Ronald Muhlenkamp's Firm Buys 3 Stocks in 4th Quarter

Muhlenkamp & Co. Inc., the investment firm founded by Ronald Muhlenkamp (Trades, Portfolio), released its portfolio for the fourth quarter of 2019 earlier this week, listing four new holdings.

While he is still acting as the firm's chairman, Muhlenkamp passed most operational responsibilities on to his sons last year. With the goal of maximizing returns through capital appreciation, as well as income from dividends and interest, his Wexford, Pennsylvania-based firm typically invests in highly profitable companies trading at a discount. When picking stocks, it seeks companies with strong balance sheets and high returns on equity. The firm believes that over time, stock prices reflect the companies' underlying value and that the long-term business of investing offers a higher chance of profitability and reliability.

Taking these criteria into account, the firm established positions in Lennar Corp. (NYSE:LEN), Tenneco Inc. (NYSE:TEN) and Rush Enterprises Inc. (NASDAQ:RUSHB) during the quarter. The firm also gained a 123,223-share holding in pharmaceutical giant Bristol-Myers Squibb Co. (NYSE:BMY) after its acquisition of Celgene Corp. (NASDAQ:CELG) was completed in November. According to the terms of the agreement, shareholders of Celgene received one share of Bristol-Myers Squibb's common stock, $50 in cash and one tradable contingent value right per share owned.

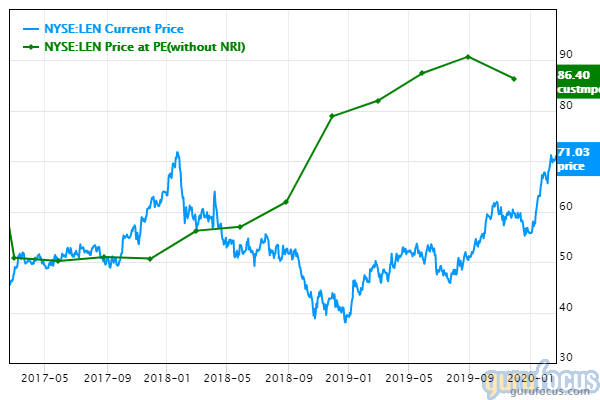

Lennar

Muhlenkamp's firm invested in 92,060 shares of Lennar, allocating 2.24% of the equity portfolio to the position. The stock traded for an average price of $58.95 per share during the quarter.

The Miami-based home construction and real estate company has a $21.87 billion market cap; its shares were trading around $70.84 on Friday with a price-earnings ratio of 12.33, a price-book ratio of 1.41 and a price-sales ratio of 1.01.

The Peter Lynch chart shows the stock is trading below its fair value, suggesting it is undervalued. Although the share price and price-sales ratios are near multiyear highs, the GuruFocus valuation rank of 6 out of 10 also supports this assessment.

GuruFocus rated Lennar's financial strength 4 out of 10 on the back of a low cash-debt ratio of 0.15 that is ranked lower than 74% of companies in its industry. The Altman Z-Score of 3.26, however, indicates the company is in good financial standing.

The company's profitability scored a 7 out of 10 rating. While the operating has declined over the past five years, it still outperforms a majority of competitors. Lennar is also supported by steady returns and a moderate Piotroski F-Score of 6, which implies operations are stable. Although the homebuilder has recorded a slowdown in revenue per share growth over the past 12 months, it still has a business predictability rank of one out of five stars. According to GuruFocus, companies with this rank typically see their stocks gain an average of 1.1% per annum over a 10-year period.

Of the gurus invested in Lennar, Glenn Greenberg (Trades, Portfolio) has the largest stake with 0.75% of outstanding shares. Other major guru shareholders include Barrow, Hanley, Mewhinney & Strauss, Ken Fisher (Trades, Portfolio), Third Avenue Management (Trades, Portfolio), the Smead Value Fund (Trades, Portfolio), Jim Simons (Trades, Portfolio)' Renaissance Technologies, Pioneer Investments (Trades, Portfolio), Ron Baron (Trades, Portfolio) and Ray Dalio (Trades, Portfolio)'s Bridgewater Associates.

Tenneco

The firm picked up 373,957 shares of Tenneco, dedicating 2.14% of the equity portfolio to the holding. During the quarter, shares traded for an average price of $13.12 each.

The aftermarket auto parts supplier, which is headquartered in Lake Forest, Illinois, has a market cap of $868.16 million; its shares were trading around $10.61 on Friday with a forward price-earnings ratio of 3.02, a price-book ratio of 0.53 and a price-sales ratio of 0.05.

According to the median price-sales chart, the stock is undervalued. The GuruFocus valuation rank of 10 out of 10 also leans toward undervaluation.

Weighed down by poor interest coverage and approximately $2.9 billion in new long-term debt, Tenneco's financial strength was rated 3 out of 10 by GuruFocus. The Altman Z-Score of 1.45 also warns that the company in financial distress and could be at risk of going bankrupt.

Despite having declining margins and returns that underperform a majority of industry peers, the company's profitability scored a 7 out of 10 rating on the back of a moderate Piotroski F-Score of 4 and consistent earnings and revenue growth. Tenneco's 2.5-star business predictability rank is on watch as a result of recording a loss in operating income over the past three years. GuruFocus says companies with this rank typically see their stocks gain an average of 7.3% per year.

With 6.98% of outstanding shares, Carl Icahn (Trades, Portfolio) is the company's largest guru shareholder. Mario Gabelli (Trades, Portfolio), Simons' firm, Steven Cohen (Trades, Portfolio) and Paul Tudor Jones (Trades, Portfolio) also own the stock.

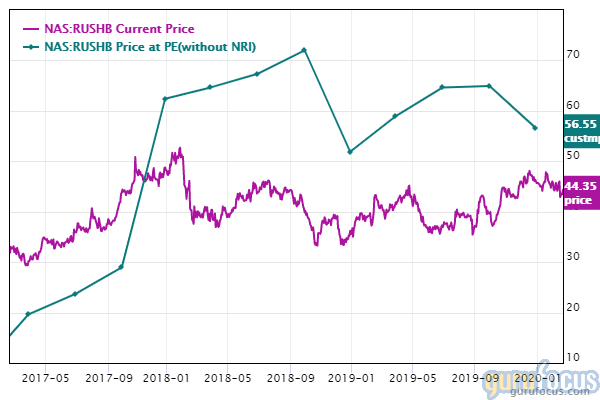

Rush Enterprises

After exiting a position in Rush Enterprises in the second quarter of 2019, the firm entered a new 4,430-share holding of its Class B stock. The trade had an impact of 0.09% on the equity portfolio. The stock traded for an average per-share price of $43.76 during the quarter.

The New Braunfels, Texas-based company, which operates commercial vehicle dealerships, has a $1.63 billion market cap; its shares were trading around $44.86 on Friday with a price-earnings ratio of 11.99, a price-book ratio of 1.46 and a price-sales ratio of 0.28.

Based on the Peter Lynch chart, the stock appears to be undervalued. Despite the share price and price-share ratio being at multiyear highs, the GuruFocus valuation rank of 7 out of 10 also supports this analysis.

GuruFocus rated Rush Enterprises' financial strength 5 out of 10. Although the company has issued approximately $204.16 million in new long-term debt over the past three years, it is at a manageable level due to adequate interest coverage. The Altman Z-Score of 2.94 suggests the company is under some financial pressure.

The company's profitability scored a 7 out of 10 rating, driven by operating margin expansion, strong returns that outperform over half of its competitors and steady earnings and revenue growth. Rush also has a moderate Piotroski F-Score of 5 and a three-star business predictability rank. According to GuruFocus, companies with this rank typically see their stocks gain an average of 8.2% per year.

Gabelli is the company's largest guru shareholder with 1.7% of outstanding shares. Simons' firm also holds the stock.

Additional trades and portfolio composition

The firm also boosted its holdings in several companies during the quarter, including Dow Inc. (NYSE:DOW), CVS Health Inc. (NYSE:CVS), Invesco BuyBack Achievers ETF (NASDAQ:PKW), Jazz Pharmaceuticals PLC (NASDAQ:JAZZ), Alerian MLP (AMLP) and Broadcom Inc. (NASDAQ:AVGO), among others.

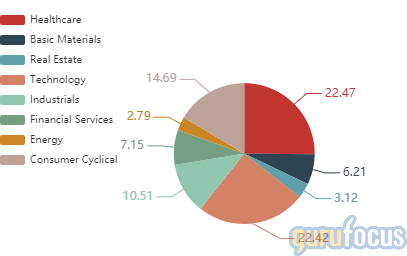

The health care and technology sectors have the largest representation in Muhlenkamp & Co.'s $229 million equity portfolio, which is composed of 37 stocks.

According to the firm's website, the Muhlenkamp Fund returned 14.39% in 2019, underperforming the S&P 500's 31.49% return. In his fourth-quarter letter to shareholders, Muhlenkamp attributed the severe underperformance to the large premiums the market is awarding to "very safe, defensive companies" like real estate investment trusts and utilities and "disruptive or high-growth companies" like Amazon (AMZN), Tesla (TSLA) and Mastercard (MA), of which the firm owns "little of either category."

Disclosure: No positions.

Read more here:

David Abrams Buys 2 Stocks in 4th Quarter

The Top 5 Buys of Steve Mandel's Lone Pine Capital

David Rolfe Adds 4 Stocks to Portfolio in 4th Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.