Rocket Companies Inc (RKT) Reports Mixed Q4 and Full-Year 2023 Results Amid Mortgage Market ...

Adjusted Revenue: Q4 adjusted revenue reached $885 million, surpassing the high end of guidance.

Net Loss: Q4 GAAP net loss reported at $233 million, with a full-year net loss of $390 million.

Cost Reduction: Reduced cost structure by nearly 20% in 2023, following a nearly 25% reduction in 2022.

Adjusted EBITDA: Delivered positive adjusted EBITDA for the third consecutive quarter and full year.

Liquidity: Maintained strong liquidity with approximately $9.0 billion available as of December 31, 2023.

Market Share Growth: Purchase and refinance market share grew by double digits in 2023.

On February 22, 2024, Rocket Companies Inc (NYSE:RKT) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year of 2023. The Detroit-based financial services powerhouse, known for its leading Rocket Mortgage business, faced a challenging mortgage market but managed to exceed adjusted revenue expectations and maintain a strong liquidity position.

Financial Performance Overview

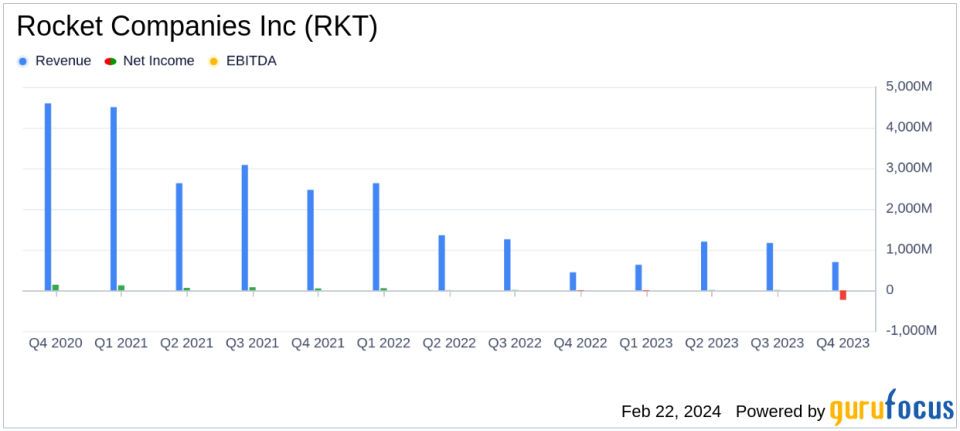

Rocket Companies reported a net revenue of $694 million for Q4 and $3.8 billion for the full year. Despite these figures, the company experienced a GAAP net loss of $233 million in Q4 and a loss of $390 million for the year. Adjusted net loss for Q4 was minimal at $6 million, equating to $0.00 per adjusted diluted loss per share, while the full-year adjusted net loss stood at $143 million, or $0.07 per adjusted diluted loss per share.

The company's CEO, Varun Krishna, highlighted the team's consistent execution amid a tough year for mortgage originations, noting the accelerating year-over-year revenue growth and positive adjusted EBITDA for the third consecutive quarter. Krishna also emphasized the company's strides in market share growth and the deployment of AI across the organization to enhance client experiences and drive profitability.

"We enter 2024 with momentum and Rocket is well-positioned to fulfill its strategy of AI-fueled home ownership," said Krishna.

Strategic Cost Management and Liquidity

Rocket Companies' disciplined approach to cost management resulted in a nearly 20% expense reduction in 2023, following a substantial cut in the previous year. This was achieved through technology-led productivity gains and organizational right-sizing. The company's liquidity remained robust, with total liquidity of approximately $9.0 billion, including $1.1 billion in cash and cash equivalents.

Market Share and Innovation

The company's purchase market share grew by 14%, and refinance market share by 10% from 2022 to 2023. Rocket Companies also introduced innovative products such as home equity loans, ONE+, and BUY+, which have resonated with new and existing clients. The company's net client retention rate was an impressive 97% for the 12 months ended December 31, 2023.

Looking Ahead

For Q1 2024, Rocket Companies anticipates adjusted revenue to be between $925 million and $1,075 million. The company continues to leverage automation and AI to improve operational efficiency and client experiences, positioning itself for future growth in a competitive mortgage market.

Rocket Companies Inc (NYSE:RKT) remains a key player in the financial services industry, navigating through market headwinds with a focus on innovation and efficiency. As the company moves forward with its AI-fueled strategy, investors and stakeholders will be watching closely to see how these initiatives translate into financial performance and market share gains.

For a more detailed analysis of Rocket Companies Inc's financial results and future outlook, please visit GuruFocus.com.

Investor Relations Contact: Sharon Ng ir@rocketcompanies.com (313) 769-2058

Media Contact: Aaron Emerson aaronemerson@rocketcentral.com (313) 373-3035

Explore the complete 8-K earnings release (here) from Rocket Companies Inc for further details.

This article first appeared on GuruFocus.