Rollins' (ROL) Q2 Earnings Meet Estimates, Increase Y/Y

Rollins, Inc. ROL reported second-quarter 2023 adjusted earnings of 23 cents per share, which matched the Zacks Consensus Estimate and increased 15% year over year.

Revenues of $820.8 million beat the consensus mark by 2.1% and improved 14.9% year over year. Organic revenues of $769.6 million increased 7.7% year over year.

Rollins’ performance in the quarter was positively impacted by a healthy demand environment for its services. The company remained focused on improving the efficiency of its business model and adding customers. Its acquisitions pipeline remained strong in the quarter.

Rollins’ shares have gained 16.2% in the past year, outperforming the 15% rally of the industry it belongs to.

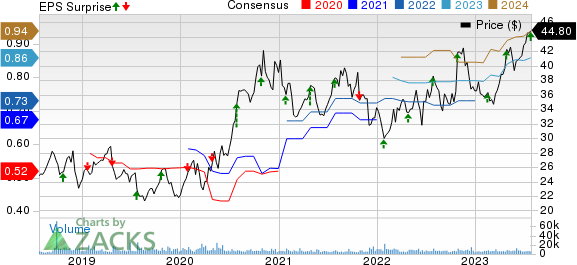

Rollins, Inc. Price, Consensus and EPS Surprise

Rollins, Inc. price-consensus-eps-surprise-chart | Rollins, Inc. Quote

Quarter Details

Residential revenues increased 18.5% year over year to $385.6 million and beat our estimate of $357.9 million. Commercial revenues increased 10.9% year over year to $260 million but missed our estimate of $272.5 million. Termite and ancillary revenues increased 13.7% year over year to $166.8 million and beat our estimate of $160.6 million.

Adjusted EBITDA of $183.3 million increased 15.1% year over year. This compares to our expectation of an adjusted EBITDA of $172.2 million, up 8.2% year over year. Adjusted EBITDA margin of 22.3% remained flat year over year. This compares with our expectation of an adjusted EBITDA margin of 21.5%, down 80 basis points year over year.

Rollins exited the quarter with a cash and cash equivalents balance of $154.7 million compared with the prior quarter’s $112.5 million. Long-term debt at the end of the quarter was $337.5 million compared with $62.4 million at the end of the prior quarter.

The company generated $147 million of cash from operating activities in the quarter and capital expenditure was $7 million. Free cash flow came in at $141 million. The company invested $312 million in acquisitions and paid dividends worth $64 million in the quarter.

Currently, Rollins carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Earnings Snapshots of Some Service Providers

Omnicom OMC reported mixed second-quarter 2023 results, wherein the company’s earnings surpassed the Zacks Consensus Estimate but revenues missed the same.

OMC’s earnings of $1.81 per share beat the consensus estimate by 0.6% and increased 7.7% year over year. Total revenues of $3.6 billion lagged the consensus mark by 0.3% but increased 1.2% year over year.

Equifax EFX reported mixed second-quarter 2023 results, wherein earnings beat the Zacks Consensus Estimate but revenues missed the same.

EFX’s adjusted earnings came in at $1.71 per share, beating the consensus mark by 2.4% but declining 18.2% from the year-ago figure. Total revenues of $1.32 billion missed the consensus estimate by 0.4% but matched the year-ago figure on a reported basis.

Interpublic’s IPG second-quarter 2023 earnings surpassed the Zacks Consensus Estimate while revenues missed the same.

IPG’s adjusted earnings came in at 74 cents per share, beating the Zacks Consensus Estimate by 23.3% but declining 17.5% on a year-over-year basis. Net revenues of $2.33 billion missed the consensus estimate by 2.9% and decreased 14.9% on a year-over-year basis. Total revenues of $2.67 billion decreased 2.6% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

Interpublic Group of Companies, Inc. (The) (IPG) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report