Rogers Corp (ROG) Faces Headwinds: Q4 and Full Year 2023 Earnings Analysis

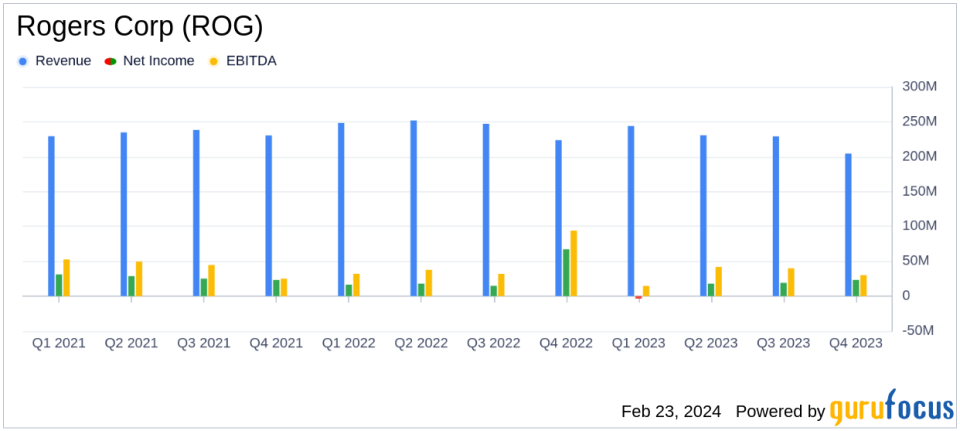

Net Sales: Q4 net sales decreased by 10.7% quarter-over-quarter to $204.6 million.

Gross Margin: Q4 gross margin declined to 32.9% from 35.1% in the previous quarter.

Operating Margin: Full year operating margin decreased to 9.4% from 14.9% in the prior year.

Net Income: Q4 net income was $23.2 million, with a net income margin of 11.3%.

Earnings Per Share: Diluted earnings per share for Q4 were $1.24, up from $1.02 in Q3.

Free Cash Flow: Generated $49.4 million in free cash flow in Q4, contributing to a total of $74.4 million for the full year.

Future Outlook: Q1 2024 net sales are projected to be between $205 million and $215 million, with adjusted earnings per diluted share estimated to be $0.45 to $0.65.

Rogers Corp (NYSE:ROG) released its 8-K filing on February 21, 2024, detailing its financial performance for the fourth quarter and full year of 2023. The company, known for its engineered materials and components used in various high-tech applications, faced significant macroeconomic headwinds that led to inventory destocking by customers and softness in end markets, particularly in industrial and portable electronics.

Company Overview

Rogers Corporation operates in three business segments: Advanced Connectivity Solutions (ACS), Elastomeric Material Solutions (EMS), and Power Electronics Solutions. The company's products are crucial in communications infrastructure, automotive, consumer electronics, and renewable energy applications. With a global presence, Rogers Corp generates most of its revenue in the United States, China, and Germany.

Performance and Challenges

The company's Q4 net sales of $204.6 million represented a 10.7% decrease from the previous quarter, with both the ACS and EMS segments experiencing declines. The gross margin also saw a decrease to 32.9% from 35.1% in Q3 2023, attributed to lower sales volume and factory throughput, despite procurement cost savings. The GAAP operating margin improved to 14.9% from 11.8% in the prior quarter, mainly due to a significant insurance recovery related to a previous fire incident.

For the full year, net sales were down 6.5% to $908.4 million compared to 2022, with gross margin slightly improving to 33.8% from 33.1%. The GAAP operating margin for the year fell to 9.4% from 14.9% in the previous year, largely due to a decrease in other operating income.

Financial Achievements and Importance

Despite the challenges, Rogers Corp managed to generate solid free cash flow of $74.4 million for the full year, a significant increase from the previous year's $12.7 million. This financial achievement demonstrates the company's ability to maintain liquidity and invest in future growth despite a difficult economic environment.

Key Financial Metrics

Net income for Q4 was $23.2 million, with a net income margin of 11.3%, and diluted earnings per share were $1.24. The adjusted earnings per diluted share were $0.60. The company ended the year with cash and cash equivalents of $131.7 million, an increase from the previous quarter.

"We made significant progress this past year as we drove structural cost improvements, secured new design wins, generated solid free cash flow, and invested in targeted capacity expansions to drive future growth," stated Colin Gouveia, Rogers' President and CEO.

Analysis of Company's Performance

Rogers Corp's performance in 2023 reflects resilience in the face of a challenging demand environment. The company's focus on cost improvements and capacity expansions positions it for potential growth when market conditions improve. However, the extended timeline beyond 2025 to achieve its financial targets indicates that the company anticipates ongoing challenges in the global manufacturing economy and the electric vehicle market.

The company's forward-looking statements suggest caution due to uncertainties in the market, including geopolitical tensions and trade policy dynamics. Investors and stakeholders will be watching closely for signs of improvement in demand visibility as the company navigates these challenges.

For more detailed information and analysis, investors are encouraged to review the full earnings report and listen to the earnings call.

For further inquiries, investors may contact Steve Haymore at 480-917-6026 or via email at stephen.haymore@rogerscorporation.com.

Explore the complete 8-K earnings release (here) from Rogers Corp for further details.

This article first appeared on GuruFocus.