn't shy away from bolstering existing positions:

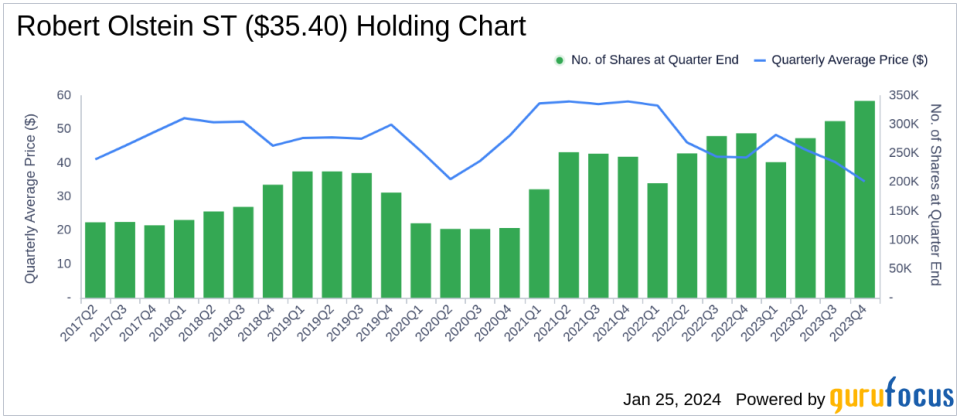

Sensata Technologies Holding PLC (NYSE:ST) saw an additional 35,000 shares, bringing the total to 341,000 shares. This represents an 11.44% increase in share count and a 0.22% impact on the current portfolio, valued at $12.81 million.

FedEx Corp (NYSE:FDX) also experienced growth with an additional 5,000 shares, resulting in a 28.57% increase in share count and a total value of $5.69 million.

Summary of Sold Out Positions

Strategic exits were part of Olstein's Q4 maneuvers:

WestRock Co (NYSE:WRK) was completely offloaded, with all 223,700 shares sold, impacting the portfolio by -1.37%.

Intel Corp (NASDAQ:INTC) also saw a complete liquidation of 119,000 shares, leading to a -0.73% portfolio impact.

Key Position Reductions

Olstein also trimmed positions where necessary:

Prosperity Bancshares Inc (NYSE:PB) was reduced by 75,000 shares, a -72.82% decrease, affecting the portfolio by -0.7%. The stock's average trading price was $58.46 during the quarter, with a 26.65% return over the past three months and a -3.38% year-to-date performance.

Equifax Inc (NYSE:EFX) saw a reduction of 17,500 shares, a -56.45% cut, impacting the portfolio by -0.55%. It traded at an average price of $202.83 in the quarter, returning 51.61% over the past three months and 0.46% year-to-date.

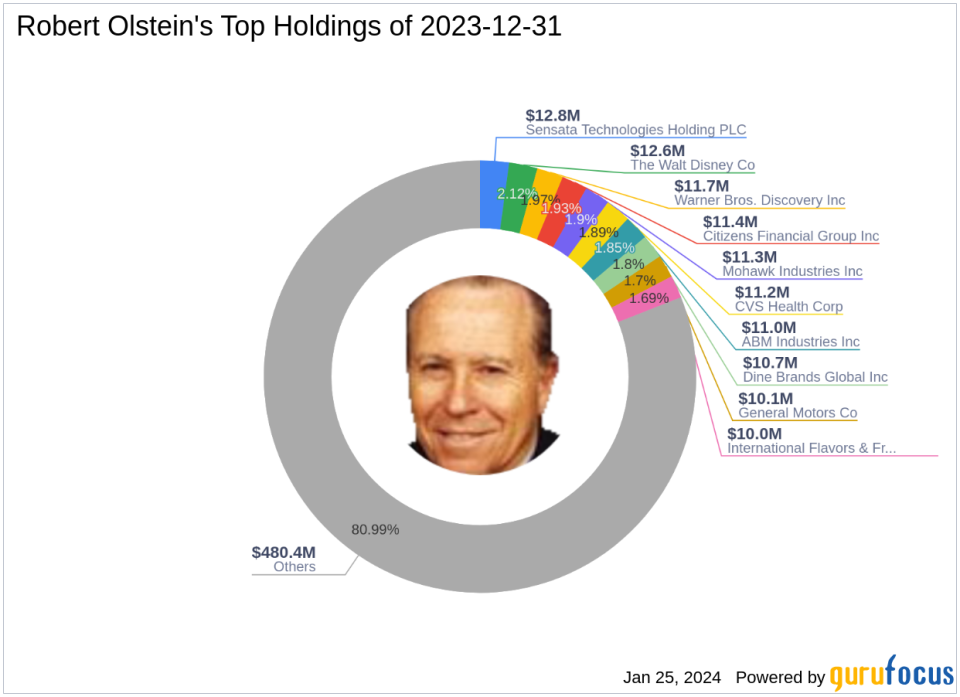

Portfolio Overview

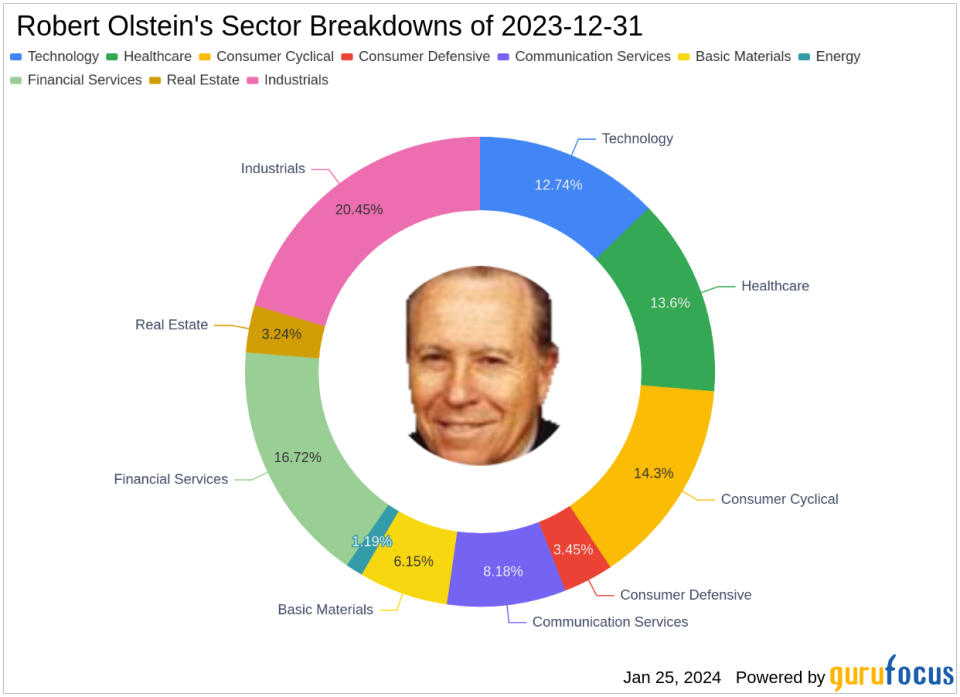

As of the fourth quarter of 2023, Robert Olstein (Trades, Portfolio)'s portfolio comprised 96 stocks. The top holdings included 2.16% in Sensata Technologies Holding PLC (NYSE:ST), 2.12% in The Walt Disney Co (NYSE:DIS), 1.97% in Warner Bros. Discovery Inc (NASDAQ:WBD), 1.93% in Citizens Financial Group Inc (NYSE:CFG), and 1.9% in Mohawk Industries Inc (NYSE:MHK). The investments span across 10 of the 11 industries, showcasing a diversified yet focused approach.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.