Rockwell Automation (ROK) Extends Its Partnership With PTC

Rockwell Automation ROK announced a partnership extension with Boston, MA-based PTC Inc. PTC. The partnership will center around the use of the Internet of Things (IoT) and augmented reality (AR) software by manufacturing companies.

For the past five years, PTC and ROK have benefited from their partnership. Rockwell Automation's manufacturing customers benefit from PTC's IoT and AR solutions for use cases, including asset monitoring, scheduled maintenance and quality inspection.

Rockwell Automation will continue to resell PTC's ThingWorx IoT software to new and existing customers across discrete and process manufacturing verticals. This includes the Digital Performance Management manufacturing solution and Vuforia AR software.

Under this partnership, customers will gain from the resources, technology and industry expertise of both companies.

Rockwell Automation is poised well to benefit from the broadening of its portfolio of hardware and software products, solutions, and services. It is also gaining traction from investments in the cloud. Significant investments to globalize manufacturing, product development, building channel capability and partner network will drive growth.

ROK is likely to witness above-market organic sales growth by expanding its served markets and improving offerings that will provide it with a competitive edge. The company continues to drive process improvement, functional streamlining, material cost savings and manufacturing productivity in an effort to augment earnings growth.

Backed by solid backlog levels and performance in the first half of fiscal 2023, as well as improvements in the availability of electronic components, Rockwell Automation anticipates sales growth of 12.5-16.5% on a reported basis for fiscal 2023. Organic sales growth is expected to be 13-17% for fiscal 2023. Adjusted earnings per share for fiscal 2023 are expected between $11.50 and $12.20.

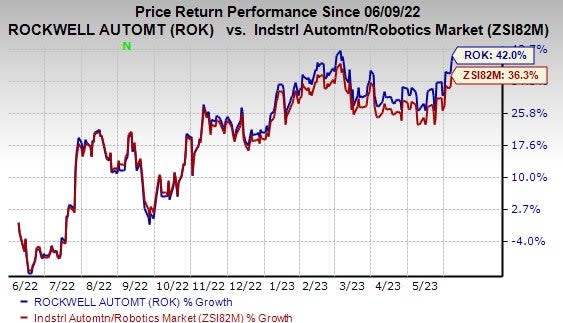

Price Performance

In the past year, Rockwell Automation’s shares have gained 42% compared with the industry’s growth of 36.3%.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

Rockwell Automation currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the Industrial Products sector are Hubbell Incorporated HUBB and Pentair plc PNR. HUBB flaunts a Zacks Rank #1 (Strong Buy) at present and PNR has a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Hubbell has an average trailing four-quarter earnings surprise of 21%. The Zacks Consensus Estimate for HUBB’s fiscal 2023 earnings is pegged at $13.81 per share. The consensus estimate for 2023 earnings has moved north by 22.5% in the past 60 days. Its shares gained 45.4% in the last year.

The Zacks Consensus Estimate for Pentair’s 2023 earnings per share is pegged at $3.66, up 3% in the past 60 days. It has a trailing four-quarter average earnings surprise of 7.2%. PNR gained 14.9% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Rockwell Automation, Inc. (ROK) : Free Stock Analysis Report

Pentair plc (PNR) : Free Stock Analysis Report

PTC Inc. (PTC) : Free Stock Analysis Report

Hubbell Inc (HUBB) : Free Stock Analysis Report