Roblox Corp (RBLX) Reports Strong Growth Amidst Net Losses in Q4 and Full Year 2023

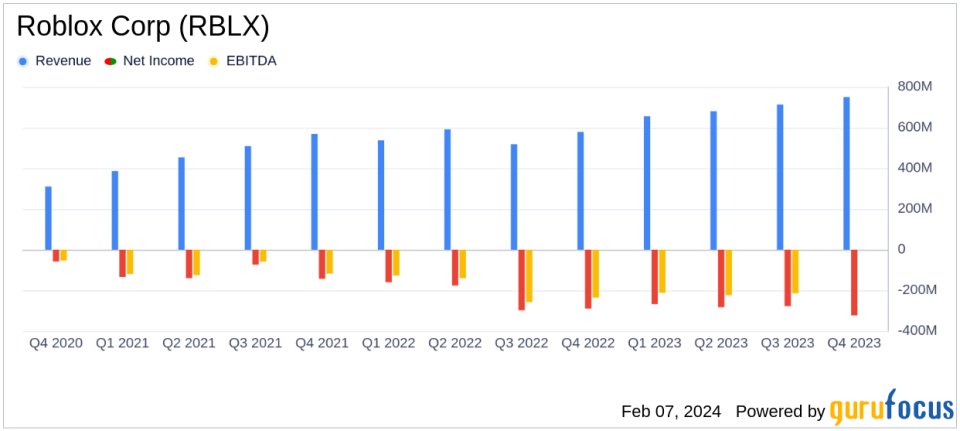

Revenue Growth: Q4 revenue increased by 30% year-over-year to $749.9 million; full-year revenue up 26% to $2.8 billion.

Bookings and User Growth: Q4 bookings rose 25% to $1.1 billion; DAUs increased by 22% to 71.5 million.

Net Loss: Q4 net loss attributable to common stockholders was $323.7 million; full-year net loss reached $1.15 billion.

Operating Cash Flow: Net cash provided by operating activities grew by 20% in Q4 to $143.3 million; full-year cash flow increased by 24%.

Financial Guidance: 2024 revenue projected between $3.3 billion and $3.4 billion; bookings expected to be between $4.14 billion and $4.28 billion.

On February 7, 2024, Roblox Corp (NYSE:RBLX) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, known for its online platform that allows users to create and play games, reported significant growth in daily active users (DAUs), hours engaged, revenue, and bookings. Despite these achievements, the company also reported substantial net losses for both the quarter and the full year.

Roblox's Operational and Financial Highlights

Roblox's platform, which combines a game engine, publishing platform, online hosting, marketplace, and social network, has seen a 30% year-over-year increase in Q4 revenue, reaching $749.9 million. This growth is attributed to a 22% increase in DAUs and a 21% increase in hours engaged. The company's bookings, which include sales of virtual currency, rose by 25% to $1.1 billion in Q4, marking a strong end to the year.

Despite these positive trends, Roblox reported a net loss of $323.7 million for Q4 and a significant net loss of $1.15 billion for the full year. The company's net cash provided by operating activities, however, showed a healthy increase, suggesting robust underlying business operations.

Financial Performance and Future Outlook

Roblox's financial achievements, particularly in revenue and bookings growth, underscore its strong position in the interactive media industry. The company's ability to scale operations efficiently and improve margins and cash flow is crucial for its long-term success. Roblox's founder and CEO, David Baszucki, expressed optimism about the company's direction, citing strong network effects and investments in immersive experiences, advertising, and AI.

Michael Guthrie, Roblox's CFO, highlighted the company's strongest rate of quarterly bookings growth in two years and its first quarter of $1 billion in bookings. Looking ahead, Roblox provides guidance for 2024, expecting revenue between $3.3 billion and $3.4 billion and bookings between $4.14 billion and $4.28 billion. However, the company also anticipates a consolidated net loss between $1.4 billion and $1.365 billion for the full year.

Roblox's Balance Sheet and Cash Flow Statements

Roblox's balance sheet shows a total asset value of $6.17 billion as of December 31, 2023, with current assets including cash and cash equivalents of $678.5 million and short-term investments of $1.51 billion. The company's liabilities total $6.1 billion, with a significant portion in deferred revenue and long-term debt.

The cash flow statements reveal that the net cash provided by operating activities for the full year was $458.2 million, a 24% increase from the previous year. The company's free cash flow for the year stood at $124 million, despite the net losses reported.

Investor Considerations

While Roblox's net losses may raise concerns, the company's revenue growth and increased user engagement are positive indicators for potential investors. The company's strategic focus on innovation and new experiences, as well as its guidance for continued growth in 2024, suggest that Roblox is positioning itself for long-term success in the dynamic and competitive interactive media landscape.

Value investors and potential GuruFocus.com members should consider the company's growth trajectory, operational efficiency improvements, and the challenges it faces in achieving profitability. Roblox's commitment to driving innovation and expanding its user base may offer opportunities for growth-oriented investments.

For a more detailed analysis of Roblox Corp's financial results and future outlook, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Roblox Corp for further details.

This article first appeared on GuruFocus.