Rockwell Automation (ROK) Buys Autonomous Mobile Robot Maker

Rockwell Automation, Inc. ROK announced that it completed the acquisition of Clearpath Robotics Inc., which would augment its Intelligent Devices portfolio. The acquisition enhances ROK’s ability to provide manufacturers with end-to-end autonomous production logistic solutions, which will help them in lowering costs, while improving efficiency and safety.

Ontario, Canada-based Clearpath was founded in 2009. It began by providing robotics technology to international research and development markets. In 2015, the company launched its industrial division OTTO Motors, which provides autonomous mobile robots (AMRs) for industrial applications.

The OTTO Motors Division provides AMRs as well as fleet management and navigation software. These help to significantly boost throughput and lower costs by ensuring that components and subassemblies are in place when needed and by transporting finished goods to a truck or warehouse upon completion.

Rockwell Automation has been working on simplifying and transforming the difficult and critical function of material handling throughout a manufacturing plant. Autonomous production logistics will help transform the workflow throughout the plant, leading to solid cut downs in costs and delivering improved operational efficiency.

ROK’s strong continuing partnerships in fixed robotic arms solutions such as Independent Cart Technology, and traditional leadership in programmable logic controllers and the addition of OTTO Motors’ AMR capabilities will create a complete portfolio of advanced material handling solutions, providing it with an edge over other industry players.

This acquisition is expected to be accretive by a percentage point to Rockwell Automation’s fiscal 2024 revenue growth.

AMRs are reshaping industries by offering unprecedented levels of automation, efficiency, and safety. It has solid growth potential and according to Interact Analysis, the market for AMRs in manufacturing is estimated to reach $6.2 billion by 2027. The projected annual growth rate is around 30%

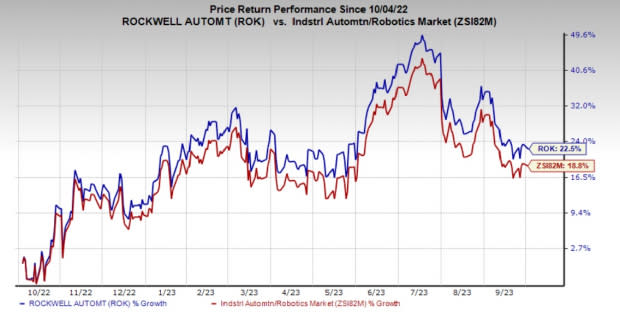

Price Performance

Image Source: Zacks Investment Research

In the past year, Rockwell Automation’s shares have gained 22.5% compared with the industry’s 18.8% growth.

Zacks Rank and Key Picks

ROK currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Industrial Products sector are Caterpillar Inc. CAT, Astec Industries, Inc. ASTE and Eaton Corporation plc. ETN. CAT and ASTE sport a Zacks Rank #1 (Strong Buy), and ETN has a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Caterpillar has an average trailing four-quarter earnings surprise of 18.5%. The Zacks Consensus Estimate for CAT’s 2023 earnings is pegged at $19.81 per share. The consensus estimate for 2023 earnings has moved 11.4% north in the past 60 days. Its shares have gained 51.6% in the last year.

Astec has an average trailing four-quarter earnings surprise of 20%. The Zacks Consensus Estimate for ASTE’s 2023 earnings is pegged at $2.81 per share. The consensus estimate for 2023 earnings has moved 4% north in the past 60 days. ASTE’s shares have gained 22.8% in the last year.

The Zacks Consensus Estimate for Eaton’s 2023 earnings per share is pegged at $8.80. The consensus estimate for 2023 earnings has moved 4% north in the past 60 days. It has a trailing four-quarter average earnings surprise of 3%. Shares of ETN have rallied 68.8% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Astec Industries, Inc. (ASTE) : Free Stock Analysis Report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

Rockwell Automation, Inc. (ROK) : Free Stock Analysis Report