Rockwell Automation Inc (ROK) Q1 2024 Earnings: Mixed Results Amidst Market Challenges

Reported Sales Growth: 3.6% increase year over year, with organic sales up 1.0%.

Diluted and Adjusted EPS: Diluted EPS at $1.86, down 44% YOY; Adjusted EPS at $2.04, down 17% YOY.

Annual Recurring Revenue (ARR): Total ARR up 20% year over year, signaling strong recurring revenue streams.

Cash Flow: Operating activities generated $32.6 million, a decrease from $66.3 million YOY; Free cash flow was negative at $(35.3) million.

Guidance: Fiscal 2024 reported sales growth guidance of 0.5% - 6.5% reaffirmed; Diluted EPS guidance updated to $11.24 - $12.74.

On January 31, 2024, Rockwell Automation Inc (NYSE:ROK) released its 8-K filing, disclosing the financial results for the first quarter of fiscal year 2024. As a leading entity in industrial automation and digital transformation, Rockwell Automation operates through segments such as intelligent devices, software and control, and lifecycle services, offering a comprehensive range of automation solutions.

Financial Performance and Challenges

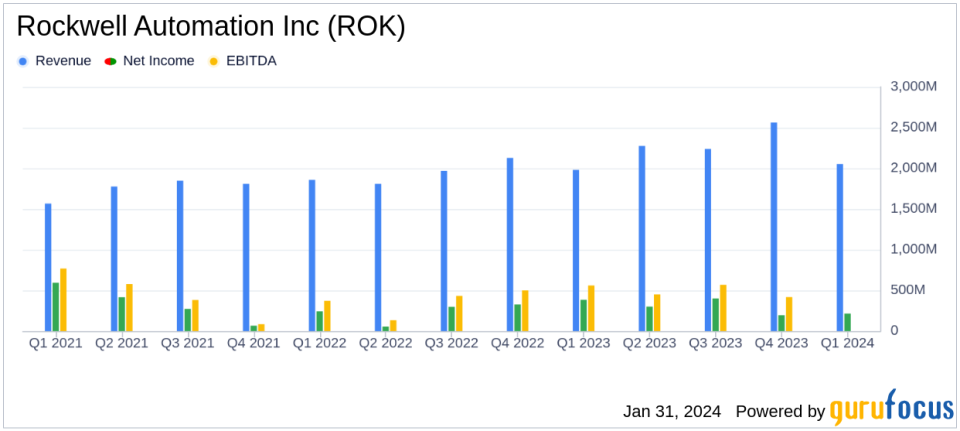

Rockwell Automation reported a modest increase in sales, with reported sales rising 3.6% year over year to $2,052 million. This growth was partially fueled by acquisitions, contributing 1.4% to the overall increase. However, the company faced a significant decline in net income attributable to Rockwell Automation, which decreased to $215 million, or $1.86 per share, from $384 million, or $3.31 per share in the previous year. Adjusted EPS also saw a downturn, decreasing by 17.1% to $2.04 compared to $2.46 in the first quarter of fiscal 2023.

The company's performance reflects the ongoing challenges in the market, including high levels of channel inventory and lingering supply chain constraints. These factors have impacted the timing of product shipments, despite positive underlying conditions and a profitable quarter for the Sensia joint venture, which saw over 25% growth in orders and sales.

Financial Achievements and Industry Significance

One notable financial achievement for Rockwell Automation is the 20% year-over-year growth in Total ARR, highlighting the increasing value of the company's recurring software and services. This metric is particularly important in the Industrial Products industry, as it indicates a stable and predictable revenue stream, which is crucial for long-term planning and investment.

Key Financial Metrics

Rockwell Automation's pre-tax margin was 12.7% in the first quarter of fiscal 2024, a decrease from 23.6% in the same period last year. The segment operating margin also declined to 17.3% from 20.2% a year ago. These margins are critical as they reflect the company's profitability and its ability to control costs relative to its sales.

Free cash flow was negative at $(35.3) million, compared to $42.1 million in the same period last year, indicating a potential concern for the company's liquidity and its ability to fund operations and growth initiatives.

"We continue to expect low-single-digit topline growth in FY24, with modest EPS growth weighted to the second half of the year as orders continue to rebound. We are focused on winning share, meeting near-term profitability targets, and investing for the most attractive future opportunities, said Blake Moret, Chairman and CEO.

Analysis of Performance

While Rockwell Automation has managed to grow its sales, the significant drop in net income and EPS suggests that the company is facing margin pressures and increased costs that are affecting its bottom line. The reaffirmed sales growth guidance indicates management's confidence in the company's ability to navigate through these challenges, with an emphasis on strategic investments and market share gains.

Investors and potential GuruFocus.com members should consider the mixed results of Rockwell Automation's first quarter as they evaluate the company's prospects. The strong ARR growth is a positive sign, but the pressure on margins and cash flow will be key areas to monitor in the coming quarters.

For a more detailed breakdown of Rockwell Automation's financials and management's outlook, interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Rockwell Automation Inc for further details.

This article first appeared on GuruFocus.