Rollins (ROL) Gains From Combined Organic and Inorganic Growth

Rollins, Inc. ROL has been growing at a decent rate, thanks to the combination of its organic and inorganic growth approach. The company’s shareholder-friendly policy has been boding well.

Rollins reported impressive first-quarter 2023 results that beat the Zacks Consensus Estimate on both counts. Adjusted earnings of 18 cents per share beat the consensus estimate by 5.9% and increased 20% year over year. Revenues of $658 million beat the consensus mark by 2.8% and improved 11.4% year over year. Organic revenues of $641.6 million increased 9.2% year over year.

The company’s stock has outperformed its Building Product Maintenance Services market in the year-to-date period partly driven by these tailwinds. ROL has grown 11.7% in the past year against its industry’s 11.2% increase.

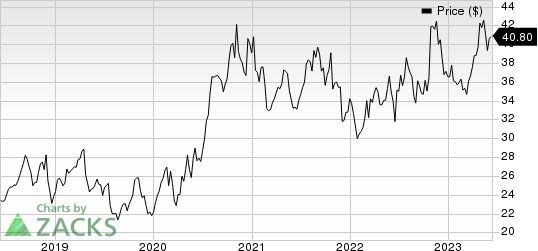

Rollins, Inc. Price

Rollins, Inc. price | Rollins, Inc. Quote

Current Situation of Rollins

A healthy demand situation supported by strong construction activity and a combination of inorganic and organic growth has been the growth catalyst for Rollins. Strong technician and customer retention are the key drivers of organic growth. The company has been taking steps to enhance customer, as well as employee retention. Rollins has been active on the acquisition front, strategically acquiring and expanding its global footprint, thereby increasing revenues. Rollins completed 31 acquisitions in 2022, 39 in 2021, 31 in 2020, 30 in 2019, 38 in 2018 and 23 in 2017.

Rollins has been taking initiatives to return value to shareholders. Its consistent dividend payment history is an indicator of such a fact. The company paid dividends of $211.6 million, $208.7 million and $160.5 million in 2022, 2021 and 2020, respectively. These factors instill investors’ confidence in the company’s shares.

An improving liquidity position when combined with such initiatives put the company in good shape. Rollins' current ratio (a measure of liquidity) was 0.79 at the end of first-quarter 2023, higher than the prior quarter’s figure of 0.71.

Zacks Rank and Other Stocks to Consider

ROL currently carries a Zacks Rank #2 (Buy).

Investors interested in the Zacks Business Services sector can also consider the following stocks:

Green Dot GDOT: For second-quarter 2023, the Zacks Consensus Estimate of Green Dot’s revenues suggests a decline of 4.5% year over year to $339.2 million and the same for earnings indicates a 59.5% plunge to 30 cents per share. The company has an impressive earning surprise history, beating the consensus mark in all four trailing quarters, the average surprise being 37.3%.

GDOT has a Value score of A and currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Maximus MMS: For second-quarter 2023, the Zacks Consensus Estimate of Maximus’ revenues suggests an increase of 6.9% year over year to $1.2 billion and the same for earnings indicates a 46.2% rise to $1.14 per share. The company has an impressive earning surprise history, beating the consensus mark in three instances and missing on one instance, the average surprise being 9.6%.

MMS has a VGM score of B along with a Zacks Rank of 1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report