Rocky Brands Inc (RCKY) Reports Mixed 2023 Financial Results Amidst Market Challenges

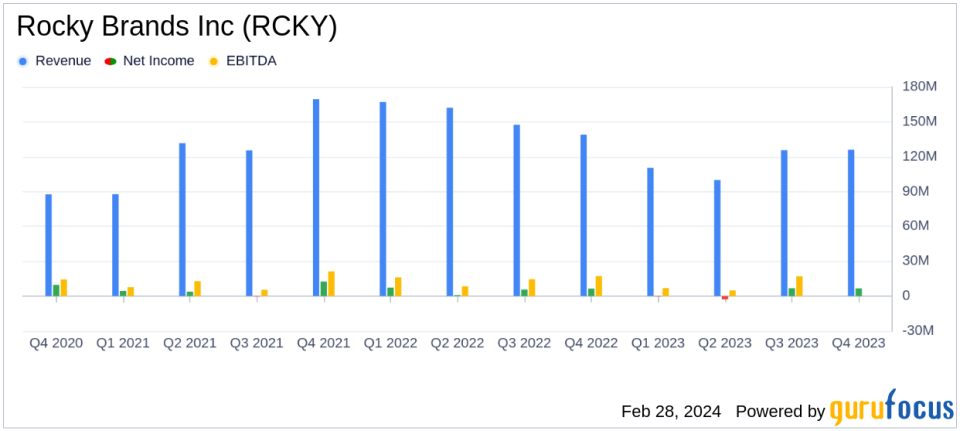

Net Sales: Full year net sales decreased by 25.0% to $461.8 million, while Q4 net sales dropped by 9.3% to $126.0 million.

Net Income: Full year net income plummeted by 49.1% to $10.4 million, with Q4 net income slightly up by 3.0% to $6.7 million.

Debt Reduction: Total debt was significantly reduced by 32.6% to $175.0 million at year-end.

Inventory Management: Year-end inventories saw a substantial decrease of 28.1% to $169.2 million.

Gross Margin: Improved gross margin to 38.7% of net sales for the full year, marking a 230-basis point increase.

Operating Expenses: Operating expenses were reduced, contributing to a more efficient cost structure.

On February 28, 2024, Rocky Brands Inc (NASDAQ:RCKY) released its 8-K filing, detailing the financial outcomes for both the fourth quarter and the full year of 2023. The company, known for its design, manufacture, and marketing of premium-quality footwear and apparel, operates through Wholesale, Retail, and Contract segments, with the majority of its revenue stemming from the Wholesale division.

Despite a challenging market environment, Rocky Brands managed to navigate through headwinds and deliver operating income that exceeded expectations for the fourth quarter. However, the full year painted a different picture with operating income and net income witnessing significant declines of 19.7% and 49.1%, respectively. The company's CEO, Jason Brooks, acknowledged the difficulties faced in the wholesale sector but remained optimistic about the consumer demand for the company's brands.

Financial Performance and Balance Sheet Strength

Rocky Brands' financial achievements in 2023 were marked by a notable reduction in both inventories and debt levels, which the company views as a strategic move to strengthen its balance sheet and position itself for future growth and increased shareholder value. The reduction in inventories and debt levels by $66.2 million and $83.8 million, respectively, reflects the company's commitment to efficient inventory management and financial stability.

The company's gross margin for the fourth quarter stood at 40.3% of net sales, slightly down from the previous year, mainly due to a tariff refund received in the fourth quarter of 2022. However, for the full year, the gross margin improved significantly, driven by a higher mix of Retail segment sales and improvements in the Wholesale segment.

Operating expenses for the fourth quarter were reduced to 28.6% of net sales, down from 31.0% in the previous year, thanks to cost-saving initiatives and operational efficiencies. The adjusted operating income for the fourth quarter improved to 12.3% of net sales, up from 11.0% in the prior year.

"We are encouraged with our fourth quarter performance as we navigated top-line headwinds and delivered operating income that was ahead of our expectations," said Jason Brooks, Chairman, President and Chief Executive Officer.

Challenges and Outlook

Rocky Brands faced several challenges throughout 2023, including market softness, delayed manufacturing and shipment schedules, and a transition to a distributor model in Canada. These factors contributed to the year-over-year declines in net sales and net income. The company's performance in the fourth quarter, however, suggests a moderation in these declines, providing a more positive outlook for the future.

Looking ahead, Rocky Brands aims to leverage its strengthened balance sheet to invest in business initiatives that drive profitable growth and enhance shareholder value. The company's focus on operational efficiency and inventory management is expected to support its ambitions for long-term success.

For a detailed analysis of Rocky Brands Inc (NASDAQ:RCKY)'s financial results, including the full income statement, balance sheet, and cash flow statement, investors are encouraged to review the company's 8-K filing.

Rocky Brands will hold a conference call to discuss the fourth quarter results, providing an opportunity for investors and analysts to gain further insights into the company's performance and strategies.

For more information on Rocky Brands and its portfolio of brands, visit RockyBrands.com.

Explore the complete 8-K earnings release (here) from Rocky Brands Inc for further details.

This article first appeared on GuruFocus.