Rollins' (ROL) Q4 Earnings Meet Estimates, Increase Y/Y

Rollins, Inc.’s ROL fourth-quarter 2023 earnings meet the Zacks Consensus Estimate and revenues beat the same.

Adjusted earnings of 21 cents per share increased 23.5% year over year. Revenues of $754.1 million beat the consensus mark by 0.5% and improved 14% year over year. Organic revenues of $708.4 million increased 7.3% year over year.

Rollins’ performance in the quarter was positively impacted by a healthy demand environment for its services. Management said that the company remains well-positioned for organic as well as inorganic growth. Rollins’ acquisitions pipeline remained strong in the quarter.

Rollins’ shares have gained 22.3% in the past year, outperforming the 17.7% rally of the industry it belongs to.

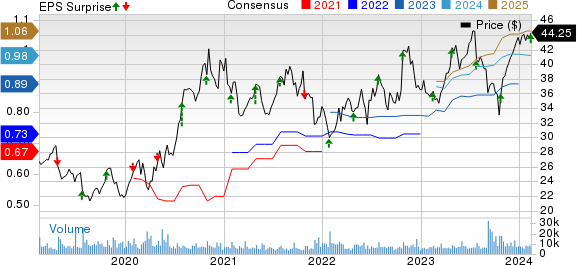

Rollins, Inc. Price, Consensus and EPS Surprise

Rollins, Inc. price-consensus-eps-surprise-chart | Rollins, Inc. Quote

Quarter Details

Residential revenues increased 17.7% year over year to $340.5 million and beat our estimate of $325.5 million. Commercial revenues increased 10.6% year over year to $256.7 million and surpassed our estimate of $252.5 million. Termite and ancillary revenues increased 13.4% year over year to $147.9 million and beat our estimate of $145.8 million.

Adjusted EBITDA of $166.7 million increased 14.2% year over year. This compares to our expectation of an adjusted EBITDA of $154.8 million, up 7.4% year over year. Adjusted EBITDA margin of 22.1% stayed flat year over year compared with our expectation of an adjusted EBITDA margin of 21%, down 110 bps year over year.

Rollins exited the quarter with a cash and cash equivalents balance of $103.8 million compared with the prior quarter’s $142.2 million. Long-term debt at the end of the quarter was $490.8 million compared with $596.6 million at the end of the prior quarter.

The company generated $152.8 million of cash from operating activities in the quarter and capital expenditure was $11.2 million. Free cash flow came in at $141.6 million. The company paid dividends worth $73 million in the quarter.

Currently, Rollins carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Earnings Snapshots

Robert Half RHI reported better-than-expected fourth-quarter 2023 results.

Quarterly earnings of 83 cents per share beat the consensus mark by 1.2% but declined 39.4% year over year. RHI’s revenues of $1.5 billion beat the consensus mark by a slight margin but decreased 14.7% year over year.

Aptiv APTV reported mixed fourth-quarter 2023 results, with earnings beating the Zacks Consensus Estimate but revenues missing the same.

Adjusted earnings of $1.4 per share beat the Zacks Consensus Estimate by 8.5% and increased 10.2% year over year. APTV’s revenues of $4.9 billion missed the Zacks Consensus Estimate by 0.5% but increased 6% year over year.

S&P Global SPGI reported mixed fourth-quarter results, wherein earnings missed the Zacks Consensus Estimate but revenues beat the same.

Adjusted EPS of $3.13 missed the Zacks Consensus Estimate by 0.6% but increased 23.2% year over. Revenues of $3.2 billion surpassed the consensus estimate by 0.5% and improved 7.3% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Robert Half Inc. (RHI) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

S&P Global Inc. (SPGI) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report