Rogers Communications (RCI) Q3 Earnings Top, Revenues Up Y/Y

Rogers Communications RCI reported adjusted earnings of 93 cents per share that beat the Zacks Consensus Estimate by a nickel. Moreover, total revenues of $2.88 billion lagged the consensus mark of $2.90 billion.

Adjusted earnings increased 13.1% year over year to C$1.21 per share. Total revenues climbed 3.4% to C$3.77 billion primarily driven by wireless service revenue growth.

Shares of Rogers Communications increased 1.22% to close at $51.63 on Oct 22. The stock has returned 1.4% year-to-date, much better than industry’s decline of 12%.

Wireless Details (In C$)

Wireless (61.8% of total revenues) increased 5.8% from the year-ago quarter to C$2.33 billion. Service revenues climbed 4.6% and equipment revenues were up 10.8% in the quarter.

Blended ARPU (average revenue per user) was C$57.2, up from C$55.8 in the year-ago quarter and C$55.6 in the previous quarter.

As of Oct 19, prepaid subscriber base totaled almost 1.77 million, a gain of 60K sequentially but a loss of 21K subscribers from the year-ago quarter. Monthly churn rate was 3.48% compared with 3.04% in the year-ago quarter.

As of Oct 19, postpaid wireless subscriber base totaled roughly 9.05 billion, a subscriber gain of 206K from the year-ago quarter and 124K from the previous quarter. Monthly churn rate declined to 1.09% from 1.16% in the year-ago quarter but increased from 1.01% in the previous quarter.

Rogers Communications continues to expand LTE coverage. The company announced plans to launch LTE-M in Ontario. LTE-M will improve expertise in 5G, IT, and network across consumer and enterprise.

In the current quarter, Rogers Communications entered into a multimillion-dollar partnership with University of British Columbia (UBC) to co-develop a made-in-Canada 5G ecosystem.

Segment operating expense increased 3.9% from the year-ago quarter to C$1.2 billion.

Adjusted EBITDA increased 8.1% year over year to C$1.1 billion. Adjusted EBITDA margin expanded 90 basis points (bps) on a year-over-year basis to 47.1% primarily attributed to higher revenues and stringent cost control.

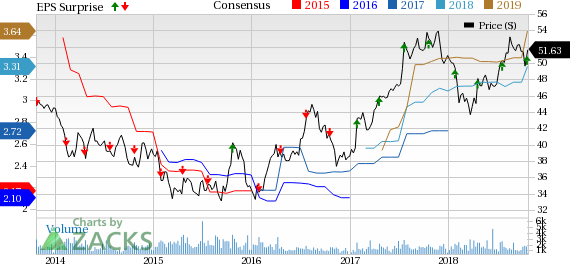

Rogers Communication, Inc. Price, Consensus and EPS Surprise

Rogers Communication, Inc. Price, Consensus and EPS Surprise | Rogers Communication, Inc. Quote

Cable Details (In C$)

Cable (26.1% of total revenues) inched up 0.6% from the year-ago quarter to C$983 million. Service revenues climbed 0.6%, while equipment revenues remained flat from the year-ago quarter.

While Internet revenues increased 7.9%, television and phone revenues declined 5.3% and 12.9%, respectively.

As of Oct 19, 2018, Internet subscriber count was nearly 2.41 million, a gain of 104K from the year-ago quarter and 35K from second-quarter 2018.

Management stated that its offering of Ignite Gigabit Internet over the entire Cable footprint continued to attract customers. Further, the company stated that the launch of Ignite TV is driving ARPA.

Per management, Ignite TV can be integrated with streaming services like Netflix NFLX and Alphabet’s GOOGL YouTube. Also, users can integrate with Amazon’s AMZN Prime in near future.

Rogers Communications lost 52K subscribers on a year-over-year basis and 18K subscribers sequentially to reach an installed base of almost 1.7 million in the Television segment.

Phone subscriber count was nearly 1.12 million, a gain of 21K from the year-ago quarter and remained same from second-quarter 2018.

Segment operating expense decreased 2.6% from the year-ago quarter to C$493 million.

Adjusted EBITDA increased 4% year over year to C$490 million driven by favorable product mix shift toward higher margin Internet services and other cost-efficiencies attained. Adjusted EBITDA margin expanded 160 bps on a year-over-year basis to 49.8%.

Media Details (In C$)

Media (12.9% of total revenues) decreased 5.4% from the year-ago quarter to C$488 million due to lower revenues to the Toronto Blue Jays.

Segment operating expense decreased 8.8% from the year-ago quarter to C$415 million.

Adjusted EBITDA increased 19.7% from the year-ago quarter to C$73 million due to cost efficiencies achieved by the company. Adjusted EBITDA margin expanded 320 bps on a year-over-year basis to 15%.

Consolidated Results

Operating costs increased 0.3% from the year-ago quarter to C$2.15 billion. As a percentage of revenues, operating costs declined 180 bps to 57%.

Adjusted EBITDA increased 7.8% from the year-ago quarter to C$1.6 billion. Adjusted EBITDA margin expanded 180 bps from the year-ago quarter, primarily owing to strong growth in wireless revenues and improving cost structure.

Cash Flow Details

Cash provided by operating activities decreased 5.3% year over year to C$1.3 billion due to “lower net funding provided by working capital items.” Moreover, free cash flow increased 5.2% year over year to C$550 million on the back of higher adjusted EBITDA.

Rogers Communications paid C$247 million in dividends and ended the third quarter with a debt leverage ratio (adjusted net debt/adjusted EBITDA) of 2.5.

Full Year Guidance

Revenues are expected to increase in the range of 3%-5% in the full year. Capital expenditures are expected in the range $2.7-$2.9 billion.

Management increased adjusted EBITDA and free cash flow guidance. Adjusted EBITDA is expected to increase in the range 7%-9% from the prior range of 5%-7%. Free cash flow is expected to increase in the range 5%-7% from the prior range of 3%-5%.

Rogers Communications currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Rogers Communication, Inc. (RCI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research