Rockwell Automation (ROK) Q4 Earnings Beat Estimates, Rise Y/Y

Rockwell Automation Inc. ROK has reported adjusted earnings per share (EPS) of $3.64 in fourth-quarter fiscal 2023 (ended Sep 30, 2023), beating the Zacks Consensus Estimate of $3.49. The bottom line improved 20% year over year on higher sales.

Including other one-time items, earnings were $2.61 per share in the fiscal fourth quarter compared with the prior-year quarter’s $2.91.

Total revenues were $2,563 million, up 20.5% from the prior-year quarter. The top line surpassed the Zacks Consensus Estimate of $2,438 million. Organic sales in the quarter were up 17.7%, surpassing our prediction of 9.5% organic sales growth. Acquisitions contributed 1.4% to sales growth, while currency translation contributed 1.4%. We expected acquisitions to contribute 0.7% and currency translation to contribute 2.9%.

Operational Update

The cost of sales increased 21.6% year over year to around $1,507 million. The gross profit rose 19.1% year over year to $1,056 million. Selling, general and administrative expenses moved up 22.9% year over year to $552 million.

Consolidated segmental operating income totaled $572 million, up 15.5% from the prior-year quarter. The total segment operating margin was 22.3% in the fiscal fourth quarter, lower than the prior-year period’s 23.3%. The decline in margins was due to higher investment spend and incentive compensation, mostly negated by higher sales volume.

Rockwell Automation, Inc. Price, Consensus and EPS Surprise

Rockwell Automation, Inc. price-consensus-eps-surprise-chart | Rockwell Automation, Inc. Quote

Segmental Results

Intelligent Devices: Net sales amounted to $1,171 million in the fiscal fourth quarter, up 22.3% year over year. The reported figure topped our estimate of $1,105 million. The segment’s operating earnings totaled $249 million compared with the year-earlier quarter’s $213 million. We predicted the segment operating earnings to be $228 million in the quarter. The segmental operating margin decreased to 21.3% in the quarter from the year-ago quarter’s 22.3%.

Software & Control: Net sales climbed 24.9% year over year to $821 million in the reported quarter. Reported sales surpassed our estimate of $744 million. The segment’s operating earnings increased 21% year over year to $275 million. We predicted segmental operating earnings of $271 million. The segment’s operating margin was 33.5% compared with 34.5% in the year-earlier quarter.

Lifecycle Services: Net sales for the segment were $571 million in the reported quarter, up 11.6% year over year. We projected the segment’s sales to be $556 million in the quarter. The segment’s operating earnings totaled $47.8 million compared with the prior-year quarter’s $54.7 million.

Our estimate for the segment’s operating earnings was $60.3 million. The variance was mainly due to higher incentive compensation and restructuring costs faced in the quarter. The segment’s operating margin was 8.4% in the reported quarter compared with the year-earlier quarter’s 10.7%.

FY23 Performance

The company has reported an adjusted EPS of $12.12 in fiscal 2023, beating the Zacks Consensus Estimate of $11.95. The bottom line improved 28% year over year. Including other one-time items, earnings were $11.95 per share in the year compared with the prior year’s $7.97.

In fiscal 2023, total revenues were $9.05 billion, up 16.7% from fiscal 2022. The top line surpassed the Zacks Consensus Estimate of $8.93 billion. Organic sales in the year were up 16.9%, surpassing our prediction of 14.7% organic sales growth. Acquisitions contributed 1.2% to sales growth, while currency translation had a negative impact of 1.4%. We expected acquisitions to contribute 1% and currency translation to have a negative impact of 1%.

Financials

At the end of fiscal 2023, cash and cash equivalents were approximately $1,072 million compared with $491 million as of the end of fiscal 2022. The long-term debt was $2,863 million at the end of fiscal 2023, down from $2,867 million at the fiscal 2022-end.

Cash flow from operations in the year ended Sep 30, 2023, was $1,375 million compared with the prior year’s $823 million. Return on invested capital was 20.9% as of Sep 30, 2023.

In the quarter under review, ROK repurchased 0.2 million shares for $54.7 million. As of the end of the quarter, $0.9 billion was available under the existing share-repurchase authorization.

FY24 Guidance

Backed by the solid backlog levels and the performance in fiscal 2023, as well as improvement in the availability of electronic components, Rockwell Automation expects adjusted EPS of $12.00-$13.50 for fiscal 2024. The mid-point indicates year-over-year growth of 5%. The company expects reported sales growth of 0.5-6.5%.

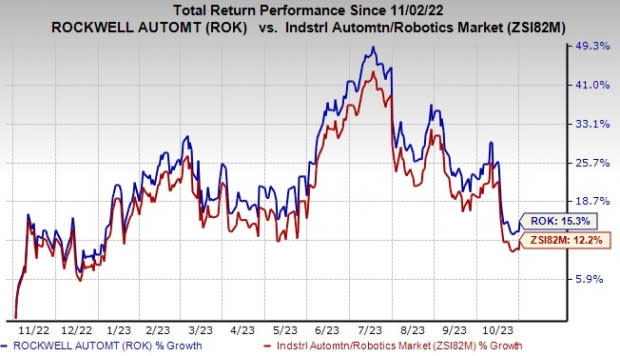

Price Performance

In the past year, Rockwell Automation’s shares have gained 15.3% compared with the industry’s growth of 12.2%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Rockwell Automation currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Industrial Products sector are Brady BRC, Applied Industrial Technologies AIT and Emerson Electric Co. EMR. BRC currently sports a Zacks Rank #1 (Strong Buy), and AIT and EMR have a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Brady’s 2023 earnings per share is pegged at $3.62. The consensus estimate for 2023

earnings has moved 13% north in the past 60 days and suggests year-over-year growth of 9.9%. The company has a trailing four-quarter average earnings surprise of 7.2%. Shares of BRC rallied 17.7% in the last year.

Applied Industrial has an average trailing four-quarter earnings surprise of 15%. The Zacks Consensus Estimate for AIT’s 2023 earnings is pegged at $9.13 per share, which indicates year-over-year growth of 2%. Estimates have moved up 2% in the past 60 days. The company’s shares gained 27% in the last year.

Emerson has an average trailing four-quarter earnings surprise of 7.4%. The Zacks Consensus Estimate for EMR’s 2023 earnings is pegged at $4.45 per share. The consensus estimate for 2023 earnings has moved 1% north in the past 60 days. EMR shares gained 5.9% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

Rockwell Automation, Inc. (ROK) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Brady Corporation (BRC) : Free Stock Analysis Report