Rollins (ROL) Gains 8.4% in a Month: What's Behind the Rally?

Rollins, Inc. ROL has gained 8.4% in the past month, outperforming the 6.8% growth of the industry it belongs to.

Reasons Behind the Rally

The demand environment for this leading pest and termite control services provider remains in good shape, driven by strong construction activity. Revenues increased 15.2% year over year in the third quarter of 2023, with all its business lines — residential, commercial and termite — registering growth.

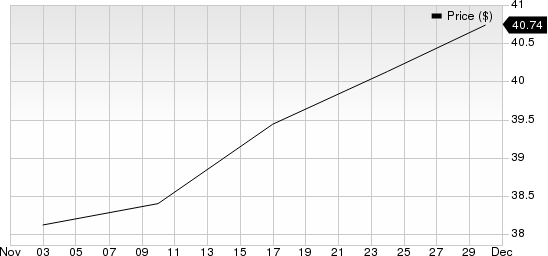

Rollins, Inc. Price

Rollins, Inc. price | Rollins, Inc. Quote

Rollins has developed its operating platform in a way that increases cross-selling opportunities and cost efficiency and facilitates swift customer service delivery. The company’s real-time service tracking and customer Internet communication technologies have increased its competitive advantage.

Its proprietary Branch Operating Support System facilitates service tracking and payment processing for technicians and provides virtual route management tools to increase route efficiency across the network, enabling cost reduction and increasing customer retention through quick response service.

Rollins believes in returning capital through dividends. Consistent dividend payment underscores the company's commitment to shareholders and underlines its confidence in business. It paid dividends of $211.6 million, $208.7 million and $160.5 million in 2022, 2021 and 2020, respectively.

Zacks Rank & Other Stocks to Consider

Rollins currently carries a Zacks Rank #2 (Buy).

Here are some other top-ranked stocks from the broader Business Service sector.

FTI Consulting FCN also carries a Zacks Rank of 2. The consensus mark for fourth-quarter 2023 earnings is pegged at $1.57 per share, indicating 3.3% year-over-year growth.

FCN has an impressive earnings surprise history, beating the consensus mark in three of the four trailing quarters and missing once, the average surprise being 8.5%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Broadridge Financial Solutions BR carries a Zacks Rank of 2. The consensus mark for second-quarter fiscal 2024 revenues is pegged at $1.39 per share, indicating 7.7% year-over-year growth.

BR has an impressive earnings surprise history, beating the consensus mark in three of the four trailing quarters and matching once, the average surprise being 5.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report