Roper (ROP) Benefits From Business Strength Despite Risks

Roper Technologies, Inc. ROP has been benefiting from strength across each of its segments. Its Application Software segment is gaining from solid momentum in its Deltek, Vertafore, Strata, Frontline and Aderant businesses. Continued SaaS strength, sustained momentum in the SMB channel and private sector solutions are aiding its Deltek business. The acquisition of Replicon (August 2023) has been supporting Deltek’s growth by boosting its SaaS solutions portfolio.

Growing adoption and cross-selling of SaaS solutions, and continued GenAI innovation are key catalysts to Aderant’s growth. The Strata business is gaining from its leading decision support and financial planning solutions. The acquisitions of MGA systems and Syntellis, and strength across core P&C business are fueling growth of Vertafore. Strong customer renewal season is aiding the Frontline business. For 2024, the company expects total revenues to increase 11-12% year over year. Organic revenues are estimated to increase 5-6%.

Roper is steadily strengthening its business through acquisitions. In August 2023, the company acquired cloud-based performance management and data solutions provider, Syntellis Performance Solutions. Also, in October 2022, it acquired Frontline Education for $3.7 billion. The acquisition builds on Roper’s Horizon software business, expanding its presence in the K-12 education market. Acquisitions boosted sales by 4% in the fourth quarter.

ROP remains committed on rewarding its shareholders through dividend payouts and share buybacks. In 2023, it rewarded its shareholders with a dividend payment of $262.3 million, up 11% year over year. In November 2023, the company hiked its dividend by 10%.

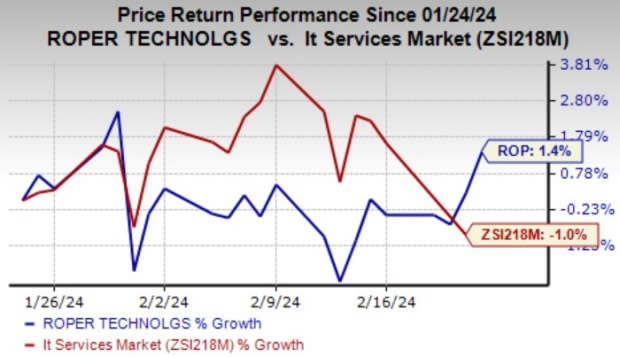

Image Source: Zacks Investment Research

In the past month, this Zacks Rank #3 (Hold) company's stock has gained 1.4% against the industry’s 1% decline.

However, escalating costs and expenses have been a concern for ROP over time. In 2023, the cost of sales increased 15.5% year over year while selling, general and administrative expenses climbed 15%. Escalating costs, if not controlled, may impede the company’s bottom line.

Given Roper’s extensive presence across international markets, its operations are subject to risks associated with unfavorable movement in foreign currencies and geopolitical issues. In 2023, movement in foreign currency translation adversely impacted revenue growth by 0.1%.

Key Picks

We have highlighted three better-ranked stocks, namely Nordson Corporation NDSN, Parker-Hannifin Corporation PH and Ingersoll-Rand plc IR, each currently carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Nordson delivered a trailing four-quarter average earnings surprise of 5.2%. In the past 60 days, the Zacks Consensus Estimate for NDSN’s 2024 earnings has increased 1.1%.

Parker-Hannifin delivered a trailing four-quarter average earnings surprise of 14.4%. In the past 60 days, the Zacks Consensus Estimate for PH’s 2024 earnings has increased 2.6%.

Ingersoll-Rand delivered a trailing four-quarter average earnings surprise of 15.9%. In the past 60 days, the Zacks Consensus Estimate for IR’s 2024 earnings has increased 1.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Parker-Hannifin Corporation (PH) : Free Stock Analysis Report

Roper Technologies, Inc. (ROP) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Nordson Corporation (NDSN) : Free Stock Analysis Report