Rollins (ROL) is Benefiting From a Solid Demand Environment

Rollins Inc. ROL has grown 10.3% in the year-to-date period, in-line with the Building Products - Maintenance Service market’s growth, compared with the 6.6% growth of Business Services sector.

ROL has an impressive Growth Score of A. This style score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth.

Rollins reported second-quarter 2023 adjusted earnings of 23 cents per share, which matched the Zacks Consensus Estimate and increased 15% year over year. Revenues of $820.8 million beat the consensus mark by 2.1% and improved 14.9% year over year. Organic revenues of $769.6 million increased 7.7% year over year. Rollins’ performance in the quarter was positively impacted by a healthy demand environment for its services. The company remained focused on improving the efficiency of its business model and adding customers. Its acquisitions pipeline remained strong in the quarter.

Factors in Favor

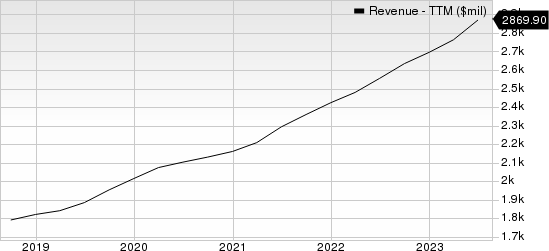

The demand environment for Rollins remains favorable due to solid construction activity. It has experienced positive revenue growth over the last five years. A well-balanced approach, which combines organic and inorganic growth, has been instrumental in achieving this success. The companys organic revenue growth rate is robust, driven by strong technician and customer retention.

Rollins, Inc. Revenue (TTM)

Rollins, Inc. revenue-ttm | Rollins, Inc. Quote

Anticipated enhancements in benefits are expected to contribute to improved employee and customer retention in the coming years. Additionally, acquisitions have played a significant role in Rollins' business strategy, acting as a major catalyst for growth. Through strategic acquisitions, the company continues to expand its global brand recognition, broaden its geographical presence, and bolster its revenues. Notably, in the years 2022, 2021, 2020, 2019, 2018, and 2017, Rollins successfully completed 31, 39, 31, 30, 38, and 23 acquisitions, respectively.

Rollins places importance on returning capital to shareholders through dividends. The consistent payment of dividends underscores the company's dedication to its shareholders and reflects its confidence in its business. Dividends totaling $211.6 million, $208.7 million, and $160.5 million were disbursed in the years 2022, 2021, and 2020, respectively. These factors have contributed to a 10.3% increase in Rollins' stock value over the past year.

Rollins' current ratio stood at 0.81 at the end of second-quarter 2023, higher than the prior quarter’s 0.79. Increasing current ratio is a favorable development and desirable as it implies that the company may not have problems meeting its short-term obligations.

Factors Against

Rollins is experiencing rising expenses due to acquisitions and IT-related costs. Additionally, its subsidiaries are facing various legal actions that allege service-related damages, further impacting costs. As a result, the company's profitability is expected to face ongoing challenges.

Rollins' extensive acquisition strategy carries potential integration risks. These acquisitions might adversely affect the company's financial position, evident in the substantial goodwill of $846.7 million, constituting 40% of total assets as of 2022. Furthermore, the frequent acquisition approach could divert management's focus, potentially impacting organic growth.

Zacks Rank and Stocks to Consider

ROL currently carries a Zacks Rank #3 (Hold).

Investors interested in Zacks Business Services sector can consider the following stocks:

Aptiv APTV holds a Zacks Rank #2(Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings for 2023 are expected to grow 37% while revenues are anticipated to gain 13.9% from the year-ago figure. APTV has an impressive earnings surprise of 13.35% in the past four quarters, having beaten the Zacks Consensus Estimate in all four trailing quarters. APTV carries a VGM score of A.

Clean HarborsCLH holds a Zacks Rank #2. Earnings for 2023 are expected to be in line with the year ago quarter while revenues are anticipated go up 5.3% year over year. CLH has an impressive earnings surprise of 13% in the past four quarters, having beaten the Zacks Consensus Estimate in all four trailing quarters. CLH carries a VGM score of B.

Verisk AnalyticsVRSK holds a Zacks Rank #2. Earnings for 2023 are expected to grow 14% while revenues are anticipated to fall 8.3% from the year-ago figure. VRSK has an impressive earnings surprise of 9.85% in the past four quarters, having beaten the Zacks Consensus Estimate in three of the four trailing quarters and matching on one instance.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Clean Harbors, Inc. (CLH) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report